Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A quoted company reported an earnings per share figure of $0.80 in last year's annual report. The company's share price has been close to

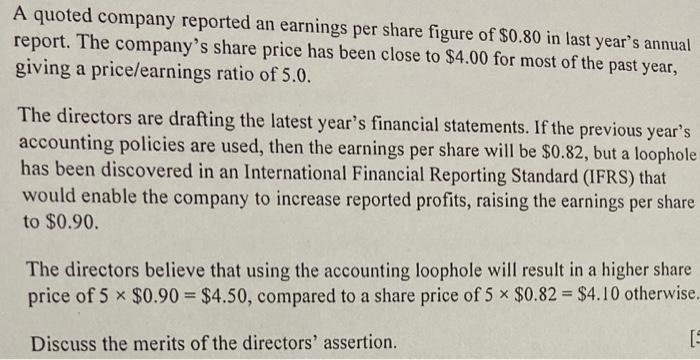

A quoted company reported an earnings per share figure of $0.80 in last year's annual report. The company's share price has been close to $4.00 for most of the past year, giving a price/earnings ratio of 5.0. The directors are drafting the latest year's financial statements. If the previous year's accounting policies are used, then the earnings per share will be $0.82, but a loophole has been discovered in an International Financial Reporting Standard (IFRS) that would enable the company to increase reported profits, raising the earnings per share to $0.90. The directors believe that using the accounting loophole will result in a higher share price of 5 $0.90 = $4.50, compared to a share price of 5 x $0.82 = $4.10 otherwise. Discuss the merits of the directors' assertion. [S

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A change in accounting policy is necessary when Its legally mandated to adopt r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started