Answered step by step

Verified Expert Solution

Question

1 Approved Answer

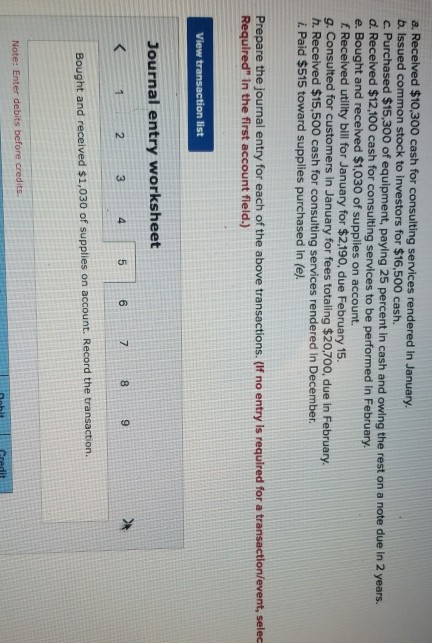

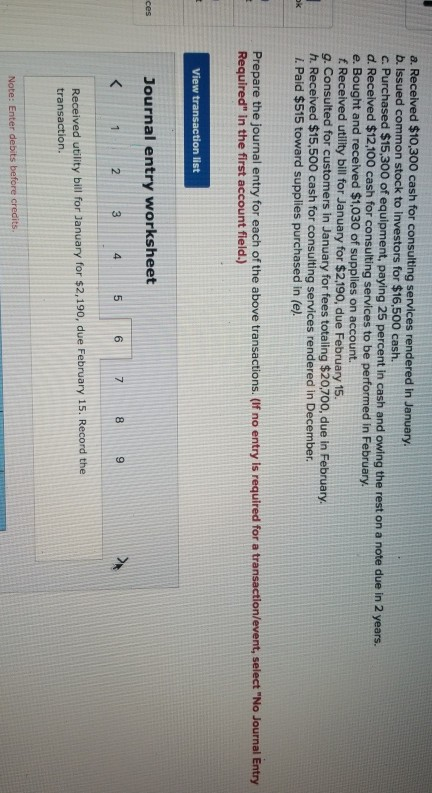

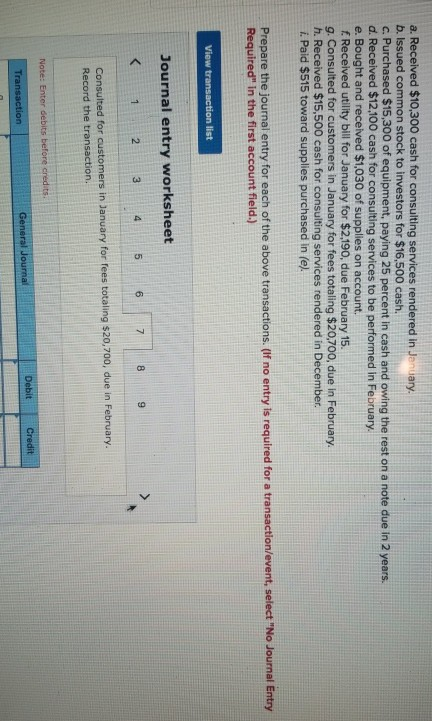

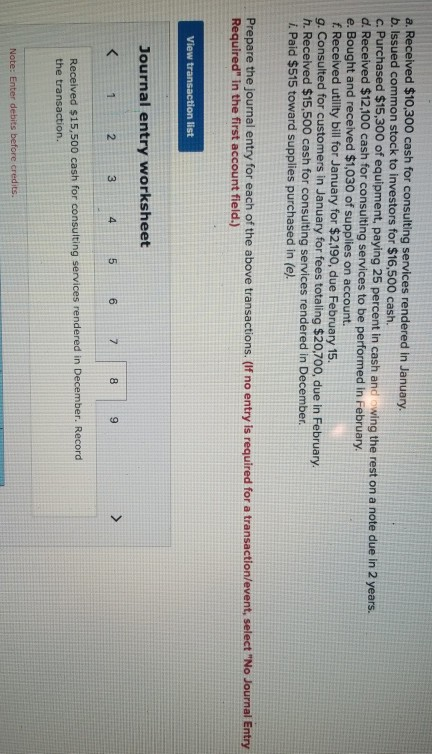

a. Received $10,300 cash for consulting services rendered in January b. Issued common stock to investors for $16,500 cash. c. Purchased $15,300 of equipment, paying

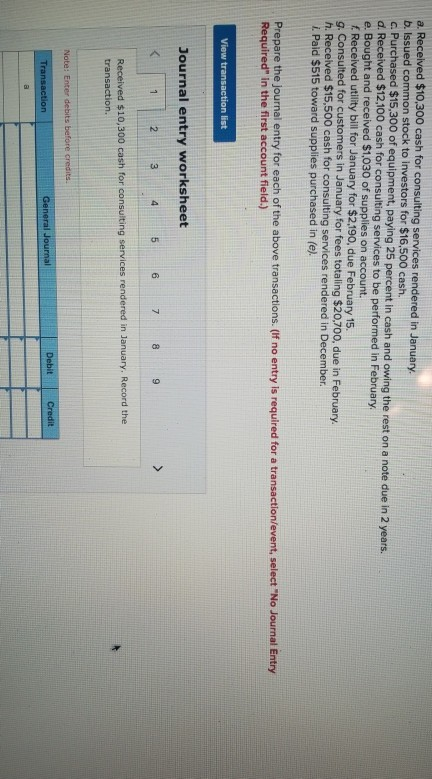

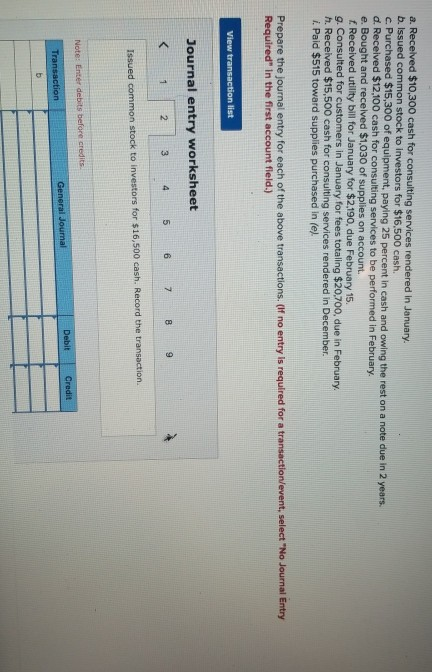

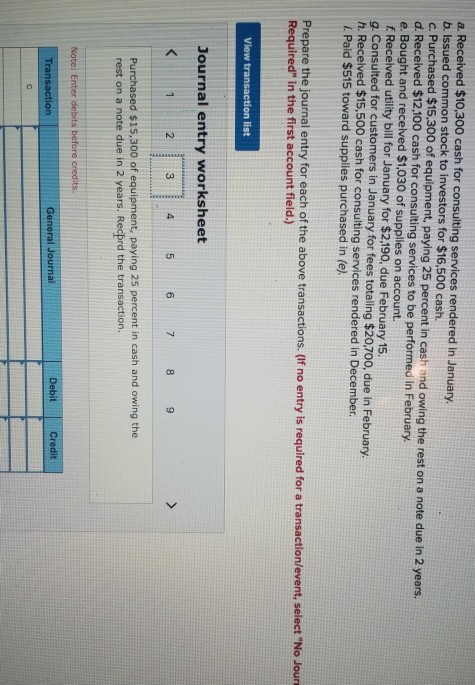

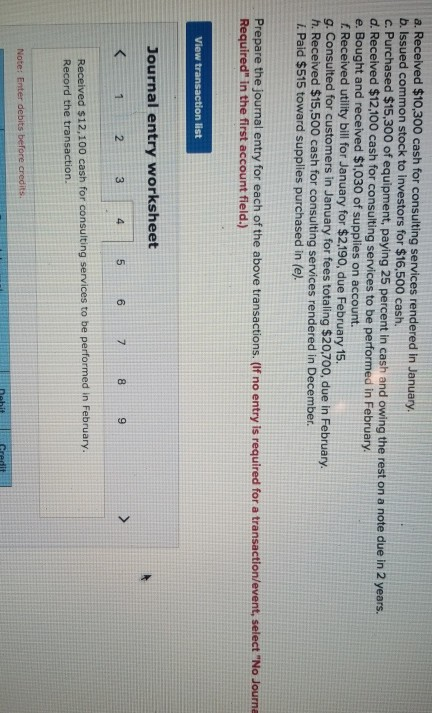

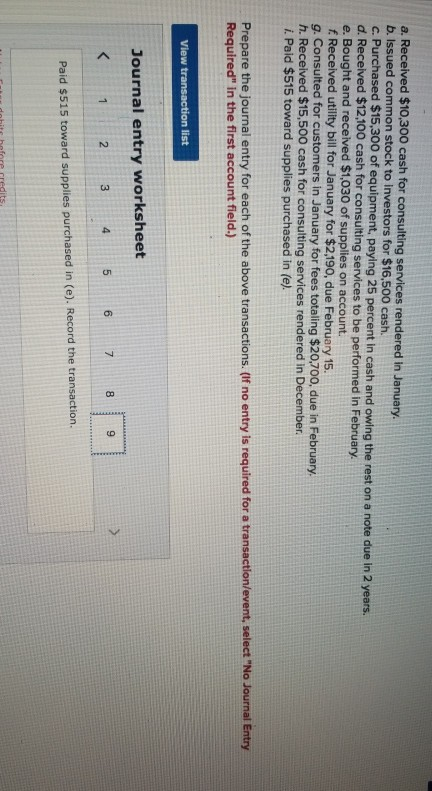

a. Received $10,300 cash for consulting services rendered in January b. Issued common stock to investors for $16,500 cash. c. Purchased $15,300 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $12,100 cash for consulting services to be performed in February e. Bought and received $1,030 of supplies on account. Received utility bill for January for $2,190, due February 15. g. Consulted for customers in January for fees totaling $20,700, due in February h. Received $15,500 cash for consulting services rendered in December 1. Pald $515 toward supplies purchased in (e). Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 6 7 8 Received $10,300 cash for consulting services rendered in January, Record the transaction. Note: Enter debits before credits Transaction General Journal Debit Credit a. Received $10,300 cash for consulting services rendered in January. b. Issued common stock to Investors for $16,500 cash. c. Purchased $15,300 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years d. Received $12,100 cash for consulting services to be performed in February e. Bought and received $1,030 of supplies on account. Received utility bill for January for $2.190, due February 15. g. Consulted for customers in January for fees totaling $20,700, due in February. h. Received $15,500 cash for consulting services rendered in December 1. Paid $515 toward supplies purchased in (e). Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet 3 4 5 6 7 8 9 Issued common stock to investors for $16,500 cash. Record the transaction Note: Enter debits before credits General Journal Debit Credit Transaction a. Received $10,300 cash for consulting services rendered in January b. Issued common stock to investors for $16,500 cash. c. Purchased $15,300 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years d. Received $12,100 cash for consulting services to be performed in February e. Bought and received $1,030 of supplies on account. f Received utility bill for January for $2,190, due February 15. g. Consulted for customers in January for fees totaling $20,700, due in February h. Received $15,500 cash for consulting services rendered in December 1. Paid $515 toward supplies purchased in (e). Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Jour Required in the first account field.) View transaction list Journal entry worksheet 4 5 6 7 8 9 Purchased $15,300 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. Reched the transaction. Note: Enter debits before credits Transaction General Journal Debit Credit a. Received $10,300 cash for consulting services rendered in January b. Issued common stock to Investors for $16,500 cash. c. Purchased $15,300 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $12,100 cash for consulting services to be performed in February e. Bought and received $1,030 of supplies on account. Received utility bill for January for $2.190, due February 15. g. Consulted for customers in January for fees totaling $20,700, due in February. h. Received $15,500 cash for consulting services rendered in December. 1. Paid $515 toward supplies purchased in (e). Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No Journe Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started