Answered step by step

Verified Expert Solution

Question

1 Approved Answer

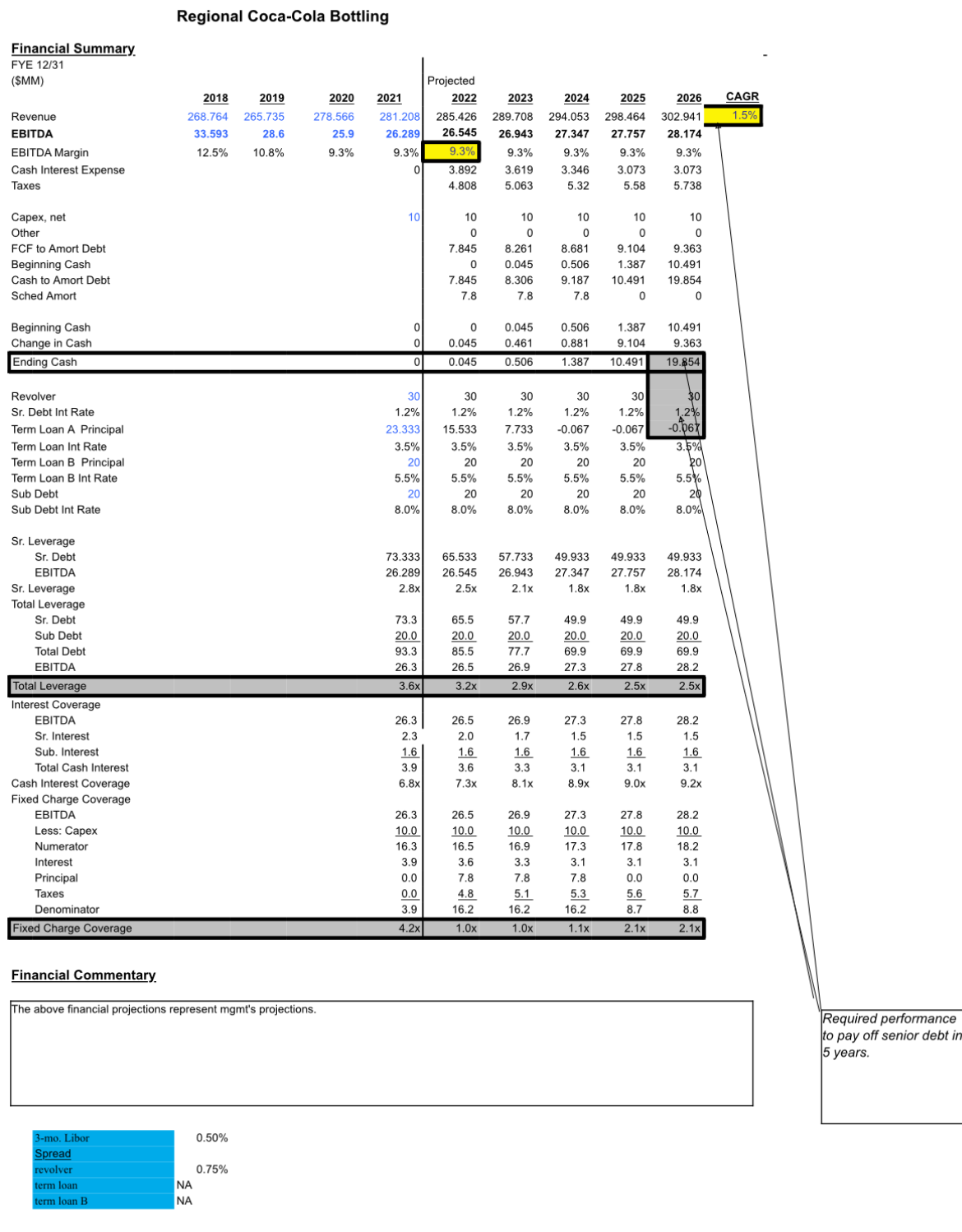

A regional Coca - Cola Bottler is evaluating a debt for equity recap, significantly increasing its overall financial leverage. The shareholders are working with their

A regional CocaCola Bottler is evaluating a debt for equity recap, significantly increasing its overall financial leverage. The shareholders are working with their investment bank to determine how large an equity redemption is supportable by the Company, and what level of performance would cause distress.

Question : Assuming a flat growth rate what level of EBITDA margin constant through the projection period will cause the company's fixed charge measure to drop below Xs

Question : Assuming a revenue growth rate of annually, what EBITDA margin will be required for the company to have enough cash at the end of five years to fully fund it's senior debt?

Question : Assuming an EBITDA margin of what level of revenue growth CAGR will be required for the company to have enough cash at the end of five years to fully fund it's senior debt?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started