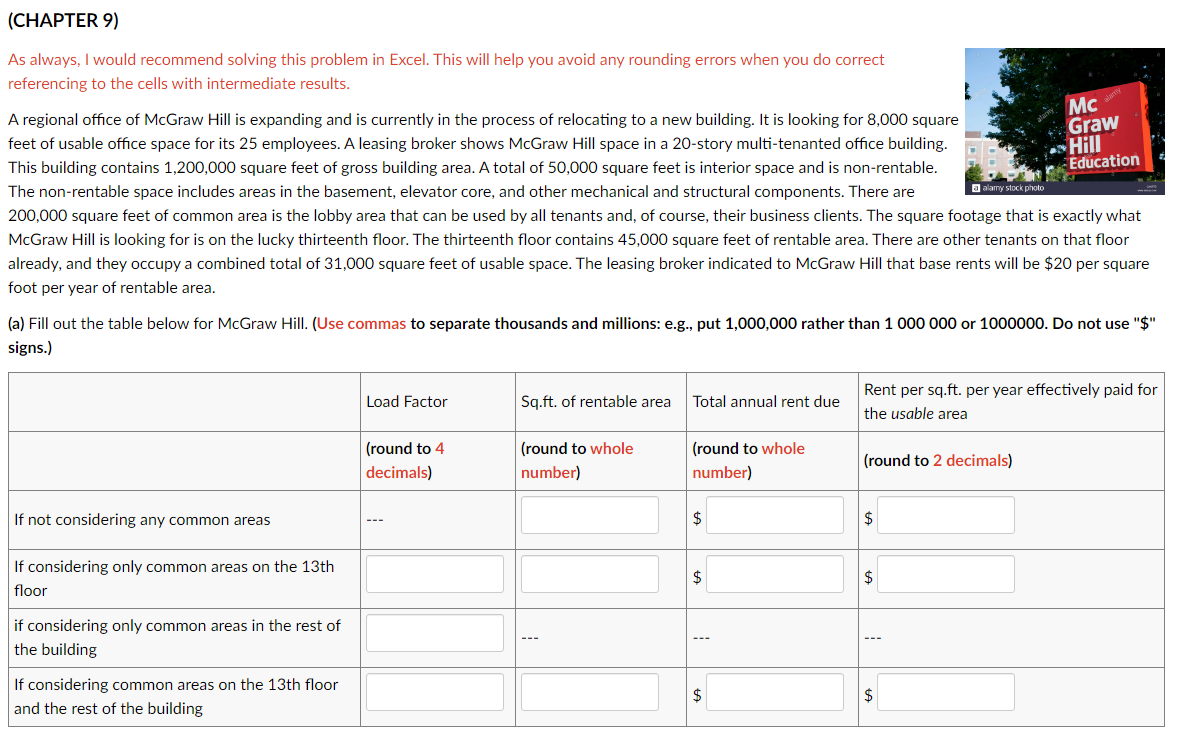

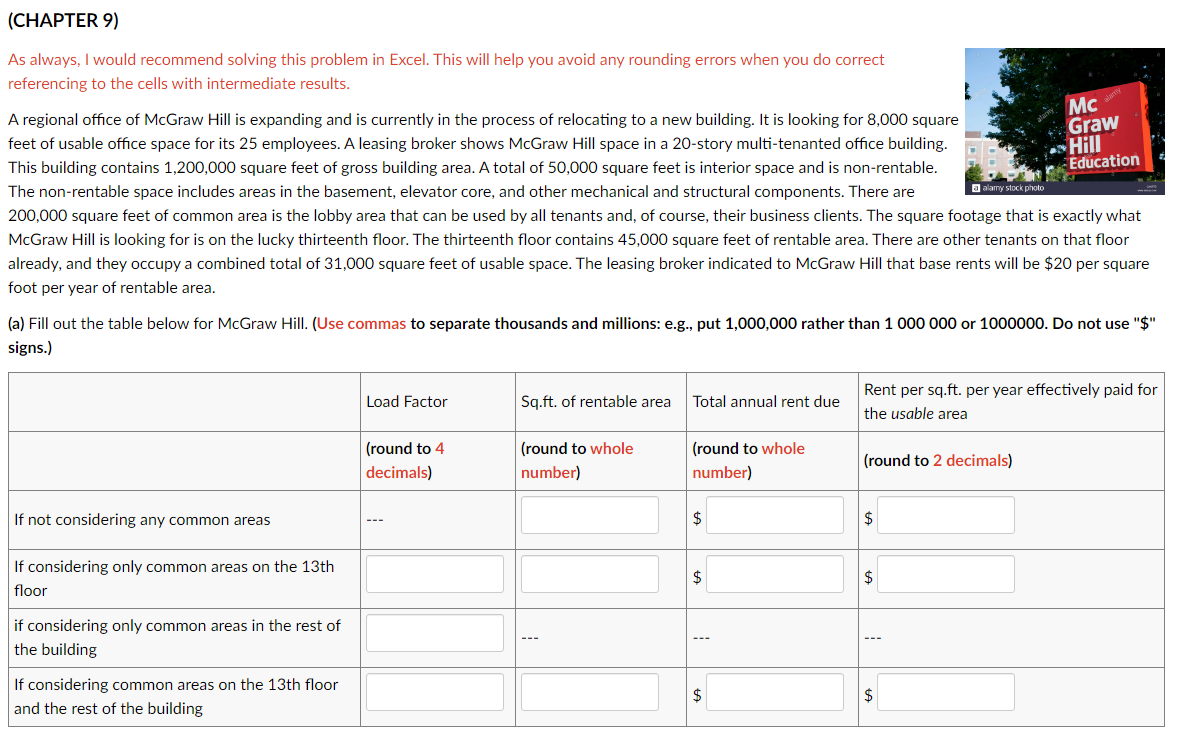

A regional office of McGraw Hill is expanding and is currently in the process of relocating to a new building. It is looking for 8,000 square feet of usable office space for its 25 employees. A leasing broker shows McGraw Hill space in a 20-story multi-tenanted office building. This building contains 1,200,000 square feet of gross building area. A total of 50,000 square feet is interior space and is non-rentable. The non-rentable space includes areas in the basement, elevator core, and other mechanical and structural components. There are 200,000 square feet of common area is the lobby area that can be used by all tenants and, of course, their business clients. The square footage that is exactly what McGraw Hill is looking for is on the lucky thirteenth floor. The thirteenth floor contains 45,000 square feet of rentable area. There are other tenants on that floor already, and they occupy a combined total of 31,000 square feet of usable space. The leasing broker indicated to McGraw Hill that base rents will be $20 per square foot per year of rentable area.

(a) Fill out the table below for McGraw Hill. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.)

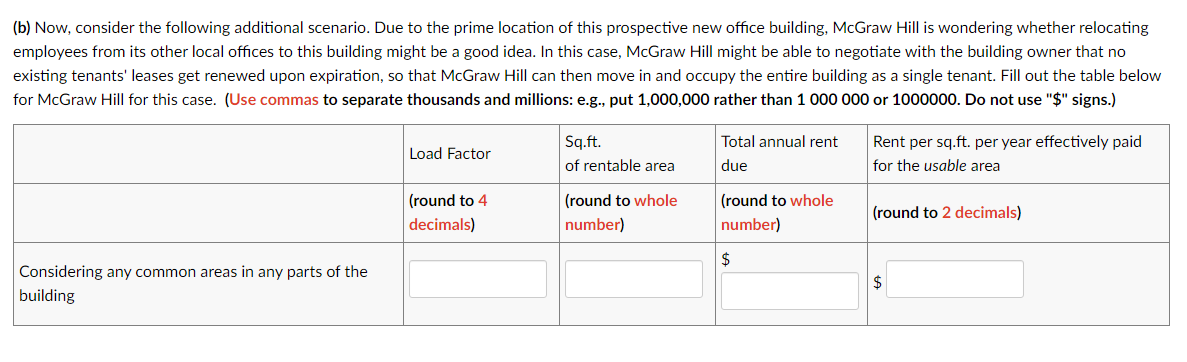

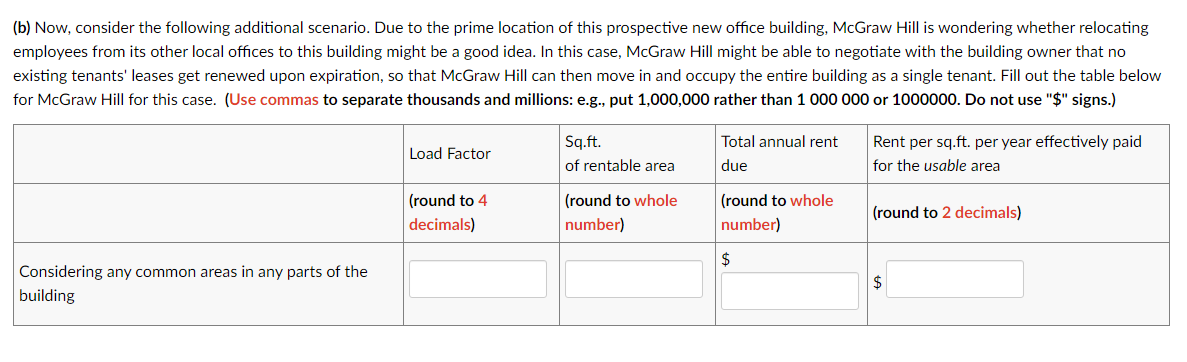

(b) Now, consider the following additional scenario. Due to the prime location of this prospective new office building, McGraw Hill is wondering whether relocating employees from its other local offices to this building might be a good idea. In this case, McGraw Hill might be able to negotiate with the building owner that no existing tenants' leases get renewed upon expiration, so that McGraw Hill can then move in and occupy the entire building as a single tenant. Fill out the table below for McGraw Hill for this case. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.)

(CHAPTER 9) As always, I would recommend solving this problem in Excel. This will help you avoid any rounding errors when you do correct referencing to the cells with intermediate results. Mc Graw Hill Education a alamy stock photo A regional office of McGraw Hill is expanding and is currently in the process of relocating to a new building. It is looking for 8,000 square feet of usable office space for its 25 employees. A leasing broker shows McGraw Hill space in a 20-story multi-tenanted office building. This building contains 1,200,000 square feet of gross building area. A total of 50,000 square feet is interior space and is non-rentable. The non-rentable space includes areas in the basement, elevator core, and other mechanical and structural components. There are 200,000 square feet of common area is the lobby area that can be used by all tenants and, of course, their business clients. The square footage that is exactly what McGraw Hill is looking for is on the lucky thirteenth floor. The thirteenth floor contains 45,000 square feet of rentable area. There are other tenants on that floor already, and they occupy a combined total of 31,000 square feet of usable space. The leasing broker indicated to McGraw Hill that base rents will be $20 per square foot per year of rentable area. (a) Fill out the table below for McGraw Hill. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.) Load Factor Rent per sq.ft. per year effectively paid for Sq.ft. of rentable area Total annual rent due the usable area (round to 4 decimals) (round to whole number) (round to whole number) (round to 2 decimals) If not considering any common areas $ $ If considering only common areas on the 13th floor $ $ if considering only common areas in the rest of the building If considering common areas on the 13th floor and the rest of the building $ $ (b) Now, consider the following additional scenario. Due to the prime location of this prospective new office building, McGraw Hill is wondering whether relocating employees from its other local offices to this building might be a good idea. In this case, McGraw Hill might be able to negotiate with the building owner that no existing tenants' leases get renewed upon expiration, so that McGraw Hill can then move in and occupy the entire building as a single tenant. Fill out the table below for McGraw Hill for this case. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.) Load Factor Sq.ft. of rentable area Total annual rent due Rent per sq.ft. per year effectively paid for the usable area (round to 4 decimals) (round to whole number) (round to whole number) (round to 2 decimals) $ Considering any common areas in any parts of the building $ (CHAPTER 9) As always, I would recommend solving this problem in Excel. This will help you avoid any rounding errors when you do correct referencing to the cells with intermediate results. Mc Graw Hill Education a alamy stock photo A regional office of McGraw Hill is expanding and is currently in the process of relocating to a new building. It is looking for 8,000 square feet of usable office space for its 25 employees. A leasing broker shows McGraw Hill space in a 20-story multi-tenanted office building. This building contains 1,200,000 square feet of gross building area. A total of 50,000 square feet is interior space and is non-rentable. The non-rentable space includes areas in the basement, elevator core, and other mechanical and structural components. There are 200,000 square feet of common area is the lobby area that can be used by all tenants and, of course, their business clients. The square footage that is exactly what McGraw Hill is looking for is on the lucky thirteenth floor. The thirteenth floor contains 45,000 square feet of rentable area. There are other tenants on that floor already, and they occupy a combined total of 31,000 square feet of usable space. The leasing broker indicated to McGraw Hill that base rents will be $20 per square foot per year of rentable area. (a) Fill out the table below for McGraw Hill. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.) Load Factor Rent per sq.ft. per year effectively paid for Sq.ft. of rentable area Total annual rent due the usable area (round to 4 decimals) (round to whole number) (round to whole number) (round to 2 decimals) If not considering any common areas $ $ If considering only common areas on the 13th floor $ $ if considering only common areas in the rest of the building If considering common areas on the 13th floor and the rest of the building $ $ (b) Now, consider the following additional scenario. Due to the prime location of this prospective new office building, McGraw Hill is wondering whether relocating employees from its other local offices to this building might be a good idea. In this case, McGraw Hill might be able to negotiate with the building owner that no existing tenants' leases get renewed upon expiration, so that McGraw Hill can then move in and occupy the entire building as a single tenant. Fill out the table below for McGraw Hill for this case. (Use commas to separate thousands and millions: e.g., put 1,000,000 rather than 1 000 000 or 1000000. Do not use "$" signs.) Load Factor Sq.ft. of rentable area Total annual rent due Rent per sq.ft. per year effectively paid for the usable area (round to 4 decimals) (round to whole number) (round to whole number) (round to 2 decimals) $ Considering any common areas in any parts of the building $