Question

On October 1, 2006, a company sold services to a customer and accepted a note in exchange with a P120,000 face value and an

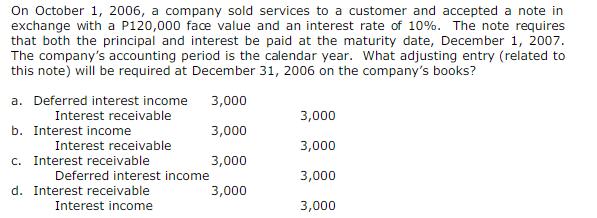

On October 1, 2006, a company sold services to a customer and accepted a note in exchange with a P120,000 face value and an interest rate of 10%. The note requires that both the principal and interest be paid at the maturity date, December 1, 2007. The company's accounting period is the calendar year. What adjusting entry (related to this note) will be required at December 31, 2006 on the company's books? 3,000 a. Deferred interest income Interest receivable b. Interest income Interest receivable 3,000 3,000 3,000 c. Interest receivable Deferred interest income d. Interest receivable Interest income 3,000 3,000 3,000 3,000

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER c Interest rece ivable 3 000 Def erred intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App