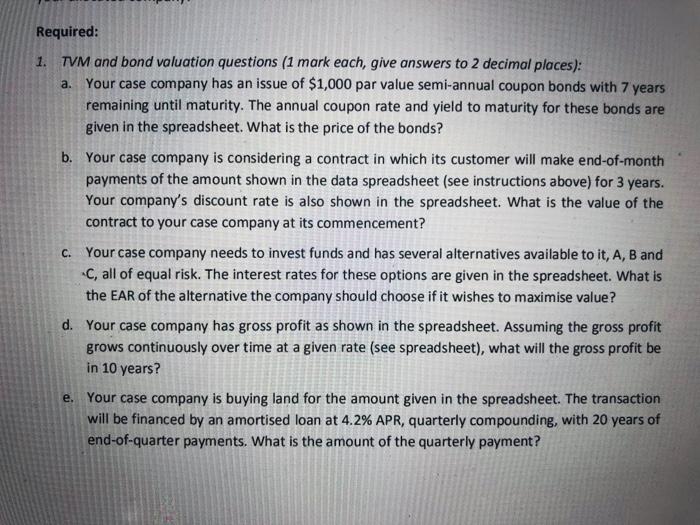

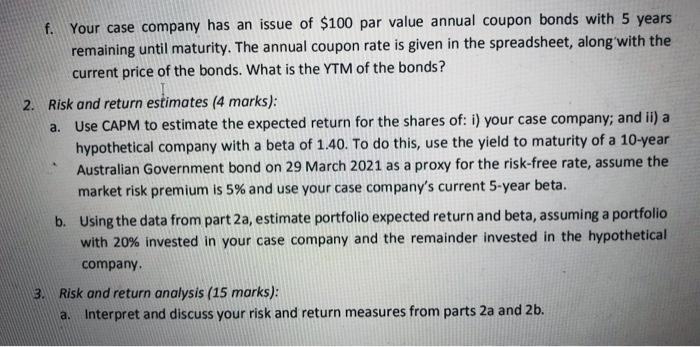

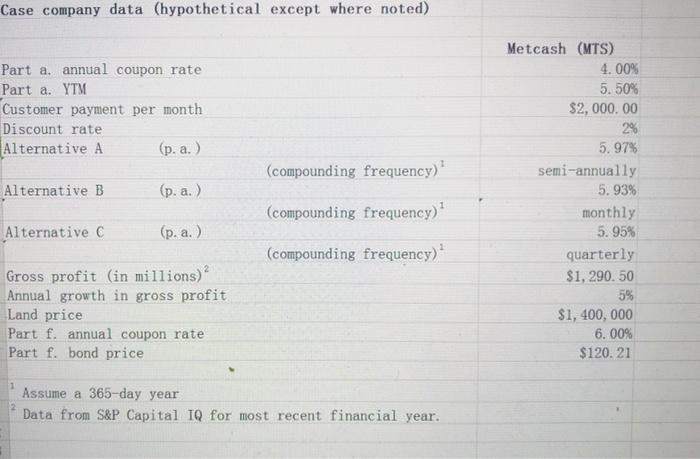

a. Required: 1. TVM and bond valuation questions (1 mark each, give answers to 2 decimal places): Your case company has an issue of $1,000 par value semi-annual coupon bonds with 7 years remaining until maturity. The annual coupon rate and yield to maturity for these bonds are given in the spreadsheet. What is the price of the bonds? b. Your case company is considering a contract in which its customer will make end-of-month payments of the amount shown in the data spreadsheet (see instructions above) for 3 years. Your company's discount rate is also shown in the spreadsheet. What is the value of the contract to your case company at its commencement? c. Your case company needs to invest funds and has several alternatives available to it, A, B and C, all of equal risk. The interest rates for these options are given in the spreadsheet. What is the EAR of the alternative the company should choose if it wishes to maximise value? d. Your case company has gross profit as shown in the spreadsheet. Assuming the gross profit grows continuously over time at a given rate (see spreadsheet), what will the gross profit be in 10 years? e. Your case company is buying land for the amount given in the spreadsheet. The transaction will be financed by an amortised loan at 4.2% APR, quarterly compounding, with 20 years of end-of-quarter payments. What is the amount of the quarterly payment? f. Your case company has an issue of $100 par value annual coupon bonds with 5 years remaining until maturity. The annual coupon rate is given in the spreadsheet, along with the current price of the bonds. What is the YTM of the bonds? 2. Risk and return estimates (4 marks): a. Use CAPM to estimate the expected return for the shares of: i) your case company; and ii) a hypothetical company with a beta of 1.40. To do this, use the yield to maturity of a 10-year Australian Government bond on 29 March 2021 as a proxy for the risk-free rate, assume the market risk premium is 5% and use your case company's current 5-year beta. b. Using the data from part 2a, estimate portfolio expected return and beta, assuming a portfolio with 20% invested in your case company and the remainder invested in the hypothetical company 3. Risk and return analysis (15 marks): a. Interpret and discuss your risk and return measures from parts 2a and 2b. Case company data (hypothetical except where noted) Part a. annual coupon rate Part a. YTM Customer payment per month Discount rate Alternative A (p. a.) Metcash (MTS) 4.00% 5. 50% $2,000.00 2% (compounding frequency) Alternative B (p. a.) (compounding frequency) Alternative C (p. a.) (compounding frequency) 5.97% semi-annually 5.93% monthly 5.95% quarterly $1,290.50 5% $1,400,000 6.00% $120.21 Gross profit (in millions) Annual growth in gross profit Land price Part f. annual coupon rate Part f. bond price 1 Assume a 365-day year Data from S&P Capital IQ for most recent financial year