Question

A research paper compares the business model, efficiency, asset quality, and stability of Islamic and conventional banks, using an array of indicators constructed from balance

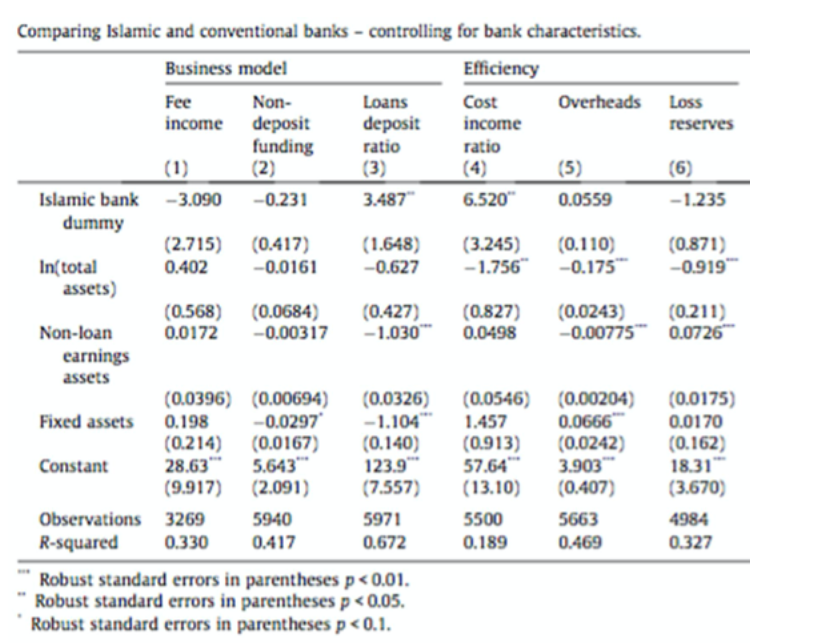

A research paper compares the business model, efficiency, asset quality, and stability of Islamic and conventional banks, using an array of indicators constructed from balance sheet and income statement data across a sample of 22 countries with both Islamic and conventional banks. The following table is among the results of this paper:

Note: Islamic bank dummy = 1 for Islamic bank and 0 for conventional bank.

Note: for efficiency, the higher the efficiency ratio means the bank is less efficient

Note: total assets is a proxy for bank size

-

What is the focus/main independent variable of this study that help the researchers to answer the research questions?

-

What are the control variables in this table?

-

Based on the different estimations in the table, how different is the business model of Islamic banks from conventional banks?

-

Based on the different estimations in the table, are the Islamic banks more efficient compared to its conventional peers?

-

Are big banks more efficient compared to small banks?

-

What can be the policy recommendation of this finding?

-

Comparing Islamic and conventional banks - controlling for bank characteristics. Business model Efficiency Fee Non- Loans Cost Overheads Loss income deposit deposit income reserves funding ratio ratio (2) (3) (5) (6) Islamic bank -3.090 -0.231 3.487" 6.520 0.0559 -1.235 dummy (2.715) (0.417) (1.648) (3.245) (0.110) (0.871) In(total 0.402 -0.0161 -0.627 -1.756 -0.175 -0.919 assets) (0.568) (0.0684) (0.427) (0.827) (0.0243) (0.211) Non-loan 0.0172 -0.00317 -1.030" 0.0498 -0.00775 0.0726 earnings assets (0.0396) (0.00694) (0.0326) (0.0546) (0.00204) (0.0175) Fixed assets 0.198 -0.0297 - 1.104 1.457 0.0666 0.0170 (0.214) (0.0167) (0.140) (0.913) (0.0242) (0.162) Constant 28.63" 5.643" 123.9 57.64" 3.903 18.31 (9.917) (2.091) (7.557) (13.10) (0.407) (3.670) Observations 3269 5940 5971 5500 5663 4984 R-squared 0.330 0.417 0.672 0.189 0.469 0.327 Robust standard errors in parentheses p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started