Question

A resident alien sustained the following losses during the year Fire loss on his uninsured residence in Manila Damage sustain by an insured vehicle

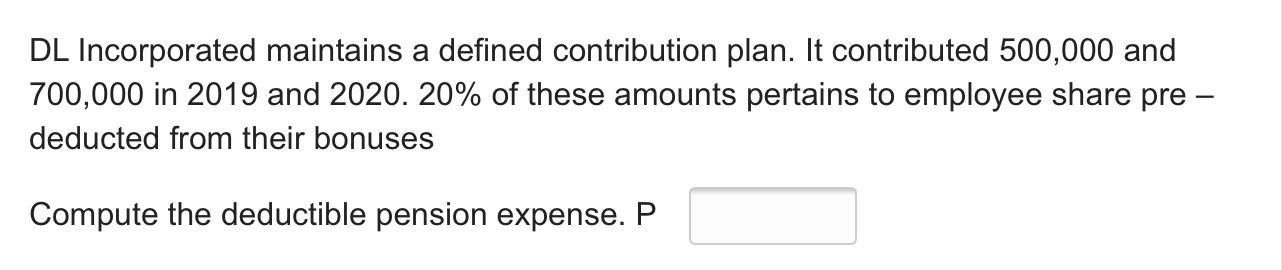

A resident alien sustained the following losses during the year Fire loss on his uninsured residence in Manila Damage sustain by an insured vehicle in a collision Various uncollectible customers account Loss on the sale of domestic bonds Loss on the sale of obsolete equipment and supplies Impairment loss on unsold inventories Value of uninsured machineries robbed in a Thailand Branch P 2,000,000 400,000 80,000 50,000 120,000 30,000 300,000 Determine the total amount of reportable losses in the income tax return. P DL Incorporated maintains a defined contribution plan. It contributed 500,000 and 700,000 in 2019 and 2020. 20% of these amounts pertains to employee share pre deducted from their bonuses Compute the deductible pension expense. P

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance

Authors: Thomas Garman, Raymond Forgue

12th edition

9781305176409, 1133595839, 1305176405, 978-1133595830

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App