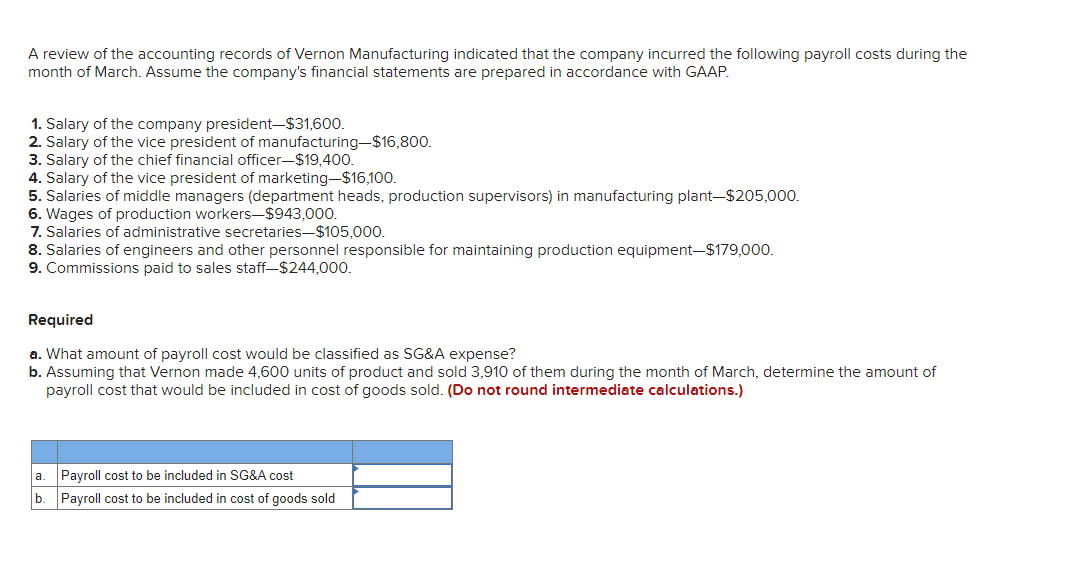

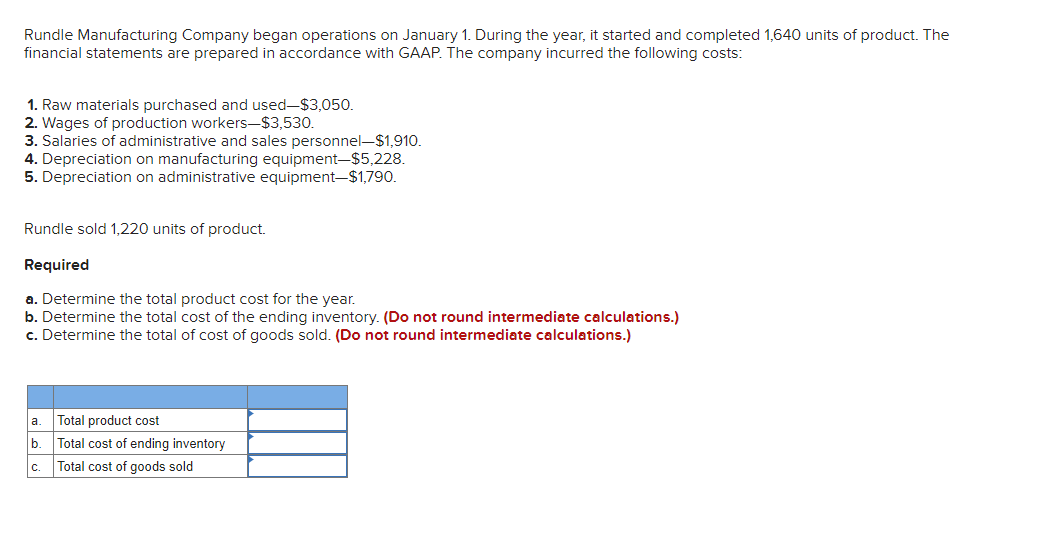

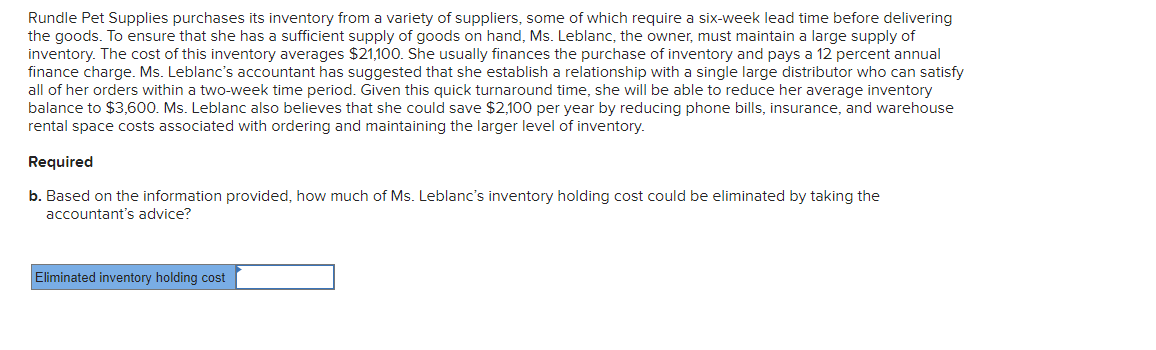

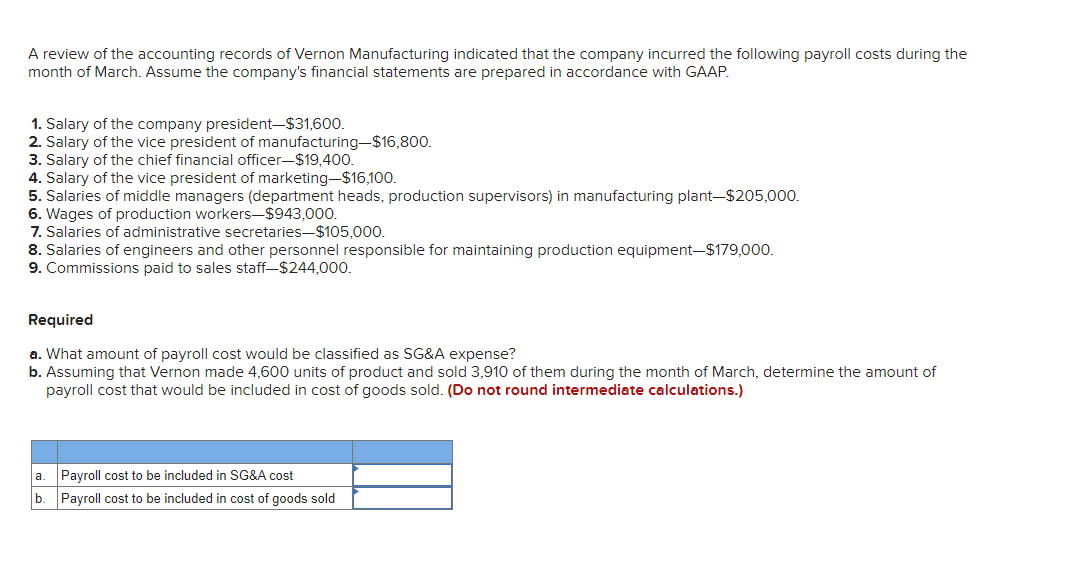

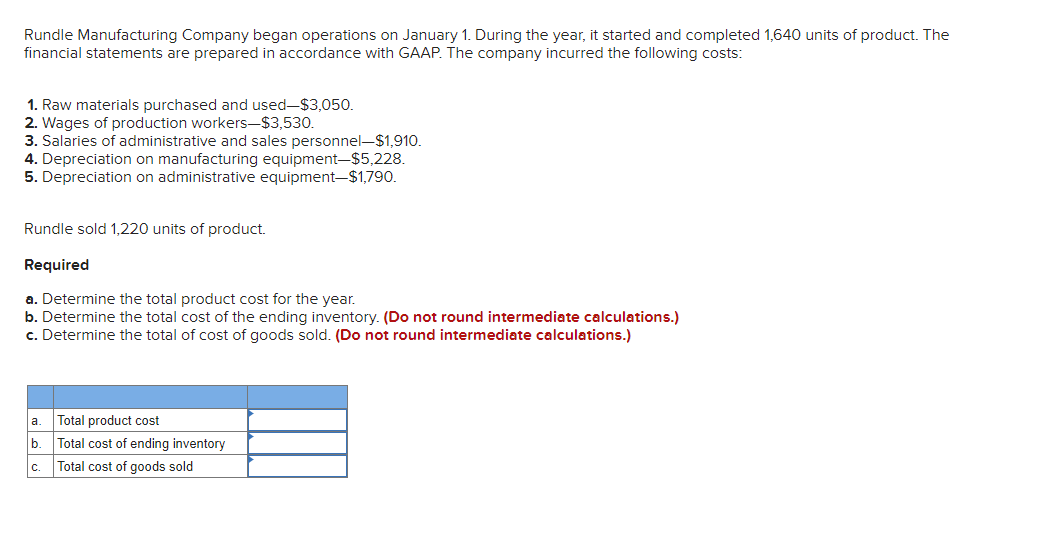

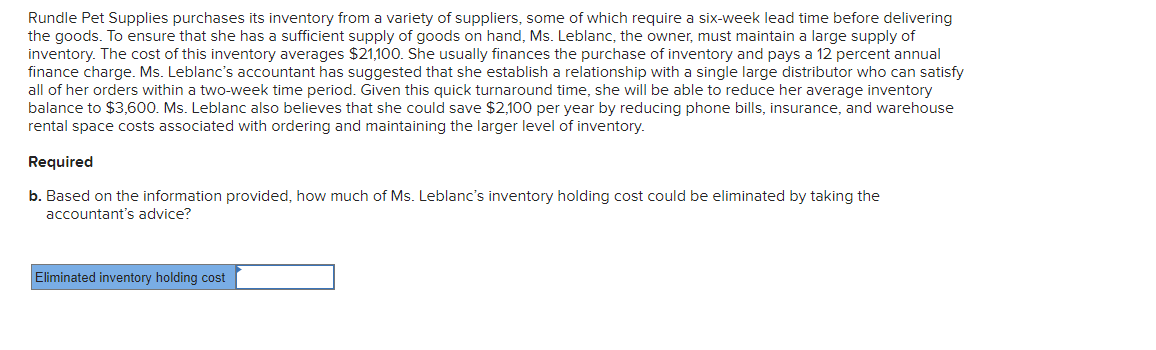

A review of the accounting records of Vernon Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president $31,600. 2. Salary of the vice president of manufacturing $16,800. 3. Salary of the chief financial officer $19,400. 4. Salary of the vice president of marketing $16,100. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant $205,000. 6. Wages of production workers $943,000. 7. Salaries of administrative secretaries $105,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment $179,000. 9. Commissions paid to sales staff- $244,000. Required a. What amount of payroll cost would be classified as SG\&A expense? b. Assuming that Vernon made 4,600 units of product and sold 3,910 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.) Rundle Manufacturing Company began operations on January 1. During the year, it started and completed 1,640 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used $3,050. 2. Wages of production workers $3,530. 3. Salaries of administrative and sales personnel $1,910. 4. Depreciation on manufacturing equipment $5,228. 5. Depreciation on administrative equipment- $1,790. Rundle sold 1,220 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) Rundle Pet Supplies purchases its inventory from a variety of suppliers, some of which require a six-week lead time before delivering the goods. To ensure that she has a sufficient supply of goods on hand, Ms. Leblanc, the owner, must maintain a large supply of inventory. The cost of this inventory averages $21,100. She usually finances the purchase of inventory and pays a 12 percent annual finance charge. Ms. Leblanc's accountant has suggested that she establish a relationship with a single large distributor who can satisfy all of her orders within a two-week time period. Given this quick turnaround time, she will be able to reduce her average inventory balance to $3,600. Ms. Leblanc also believes that she could save $2,100 per year by reducing phone bills, insurance, and warehouse rental space costs associated with ordering and maintaining the larger level of inventory. Required b. Based on the information provided, how much of Ms. Leblanc's inventory holding cost could be eliminated by taking the accountant's advice