Answered step by step

Verified Expert Solution

Question

1 Approved Answer

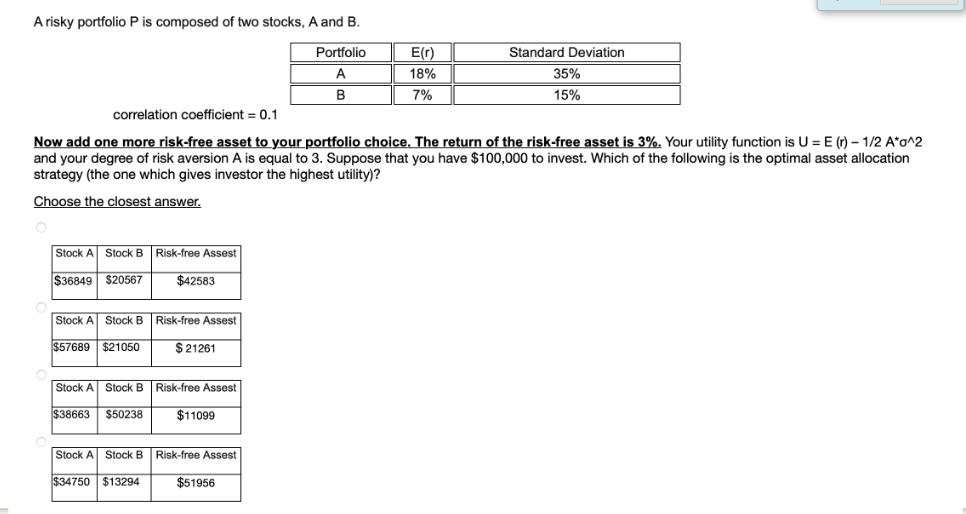

A risky portfolio P is composed of two stocks, A and B. Portfolio A B Stock A Stock B Risk-free Assest $36849 $20567 correlation

A risky portfolio P is composed of two stocks, A and B. Portfolio A B Stock A Stock B Risk-free Assest $36849 $20567 correlation coefficient = 0.1 Now add one more risk-free asset to your portfolio choice. The return of the risk-free asset is 3%. Your utility function is U = E (r) - 1/2 A*o^2 and your degree of risk aversion A is equal to 3. Suppose that you have $100,000 to invest. Which of the following is the optimal asset allocation strategy (the one which gives investor the highest utility)? Choose the closest answer. Stock A Stock B Risk-free Assest $57689 $21050 $42583 $38663 $50238 $21261 Stock A Stock B Risk-free Assest $11099 Stock A Stock B Risk-free Assest $34750 $13294 E(r) 18% 7% $51956 Standard Deviation 35% 15%

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SOLUTION To determine the optimal asset allocation strategy that gives the investor the h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started