Answered step by step

Verified Expert Solution

Question

1 Approved Answer

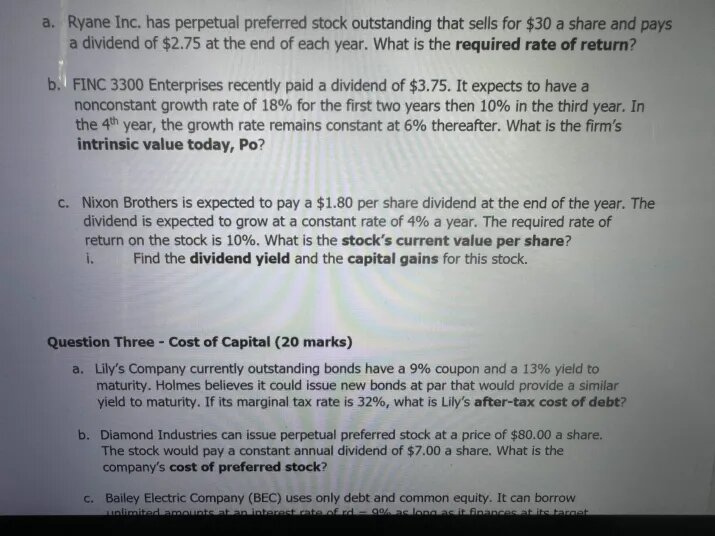

a . Ryane Inc. has perpetual preferred stock outstanding that sells for $ 3 0 a share and pays tion Three - Cost of Capital

a Ryane Inc. has perpetual preferred stock outstanding that sells for $ a share and pays tion Three Cost of Capital marks

Lily's Company currently outstanding bonds have a coupon and a yield to

maturity. Holmes believes it could issue new bonds at par that would provide a similar

yield to maturity. If its marginal tax rate is what is Lily's aftertax cost of debt?

Diamond Industries can issue perpetual preferred stock at a price of $ a share.

The stock would pay a constant annual dividend of $ a share. What is the

company's cost of preferred stock?

c Bailey Electric Company BEC uses only debt and common equity. It can borrow

unlimited amounts at an interest rate of rd as long as it finances at its target

capital structure, which calls for debt and common equity. Its last dividend

was $ its expected constant growth rate is and its common stock sells for $

BEC's tax rate is

i What is the cost of common equity?

ii What is BEC's WACC?

Veronica UC has an WACC and is considering two mutually exclusive investments with the

following cash flows:

a dividend of $ at the end of each year. What is the required rate of return?

b FINC Enterprises recently paid a dividend of $ It expects to have a

nonconstant growth rate of for the first two years then in the third year. In

the year, the growth rate remains constant at thereafter. What is the firm's

intrinsic value today, Po

c Nixon Brothers is expected to pay a $ per share dividend at the end of the year. The

dividend is expected to grow at a constant rate of a year. The required rate of

return on the stock is What is the stock's current value per share?

i Find the dividend yield and the capital gains for this stock.

Question Three Cost of Capital marks

a Lily's Company currently outstanding bonds have a coupon and a yield to

maturity. Holmes believes it could issue new bonds at par that would provide a similar

yield to maturity. If its marginal tax rate is what is Lily's aftertax cost of debt?

b Diamond Industries can issue perpetual preferred stock at a price of $ a share.

The stock would pay a constant annual dividend of $ a share. What is the

company's cost of preferred stock?

c Bailey Electric Company BEC uses only debt and common equity. It can borrow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started