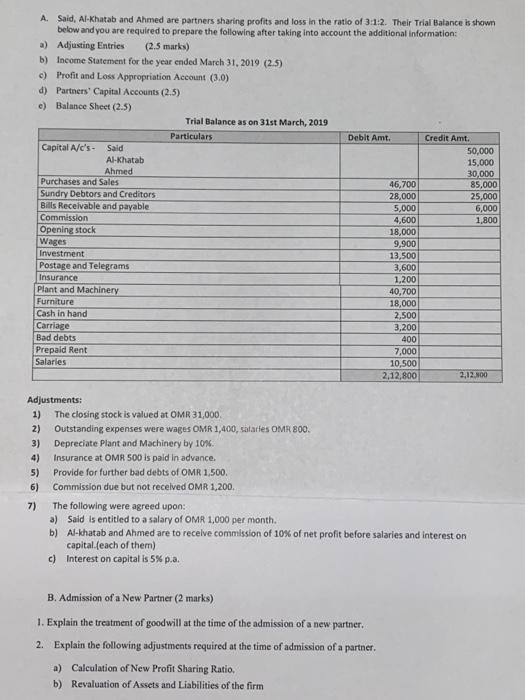

A. Said, Al-Khatab and Ahmed are partners sharing profits and loss in the ratio of 3:12. Their Trial Balance is shown below and you are required to prepare the following after taking into account the additional Information: a) Adjusting Entries (2.5 marks) b) Income Statement for the year ended March 31, 2019 (2,5) c) Profit and Loss Appropriation Account (3.0) d) Partners' Capital Accounts (2.5) e) Balance Sheet (2.5) Trial Balance as on 31st March, 2019 Particulars Debit Amt. Credit Amt. Capital A/c's - Sald 50,000 Al-Khatab 15,000 Ahmed 30,000 Purchases and Sales 46,700 85,000 Sundry Debtors and Creditors 28,000 25,000 Bills Receivable and payable 5,000 6,000 Commission 4,600 1.800 Opening Stock 18,000 Wages 9,900 Investment 13,500 Postage and Telegrams 3,600 Insurance 1,200 Plant and Machinery 40,700 Furniture 18,000 Cash in hand 2,500 Carriage 3,200 Bad debts 400 Prepaid Rent 7,000 Salaries 10,500 2 12,800 2.12.10 Adjustments: 1) The closing stock is valued at OMR 31,000 2) Outstanding expenses were wages OMR 1,400, salaries OMR 800. 3) Depreciate Plant and Machinery by 10%. 4) Insurance at OMR 500 is paid in advance. 5) Provide for further bad debts of OMR 1,500. 6) Commission due but not received OMR 1,200, 7) The following were agreed upon: a) Said is entitled to a salary of OMR 1,000 per month. b) Al-khatab and Ahmed are to receive commission of 10% of net profit before salaries and interest on capital (each of them) c) Interest on capital is 5% p.a. B. Admission of a New Partner (2 marks) 1. Explain the treatment of goodwill at the time of the admission of a new partner. 2. Explain the following adjustments required at the time of admission of a partner. a) Calculation of New Profit Sharing Ratio. b) Revaluation of Assets and Liabilities of the firm A. Said, Al-Khatab and Ahmed are partners sharing profits and loss in the ratio of 3:12. Their Trial Balance is shown below and you are required to prepare the following after taking into account the additional Information: a) Adjusting Entries (2.5 marks) b) Income Statement for the year ended March 31, 2019 (2,5) c) Profit and Loss Appropriation Account (3.0) d) Partners' Capital Accounts (2.5) e) Balance Sheet (2.5) Trial Balance as on 31st March, 2019 Particulars Debit Amt. Credit Amt. Capital A/c's - Sald 50,000 Al-Khatab 15,000 Ahmed 30,000 Purchases and Sales 46,700 85,000 Sundry Debtors and Creditors 28,000 25,000 Bills Receivable and payable 5,000 6,000 Commission 4,600 1.800 Opening Stock 18,000 Wages 9,900 Investment 13,500 Postage and Telegrams 3,600 Insurance 1,200 Plant and Machinery 40,700 Furniture 18,000 Cash in hand 2,500 Carriage 3,200 Bad debts 400 Prepaid Rent 7,000 Salaries 10,500 2 12,800 2.12.10 Adjustments: 1) The closing stock is valued at OMR 31,000 2) Outstanding expenses were wages OMR 1,400, salaries OMR 800. 3) Depreciate Plant and Machinery by 10%. 4) Insurance at OMR 500 is paid in advance. 5) Provide for further bad debts of OMR 1,500. 6) Commission due but not received OMR 1,200, 7) The following were agreed upon: a) Said is entitled to a salary of OMR 1,000 per month. b) Al-khatab and Ahmed are to receive commission of 10% of net profit before salaries and interest on capital (each of them) c) Interest on capital is 5% p.a. B. Admission of a New Partner (2 marks) 1. Explain the treatment of goodwill at the time of the admission of a new partner. 2. Explain the following adjustments required at the time of admission of a partner. a) Calculation of New Profit Sharing Ratio. b) Revaluation of Assets and Liabilities of the firm