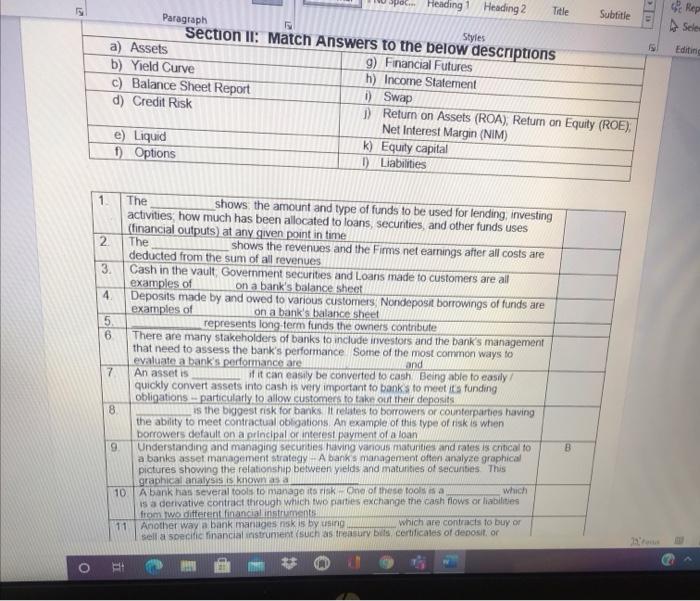

A Selen dem Heading Heading 2 Title Subtitle Paragraph Styles Section 1: Match Answers to the below descriptions a) Assets 9) Financial Futures b) Yield Curve h) Income Statement c) Balance Sheet Report i) Swap d) Credit Risk 1) Return on Assets (ROA), Retum on Equity (ROE), Net Interest Margin (NIM) e) Liquid k) Equity capital f) Options D Liabilities 1 The shows the amount and type of funds to be used for lending, investing activities, how much has been allocated to loans, securities, and other funds uses (financial outputs) at any given point in time 2 The shows the revenues and the Firms net earnings after all costs are deducted from the sum of all revenues 3. Cash in the vault, Government securities and Loans made to customers are all examples of on a bank's balance sheet 4 Deposits made by and owed to various customers; Nondeposit borrowings of funds are examples of on a bank's balance sheet 5 represents long term funds the owners contribute 6 There are many stakeholders of banks to include investors and the bank's management that need to assess the bank's performance Some of the most common ways to evaluate a bank's performance are and 7 An asset is if it can easily be converted to cash Being able to easily quickly convert assets into cash is very important to banks to meet is funding obligations particularly to allow customers to take out their deposits 8 is the biggest risk for banks. It relates to borrowers or counterpares having the ability to meet contractual obligations. An example of this type of risks when borrowers default on a principal or interest payment of a loan 9 Understanding and managing securities having various maturities and rates is critical to a banks asset management Strategy - A banks management often analyze graphical pictures showing the relationship between yields and matunities of securities This graphical analysis is known as a 10. Abank has several tools to manage its risk One of these tools a which is a derivative contract through which two paties exchange the cash flows or liabilities from two different financial instruments which are contracts to buy or 11 Another way a bank manages risk is by using sella specific financial instrument (such as treasury bus certificates of depositor o