Answered step by step

Verified Expert Solution

Question

1 Approved Answer

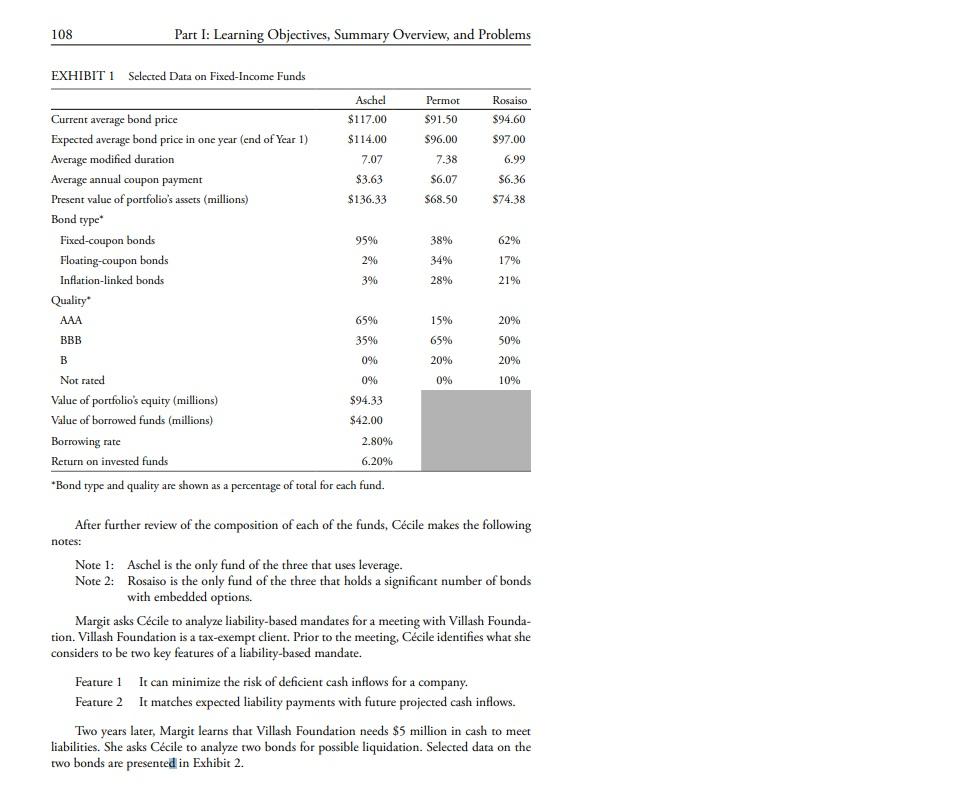

2) Based on Exhibit 1, the rolling yield of Aschel over a one-year investment horizon is closet to: A) -2.56% B) 0.54% C) 5.66% Bond

2) Based on Exhibit 1, the rolling yield of Aschel over a one-year investment horizon is closet to:

A) -2.56%

B) 0.54%

C) 5.66%

"Bond type and quality are shown as a percentage of total for each fund. After further review of the composition of each of the funds, Ccile makes the following notes: Note 1: Aschel is the only fund of the three that uses leverage. Note 2: Rosaiso is the only fund of the three that holds a significant number of bonds with embedded options. Margit asks Ccile to analyze liability-based mandates for a meeting with Villash Foundation. Villash Foundation is a tax-exempt client. Prior to the meeting, Ccile identifies what she considers to be two key features of a liability-based mandate. Feature 1 It can minimize the risk of deficient cash inflows for a company. Feature 2 It matches expected liability payments with future projected cash inflows. Two years later, Margit learns that Villash Foundation needs $5 million in cash to meet liabilities. She asks Ccile to analyze two bonds for possible liquidation. Selected data on the two bonds are presented in Exhibit 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started