Question: A. Set up an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 20

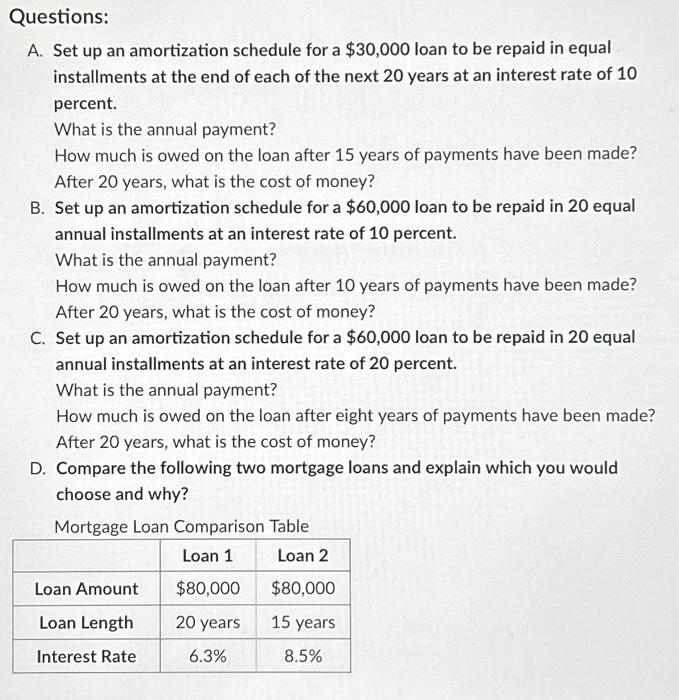

A. Set up an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 10 percent. What is the annual payment? How much is owed on the loan after 15 years of payments have been made? After 20 years, what is the cost of money? B. Set up an amortization schedule for a $60,000 loan to be repaid in 20 equal annual installments at an interest rate of 10 percent. What is the annual payment? How much is owed on the loan after 10 years of payments have been made? After 20 years, what is the cost of money? C. Set up an amortization schedule for a $60,000 loan to be repaid in 20 equal annual installments at an interest rate of 20 percent. What is the annual payment? How much is owed on the loan after eight years of payments have been made? After 20 years, what is the cost of money? D. Compare the following two mortgage loans and explain which you would choose and why? Mortgage Loan Comparison Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts