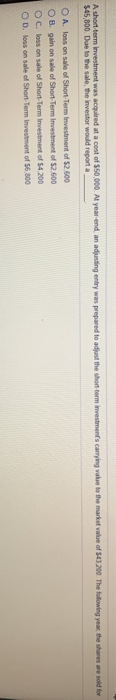

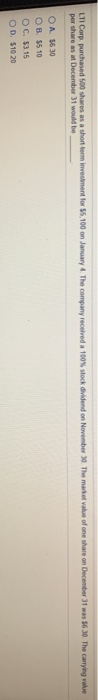

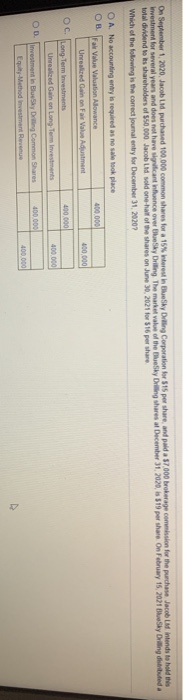

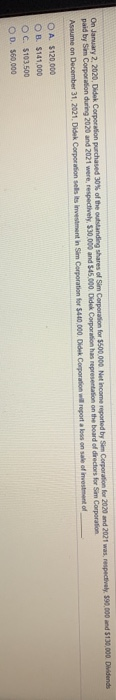

A short term investment was acquired at a cost of $50,000. At year-end an adjusting entry was prepared to adjust the short-term investment's carrying value to the market value of 0.200 The following year, the shares are sold for 545,800 Due to the sale, the investor would report a O A. loss on sale of Short-Term Investment of $2.500 OB. gain on sale of Short-Term Investment of $2.600 OC. loss on sale of Short Term Investment of $4200 OD. loss on sale of Short-Term Investment of 56 300 LTI Corp purchased 500 shares as a short term investment for $5,100 on January 4. The company received a 100% stock dividend on November 30. The market value of one share on December 31 was 5630 The carrying value per shwe as at December 31 would be O A 5630 OB. 55.10 OC. $3.15 OD 510 20 On September 1, 2020, Jacob Lad purchased 100.000 common shares for a 15% were in Blue Sky Dating Corporation for 515 per share, and paid a 57000 brokerage commission for the purchase Jacob LM intends to hold the Investment for several years and does not have significant fence over the sky Drilling the market value of the Besky Ding shares at December 31, 2020, is 519 per share on February 15, 2021 Blue Sky Ding dibuted a total dividend to as shareholders of $50,000 Jacob Lid sold one half of the shares on June 30, 2021 for $16 per share Which of the following is the correct journal entry for December 31, 2020? O A No accounting entry is required as no sale took place OB Fair Value Valuation Allowance Unreaked Gain on Fair Value Adjustment 400.000 100,000 . 400.000 400 000 Long-Term Investments Unrealized Gain on Long Term Investments Investment in Blue Sky Da Common Shares EquyMethod investment Revenue OD 400.000 400.000 On January 2, 2020, Didek Corporation purchased 30% of the outstanding shares of Sim Corporation for $500,000 Net Income reported by Sim Corporation for 2020 and 2021 was, respectively. 590,000 and 5130,000 Dividends paid by Sim Corporation during 2020 and 2021 were, respectively, 530,000 and 545.000 Didek Corporation has representation on the board of directors for Sam Corporation Assume on December 31, 2021, Didek Corporion ses its investment in Sim Corporation for 5440 000. Didik Corporation will report a loss on sale of investment of O A $120.000 OB. $141,000 OC 5103.500 OD. 560,000