Question

A simple expert system can be designed by using just a few functions. Our system will analyze each ratio separately and will only determine whether

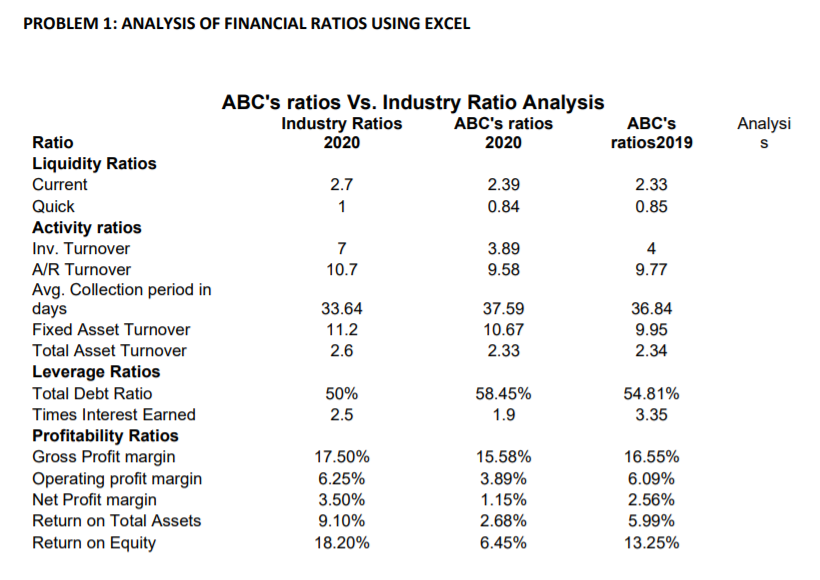

A simple expert system can be designed by using just a few functions. Our system will analyze each ratio separately and will only determine whether a ratio is either "Good", "OK", or "Bad". To be really useful, the system would need to consider the interrelationships between the ratios, the industry that the company is in, etc. I leave it to you to improve the system.

We want to make 2 tests to determine whether a ratio is "good", "ok", or "bad".

First we will test to see if the 2020 ratio of the company is greater than 2019 ratio, and the 2020 ratio is greater than the industry average. If it is then the ratio is "Good". Ratio will be judged as good if both conditions are true.

We will say that the ratio is "OK" if the 2020 value is greater than the 2019 value, or the 2020 value is greater than the industry average.

Remember, that for leverage ratio, lower is generally better. Make adjustment for this. Also you need to make the same change for the average collection period

PROBLEM 1: ANALYSIS OF FINANCIAL RATIOS USING EXCEL ABC's ratios Vs. Industry Ratio Analysis Industry Ratios ABC's ratios ABC's 2020 2020 ratios 2019 Analysi s 2.7 1 2.39 0.84 2.33 0.85 7 10.7 3.89 9.58 4 9.77 Ratio Liquidity Ratios Current Quick Activity ratios Inv. Turnover A/R Turnover Avg. Collection period in days Fixed Asset Turnover Total Asset Turnover Leverage Ratios Total Debt Ratio Times Interest Earned Profitability Ratios Gross Profit margin Operating profit margin Net Profit margin Return on Total Assets Return on Equity 33.64 11.2 2.6 37.59 10.67 2.33 36.84 9.95 2.34 50% 2.5 58.45% 1.9 54.81% 3.35 17.50% 6.25% 3.50% 9.10% 18.20% 15.58% 3.89% 1.15% 2.68% 6.45% 16.55% 6.09% 2.56% 5.99% 13.25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started