Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A simple optimal portfolio problem is the cash matching problem. Suppose you are given a sequence of future monetary obligations, in dollars, required to be

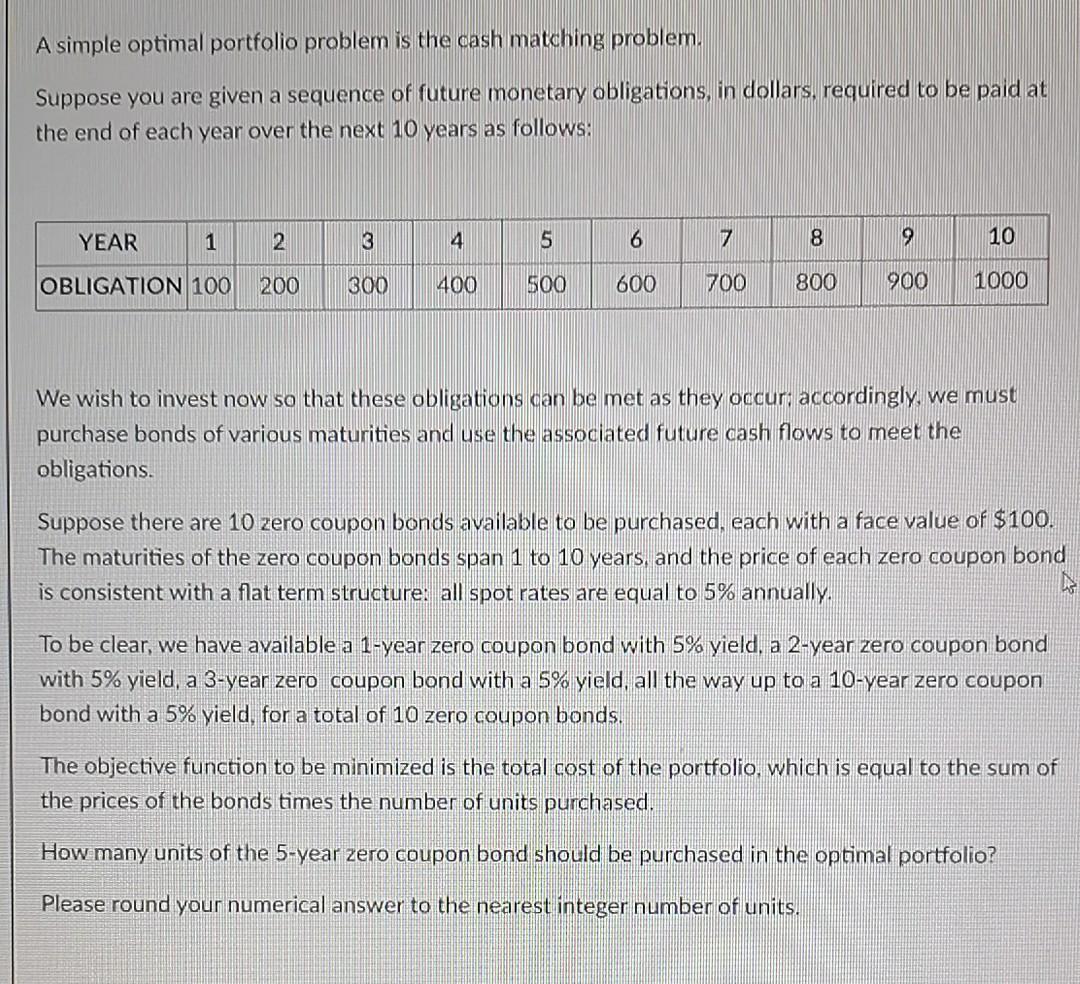

A simple optimal portfolio problem is the cash matching problem. Suppose you are given a sequence of future monetary obligations, in dollars, required to be paid at the end of each year over the next 10 years as follows: YEAR 1 2 3 5 6 7 8 9 10 OBLIGATION 100 200 300 400 500 600 700 800 900 1000 We wish to invest now so that these obligations can be met as they occur accordingly, we must purchase bonds of various maturities and use the associated future cash flows to meet the obligations. Suppose there are 10 zero coupon bonds available to be purchased, each with a face value of $100. The maturities of the zero coupon bonds span 1 to 10 years, and the price of each zero coupon bond is consistent with a flat term structure: all spot rates are equal to 5% annually. To be clear, we have available a 1-year zero coupon bond with 5% yield, a 2-year zero coupon bond with 5% yield, a 3-year zero coupon bond with a 5% yield, all the way up to a 10-year zero coupon bond with a 5% yield, for a total of 10 zero coupon bonds. The objective function to be minimized is the total cost of the portfolio, which is equal to the sum of the prices of the bonds times the number of units purchased. How many units of the 5-year zero coupon bond should be purchased in the optimal portfolio? Please round your numerical answer to the nearest integer number of units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started