Question

A small company heats its building and spends $8 comma 5008,500 per year on natural gas for this purpose. Cost increases of natural gas are

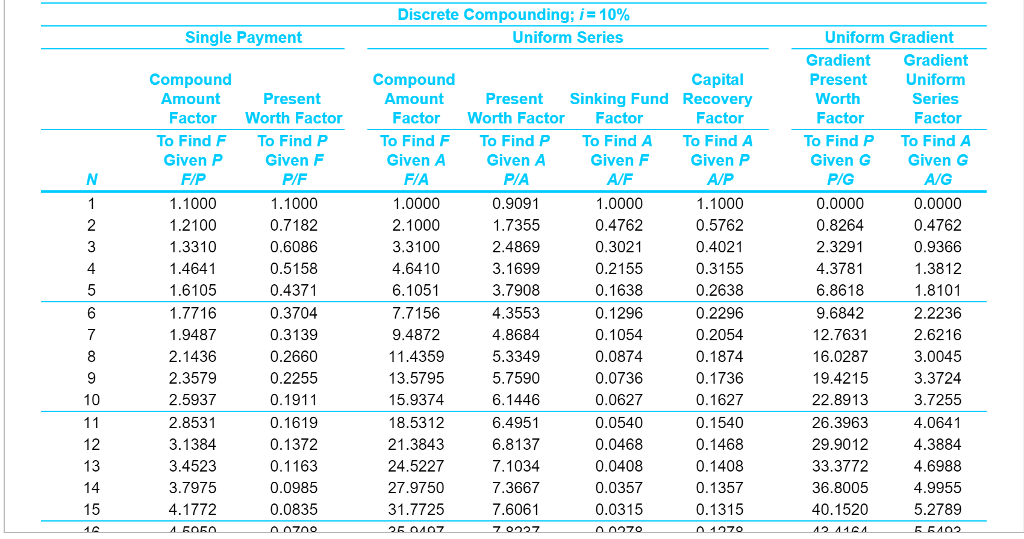

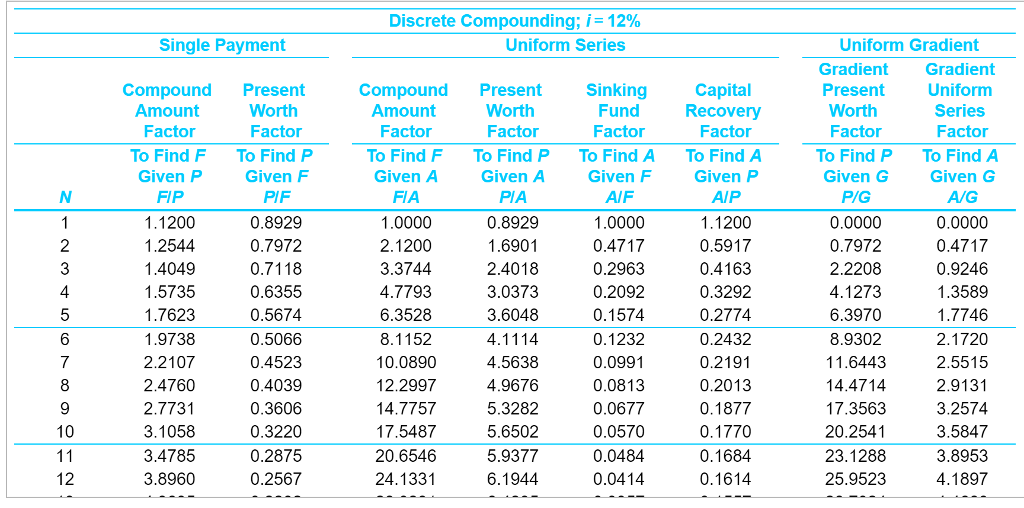

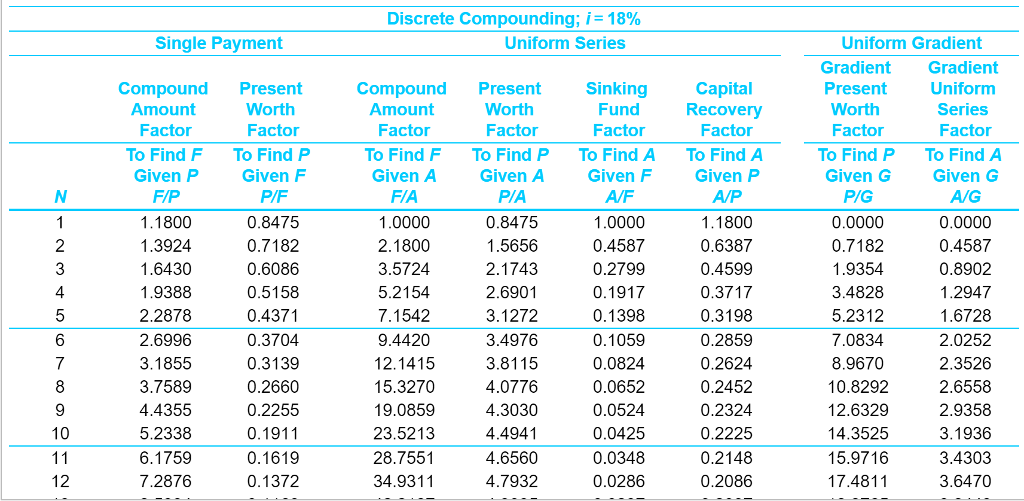

A small company heats its building and spends $8 comma 5008,500 per year on natural gas for this purpose. Cost increases of natural gas are expected to be 1010% per year starting one year from now (i.e., the first cash flow is $9 comma 3509,350 at EOY one). Their maintenance on the gas furnace is $355355 per year, and this expense is expected to increase by 1212% per year starting one year from now (i.e., the first cash flow for this expense is $397.60397.60 at the EOY one). If the planning horizon is 1414 years, what is the total annual equivalent expense for operating and maintaining the furnace? The interest rate is 1818% per year.

A small company heats its building and spends $8 comma 5008,500 per year on natural gas for this purpose. Cost increases of natural gas are expected to be 1010% per year starting one year from now (i.e., the first cash flow is $9 comma 3509,350 at EOY one). Their maintenance on the gas furnace is $355355 per year, and this expense is expected to increase by 1212% per year starting one year from now (i.e., the first cash flow for this expense is $397.60397.60 at the EOY one). If the planning horizon is 1414 years, what is the total annual equivalent expense for operating and maintaining the furnace? The interest rate is 1818% per year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started