Answered step by step

Verified Expert Solution

Question

1 Approved Answer

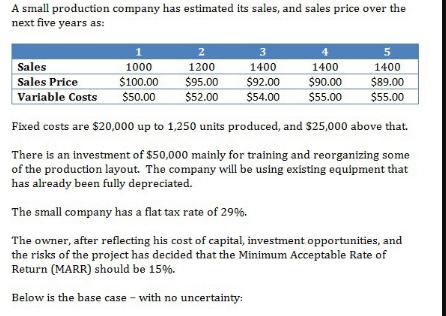

A small production company has estimated its sales, and sales price over the next five years as: 2 1200 $95.00 $52.00 3 1400 $92.00

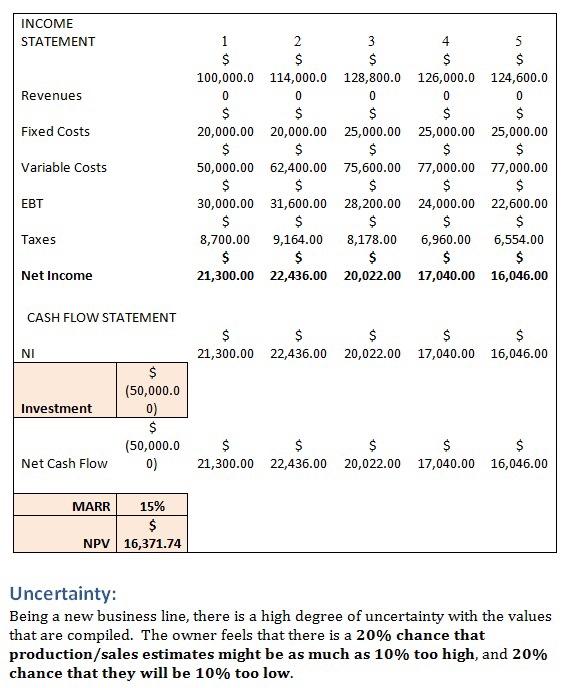

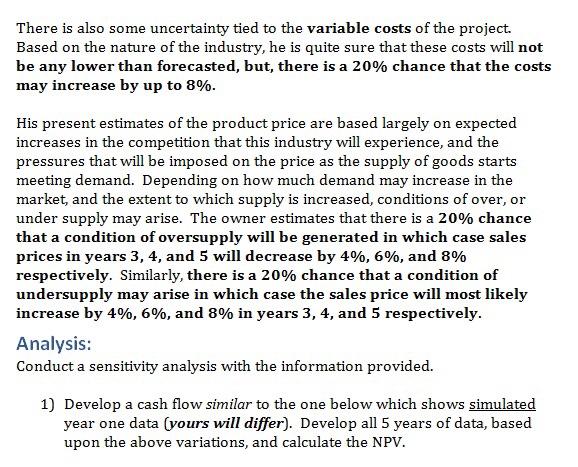

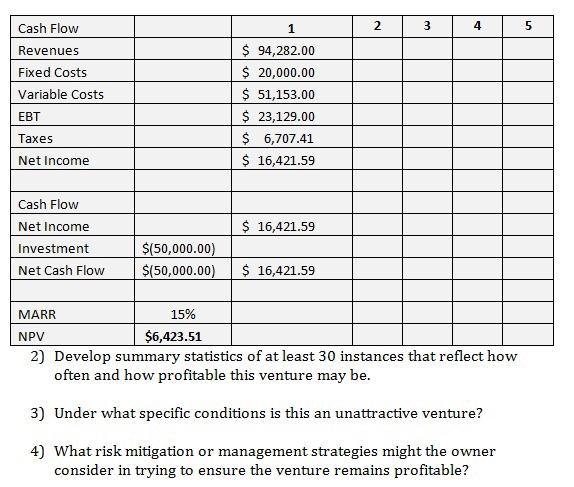

A small production company has estimated its sales, and sales price over the next five years as: 2 1200 $95.00 $52.00 3 1400 $92.00 $54.00 1 Sales 1000 Sales Price $100.00 Variable Costs $50.00 Fixed costs are $20,000 up to 1,250 units produced, and $25,000 above that. There is an investment of $50,000 mainly for training and reorganizing some of the production layout. The company will be using existing equipment that has already been fully depreciated. The small company has a flat tax rate of 29%. The owner, after reflecting his cost of capital, investment opportunities, and the risks of the project has decided that the Minimum Acceptable Rate of Return (MARR) should be 15%. Below is the base case with no uncertainty: 5 1400 $89.00 $55.00 1400 $90.00 $55.00 INCOME STATEMENT Revenues Fixed Costs Variable Costs EBT Taxes Net Income CASH FLOW STATEMENT NI Investment Net Cash Flow MARR $ (50,000.0 0) $ (50,000.0 0) 15% $ NPV 16,371.74 1 S $ 100,000.0 0 $ 20,000.00 $ 50,000.00 $ 30,000.00 $ 8,700.00 $ 21,300.00 2S $ 9,164.00 $ 3 $ $ 21,300.00 22,436.00 $ 4 $ 126,000.0 0 114,000.0 128,800.0 0 0 $ $ 20,000.00 25,000.00 $ $ 62,400.00 75,600.00 77,000.00 77,000.00 $ $ $ $ 31,600.00 28,200.00 24,000.00 22,600.00 $ $ $ $ 8,178.00 6,554.00 $ $ 22,436.00 20,022.00 16,046.00 $ 25,000.00 $ 5 6,960.00 $ 17,040.00 $ 124,600.0 0 $ 25,000.00 $ $ $ $ 20,022.00 17,040.00 16,046.00 $ $ $ $ $ 21,300.00 22,436.00 20,022.00 17,040.00 16,046.00 Uncertainty: Being a new business line, there is a high degree of uncertainty with the values that are compiled. The owner feels that there is a 20% chance that production/sales estimates might be as much as 10% too high, and 20% chance that they will be 10% too low. There is also some uncertainty tied to the variable costs of the project. Based on the nature of the industry, he is quite sure that these costs will not be any lower than forecasted, but, there is a 20% chance that the costs may increase by up to 8%. His present estimates of the product price are based largely on expected increases in the competition that this industry will experience, and the pressures that will be imposed on the price as the supply of goods starts meeting demand. Depending on how much demand may increase in the market, and the extent to which supply is increased, conditions of over, or under supply may arise. The owner estimates that there is a 20% chance that a condition of oversupply will be generated in which case sales prices in years 3, 4, and 5 will decrease by 4%, 6%, and 8% respectively. Similarly, there is a 20% chance that a condition of undersupply may arise in which case the sales price will most likely increase by 4%, 6%, and 8% in years 3, 4, and 5 respectively. Analysis: Conduct a sensitivity analysis with the information provided. 1) Develop a cash flow similar to the one below which shows simulated year one data (yours will differ). Develop all 5 years of data, based upon the above variations, and calculate the NPV. Cash Flow Revenues Fixed Costs Variable Costs EBT Taxes Net Income Cash Flow Net Income Investment Net Cash Flow $(50,000.00) $(50,000.00) 1 $ 94,282.00 $ 20,000.00 $ 51,153.00 $ 23,129.00 $ 6,707.41 $ 16,421.59 15% $6,423.51 $ 16,421.59 $ 16,421.59 2 3 4 MARR NPV 2) Develop summary statistics of at least 30 instances that reflect how often and how profitable this venture may be. 3) Under what specific conditions is this an unattractive venture? 4) What risk mitigation or management strategies might the owner consider in trying to ensure the venture remains profitable? 5

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To conduct a sensitivity analysis based on the provided information lets calculate the cash flows for each year incorporating the variations and uncertainties mentioned Well also calculate the net pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started