Answered step by step

Verified Expert Solution

Question

1 Approved Answer

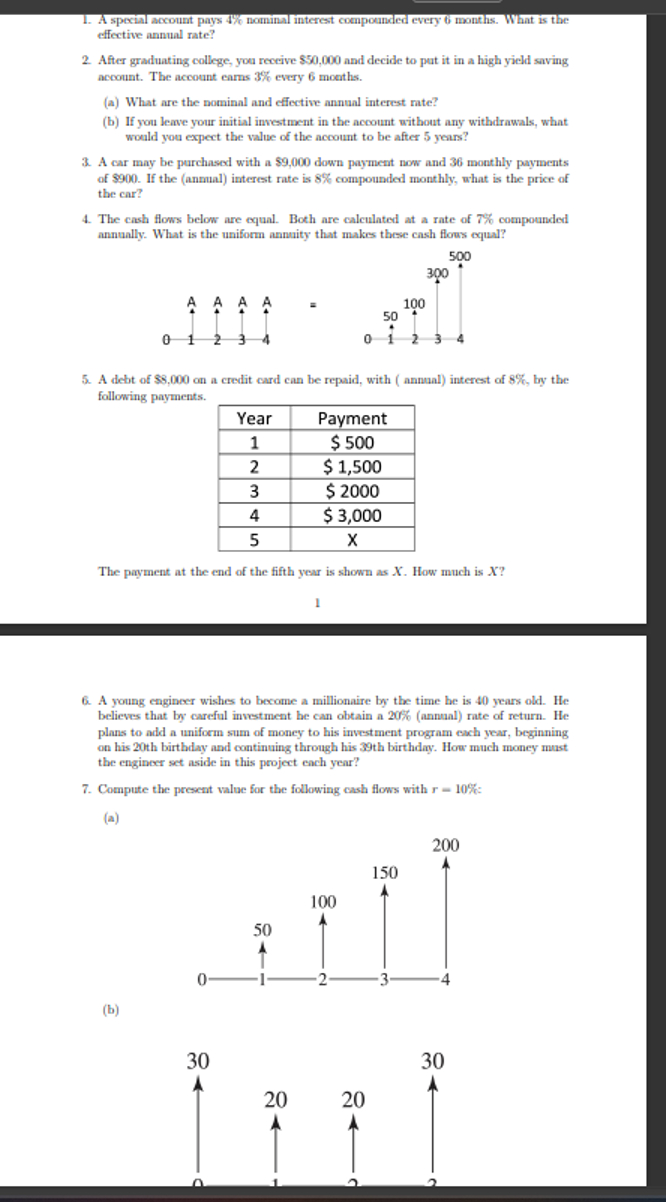

A special account pays 4 % nominal interest compounded every 6 months. What i s the effective annual rate? After graduating college, you receive $

A special account pays nominal interest compounded every months. What the

effective annual rate?

After graduating college, you receive $ and decide put a high yield saving

account. The account earns every months.

What are the nominal and effective annual interest rate?

you leave your initial investment the account without any withdrawals, what

would you expect the value the account after years?

A car may purchased with $ down payment now and monthly payments

$ the interest rate compounded monthly, what the price

the car?

The cash flows below are equal. Both are calculated a rate compounded

annually. What the uniform annuity that makes these cash flous equal?

A debt $ a credit card can repaid, with interest the

following payments.

The payment the end the fifth year shown How much

A young engineer wishes become a millionaire the time years old.

believes that careful investment can obtain rate return.

plans add a uniform sum moncy his investment program each year, beginning

his birthday and continuing through his birthday. How much moncy must

the engineer set aside this project each year?

Compute the present value for the following cash flows with :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started