Question

A spot market and a futures and option market have been established for trading electrical energy in Syldavia. There are a number of participants in

A spot market and a futures and option market have been established for trading electrical energy in Syldavia. There are a number of participants in this market, but we consider only the following three players:

Syldavian Genco: A generating company owning a portfolio of plants with a maximum capacity of 800 MW.

Syldavian Power and Light: A company that owns one generating plant with a maximum capacity of 500 MW and serves load for one industrial user and residential consumers.

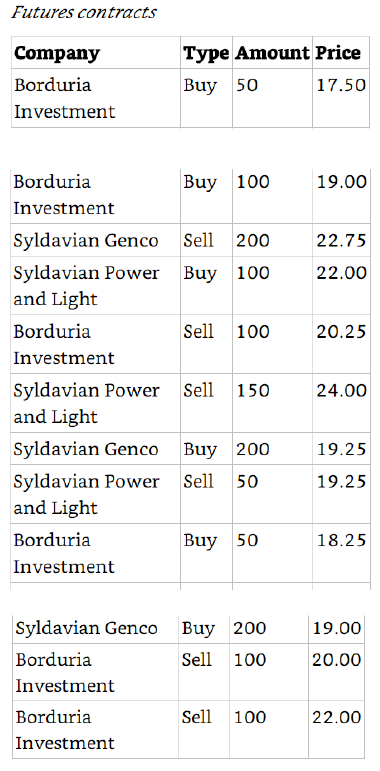

Borduria Investment: A trading company with no generating assets and no demand. We focus on contracts for delivery on May 14 between 1: 00 and 2: 00 p.m. These companies are parties to the following trades during this period.

Long-term contracts:

June 11, 2011: Syldavian Genco signed a contract for the supply of 600 MW during peak hours at a price of 20.00 $/ MWh.

July 04, 2012: Syldavian Genco signed a contract for the supply of 400 MW during off-peak hours at a price of 16.00 $/ MWh.

August 04, 2013: Syldavian Power and Light signed a long-term contract with the industrial user for the sale of 50 MW at a flat rate of 19.00 $/ MWh.

January 01, 2015: The regulatory agency required Syldavian Power and Light to sell electricity to residential customers at a tariff of 21.75 $/ MWh.

June 11, 2009: Syldavian Power and Light signed a contract for the purchase of 800 MW for all hours from January 1, 2015 to December 31, 2015. The price is 18 $/ MWh for off-peak hours and 21 $/ MWh for peak hours.

Option Contracts:

On March 1, 2015, Syldavian Genco bought a put option for 200 MWh at $ 20.75/ MWh.

On May 1, 2015, Syldavian Power and Light bought a call option for 150 MWh at an exercise price of 20.50 $/ MWh.

On May 7, 2015, Syldavian Power and Light bought a put option for 200 MWh at an exercise price of 23.50 $/ MWh. On May 10, 2015, Syldavian

Power and Light bought a call option for 300 MWh at an exercise price of 24.00 $/ MWh.

Spot Market (Outcome for May 14, 2015 between 1: 00 and 2: 00 p.m.)

The spot price was 21.50 $/ MWh.

The total load of the Syldavian Power and Light Company was 1400 MW, including the large industrial customer.

The power plant of Syldavian Power and Light produced 300 MWh at an average cost of 21.25 $/ MWh.

Syldavian Genco generated 730 MW at an average cost of 21.20 $/ MWh. The option fee for all the options is 1.00 $/ MWh. The peak hours are defined as being the hours between 8: 00 a.m. and 8: 00 p.m. Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by each company during that hour.

The option fee for all the options is 1.00 $/ MWh. The peak hours are defined as being the hours between 8: 00 a.m. and 8: 00 p.m.

a) Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by each company during that hour.

b) What value of the spot price would reduce the profit or loss of Syldavian Genco to zero?

c) Assume that the power plant Syldavian Power and Light owns has a cost function of C = 0.015P2 + 9P + 2325 and that this company has full control over the output of this plant at that hour. Was it optimal for this plant to produce 300 MWh during this period? If not, what should it have produced?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started