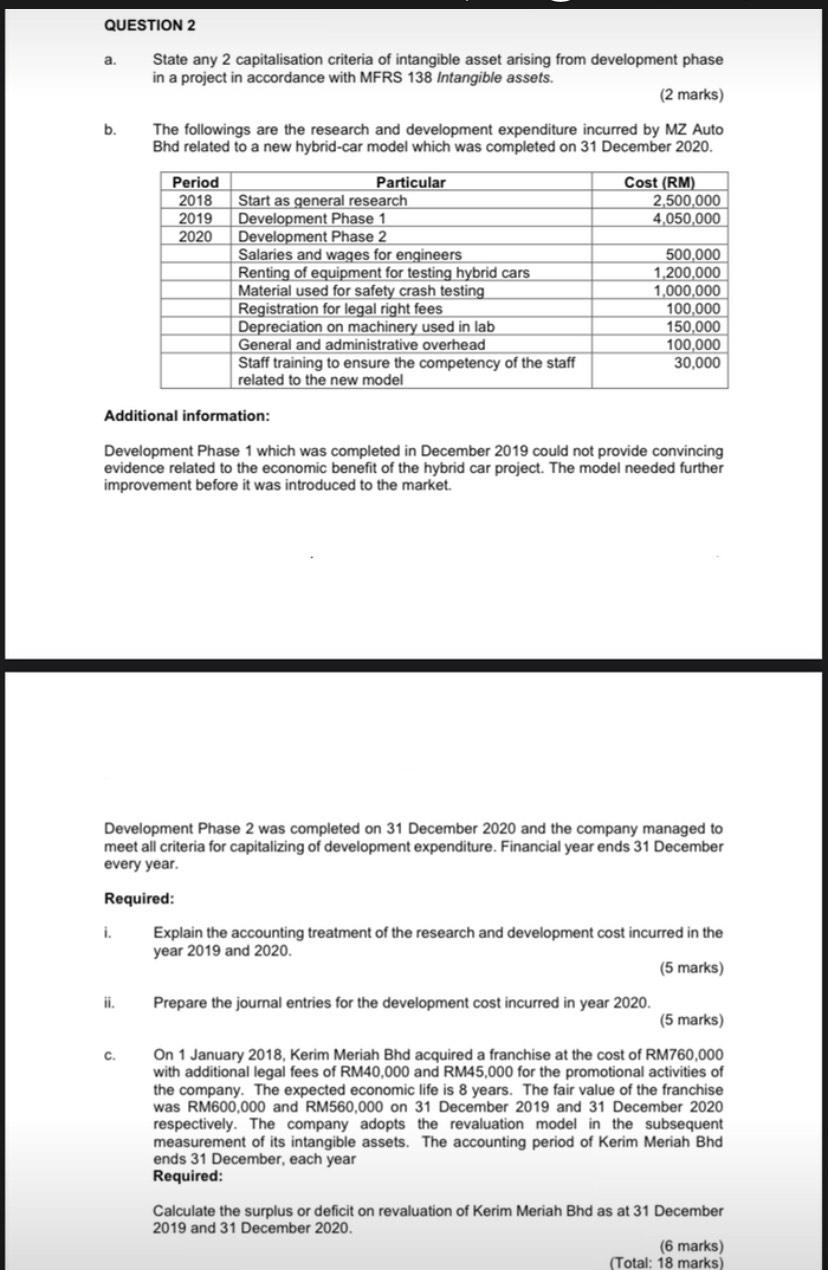

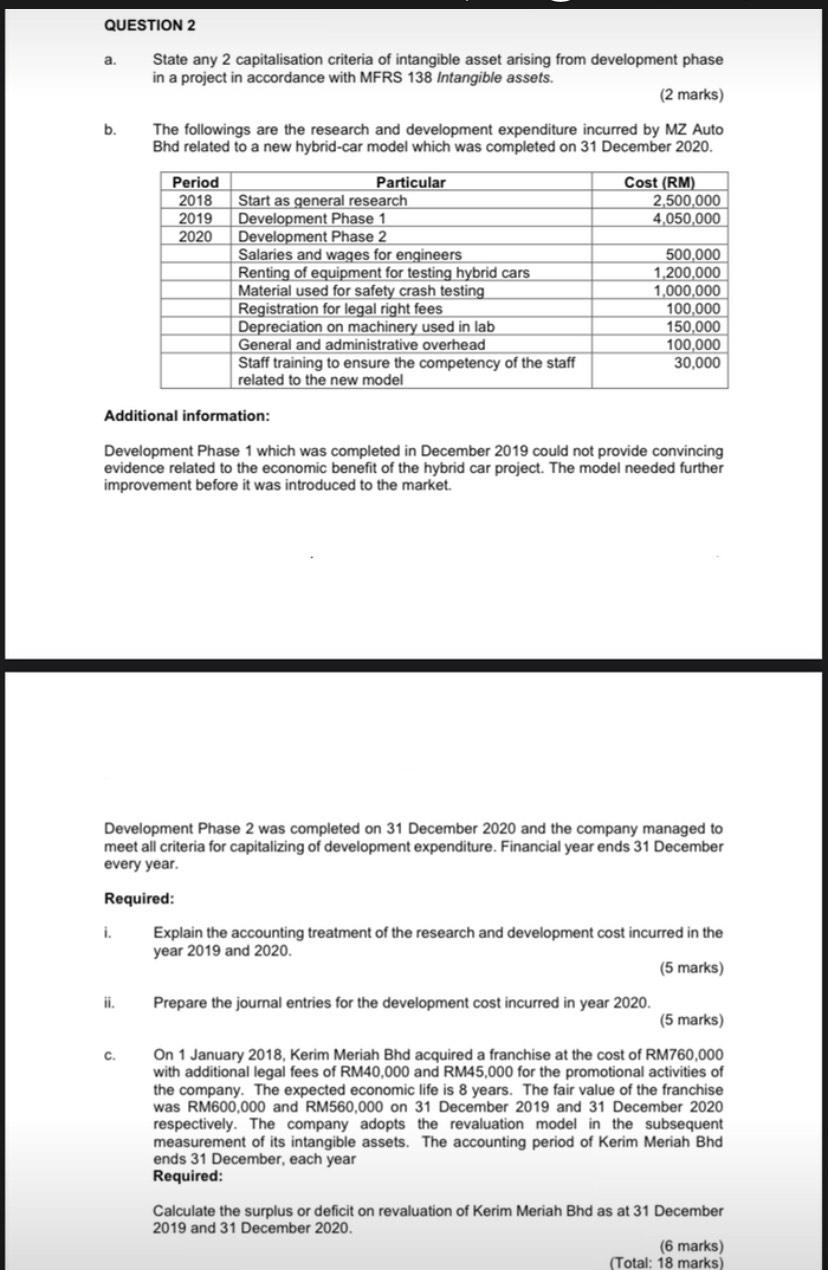

a. State any 2 capitalisation criteria of intangible asset arising from development phase in a project in accordance with MFRS 138 Intangible assets. (2 marks) b. The followings are the research and development expenditure incurred by MZ Auto Bhd related to a new hybrid-car model which was completed on 31 December 2020. Additional information: Development Phase 1 which was completed in December 2019 could not provide convincing evidence related to the economic benefit of the hybrid car project. The model needed further improvement before it was introduced to the market. Development Phase 2 was completed on 31 December 2020 and the company managed to meet all criteria for capitalizing of development expenditure. Financial year ends 31 December every year. Required: i. Explain the accounting treatment of the research and development cost incurred in the year 2019 and 2020. (5 marks) ii. Prepare the journal entries for the development cost incurred in year 2020. (5 marks) c. On 1 January 2018, Kerim Meriah Bhd acquired a franchise at the cost of RM760,000 with additional legal fees of RM40,000 and RM45,000 for the promotional activities of the company. The expected economic life is 8 years. The fair value of the franchise was RM600,000 and RM560,000 on 31 December 2019 and 31 December 2020 respectively. The company adopts the revaluation model in the subsequent measurement of its intangible assets. The accounting period of Kerim Meriah Bhd ends 31 December, each year Required: Calculate the surplus or deficit on revaluation of Kerim Meriah Bhd as at 31 December 2019 and 31 December 2020. (6 marks) (Total: 18 marks) a. State any 2 capitalisation criteria of intangible asset arising from development phase in a project in accordance with MFRS 138 Intangible assets. (2 marks) b. The followings are the research and development expenditure incurred by MZ Auto Bhd related to a new hybrid-car model which was completed on 31 December 2020. Additional information: Development Phase 1 which was completed in December 2019 could not provide convincing evidence related to the economic benefit of the hybrid car project. The model needed further improvement before it was introduced to the market. Development Phase 2 was completed on 31 December 2020 and the company managed to meet all criteria for capitalizing of development expenditure. Financial year ends 31 December every year. Required: i. Explain the accounting treatment of the research and development cost incurred in the year 2019 and 2020. (5 marks) ii. Prepare the journal entries for the development cost incurred in year 2020. (5 marks) c. On 1 January 2018, Kerim Meriah Bhd acquired a franchise at the cost of RM760,000 with additional legal fees of RM40,000 and RM45,000 for the promotional activities of the company. The expected economic life is 8 years. The fair value of the franchise was RM600,000 and RM560,000 on 31 December 2019 and 31 December 2020 respectively. The company adopts the revaluation model in the subsequent measurement of its intangible assets. The accounting period of Kerim Meriah Bhd ends 31 December, each year Required: Calculate the surplus or deficit on revaluation of Kerim Meriah Bhd as at 31 December 2019 and 31 December 2020. (6 marks) (Total: 18 marks)