Question

(a) State the put-call parity, and use it to show the almost equivalence of the profit diagrams between a long call and the combination (a

(a) State the put-call parity, and use it to show the almost equivalence of the profit diagrams between a long call and the combination (a long stock & a long put). Assume that each option contract concerns one share of the stock only

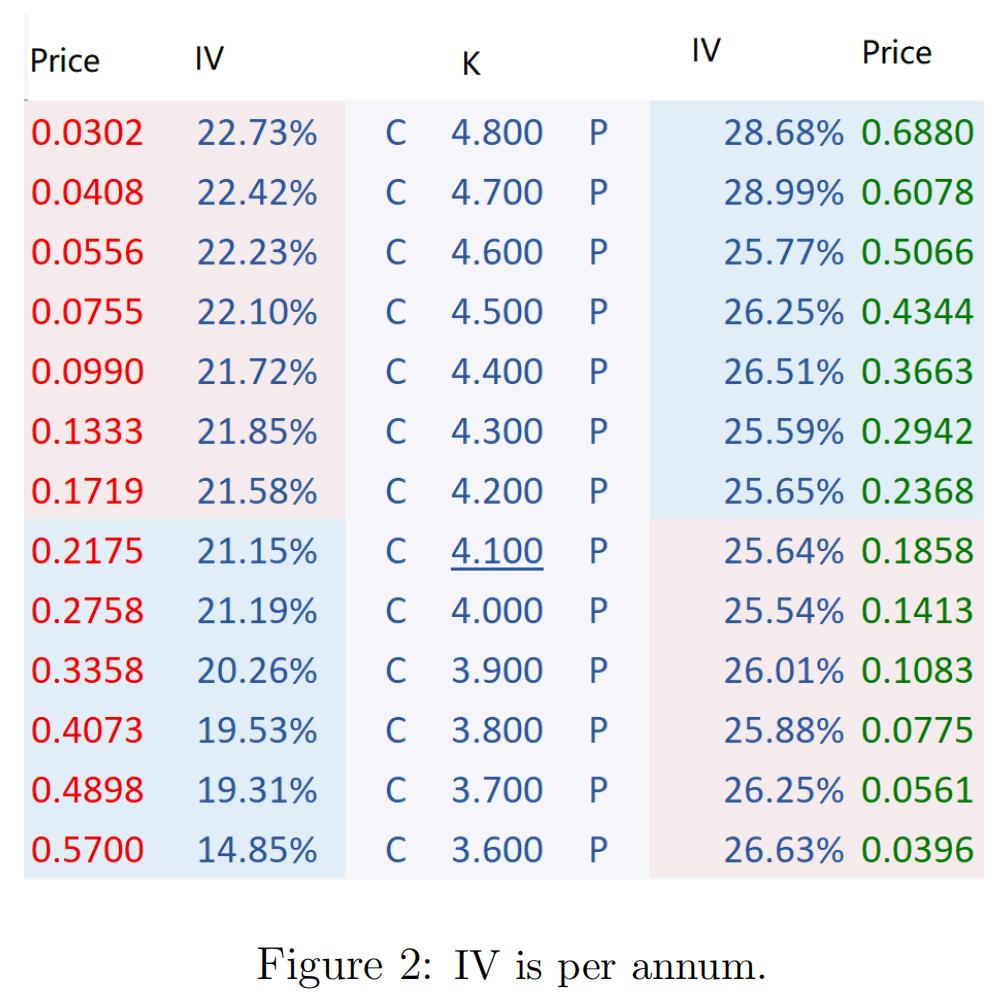

(b) The 300ETF closed at 4.146 on Mar 16th 2022. The information about the 2206 300ETF options is given in Figure 2. There are 98 natural days left.

(i) It is often the practice that the at-the-money call's IV is used to calculate the mathematical probabilities implied by IV. State this IV.

(ii) The market price of the K = 4.1 call is 0.2175. Interpret this price from the seller's point of view.

(iii) If you buy the K = 4.1 call, use the IV in (i) to assess the probability of you making money on the maturity date. Remember to take into account of the cost of the option.

Price IV K 0.0302 22.73% C 4.800 P 0.0408 22.42% C 4.700 P 0.0556 22.23% C 4.600 P 0.0755 22.10% C 4.500 P 0.0990 21.72% C 4.400 P 0.1333 21.85% C 4.300 0.1719 21.58% C 4.200 P P 0.2175 21.15% C 4.100 P 0.2758 21.19% C 4.000 P 0.3358 20.26% C 3.900 P 0.4073 19.53% C 3.800 P 0.4898 19.31% 3.700 P 0.5700 14.85% C 3.600 P IV Price 28.68% 0.6880 28.99% 0.6078 25.77% 0.5066 26.25% 0.4344 26.51% 0.3663 25.59% 0.2942 25.65% 0.2368 25.64% 0.1858 25.54% 0.1413 26.01% 0.1083 25.88% 0.0775 26.25% 0.0561 26.63% 0.0396 Figure 2: IV is per annum.

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a PutCall Parity The putcall parity relationship states that the price of a European call option C plus the present value of the exercise price K is equal to the price of a European put option P plus ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started