Answered step by step

Verified Expert Solution

Question

1 Approved Answer

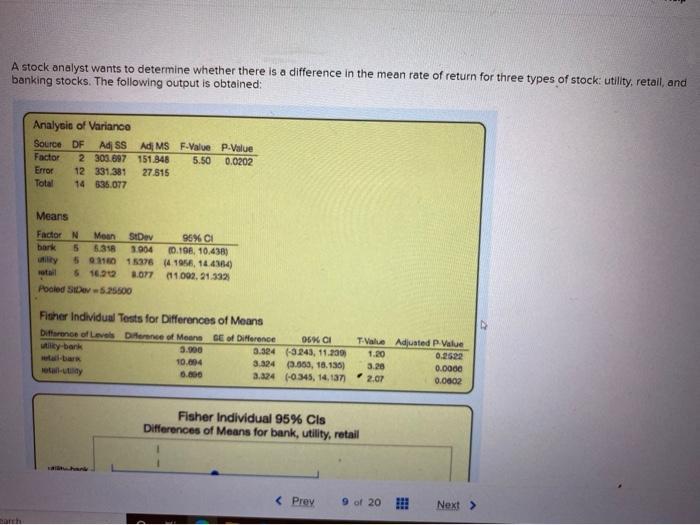

A stock analyst wants to determine whether there is a difference in the mean rate of return for three types of stock: utility, retail,

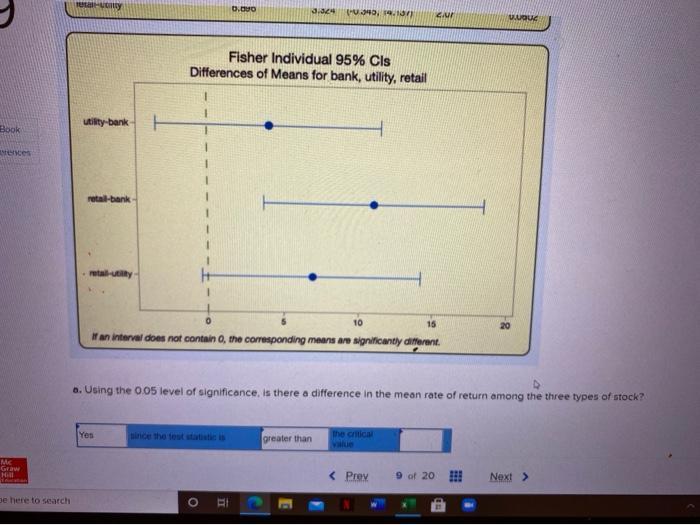

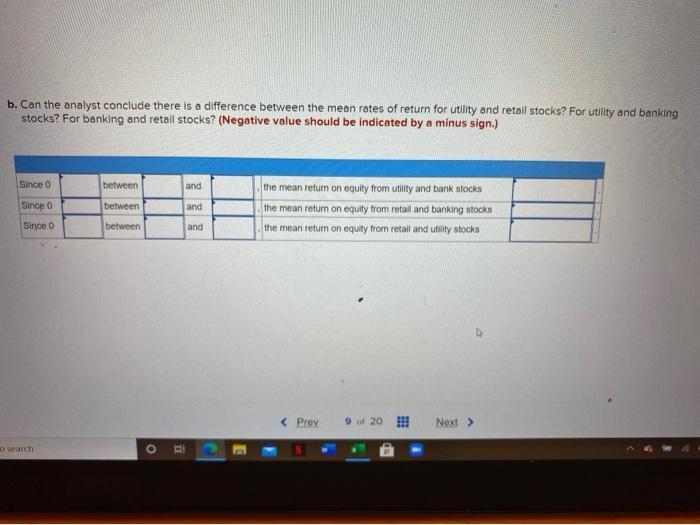

A stock analyst wants to determine whether there is a difference in the mean rate of return for three types of stock: utility, retail, and banking stocks. The following output is obtained: Analysis of Variance Source DF Adj SS Ad MS F-Value P-Value marth Factor 2 303.697 151.848 Error 12 331.381 27.815 Total 14 635.077 5.50 0.0202 Means Factor N Mean StDev bark 5 6.318 utility 5 93180 15376 3.904 95% CI 0.198, 10.438) (4.1956, 14.4364) rotail 6 16.212 8.077 (11.092, 21.332) Pooled StDev-5.25500 Fisher Individual Tests for Differences of Means Difference of Levels Difference of Means GE of Difference utility-bark 3.900 3.324 etail-bark etall-utility 10.004 6.000 05% CI (-3.243, 11.239) 3.324 (3.003, 18.136) 3.324 (-0.345, 14,137) T-Value Adjusted P.Value 1.20 0.2522 3.20 0.0000 2.07 0.0002 Fisher Individual 95% Cls Differences of Means for bank, utility, retail < Prev 9 of 20 Next > Mc Graw Hill Book vences be here to search aunty 0.00 3.324 (-0.340, 19.137 ZNI U.UQU utility-bank- retail-bank retail-utility- Fisher Individual 95% Cls Differences of Means for bank, utility, retail 10 15 20 If an interval does not contain 0, the corresponding means are significantly different. a. Using the 0.05 level of significance, is there a difference in the mean rate of return among the three types of stock? Yes since the test statistic is greater than the critical value < Prev 9 of 20 Next > O b. Can the analyst conclude there is a difference between the mean rates of return for utility and retail stocks? For utility and banking stocks? For banking and retail stocks? (Negative value should be indicated by a minus sign.) Since 0 between and Since 0 between and Since 0 between and the mean return on equity from utility and bank stocks the mean return on equity from retail and banking stocks the mean return on equity from retail and utility stocks o search O < Prev 9 of 20 Next > F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started