Question

A stock has a current price of $150, an annual volatility of returns of 10%, and pays no dividends. The risk-free rate is 10%.

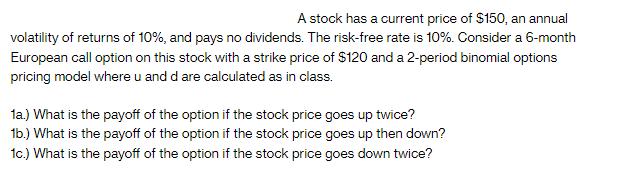

A stock has a current price of $150, an annual volatility of returns of 10%, and pays no dividends. The risk-free rate is 10%. Consider a 6-month European call option on this stock with a strike price of $120 and a 2-period binomial options pricing model where u and d are calculated as in class. 1a.) What is the payoff of the option if the stock price goes up twice? 1b.) What is the payoff of the option if the stock price goes up then down? 1c.) What is the payoff of the option if the stock price goes down twice?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payoffs of the option in each scenario we can use the binomial options pricing mode...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Risk Management and Financial Institutions

Authors: Hull John

4th edition

1118955943, 978-1118955949

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App