Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jennifer is choosing between buying a condominium property and renting it. The price for the condo is $157,000. The financing terms, if the condo

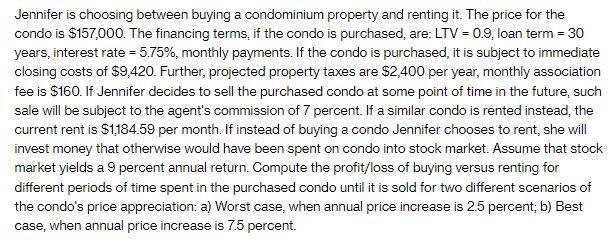

Jennifer is choosing between buying a condominium property and renting it. The price for the condo is $157,000. The financing terms, if the condo is purchased, are: LTV = 0.9, loan term = 30 years, interest rate = 5.75%, monthly payments. If the condo is purchased, it is subject to immediate closing costs of $9,420. Further, projected property taxes are $2,400 per year, monthly association fee is $160. If Jennifer decides to sell the purchased condo at some point of time in the future, such sale will be subject to the agent's commission of 7 percent. If a similar condo is rented instead, the current rent is $1,184.59 per month. If instead of buying a condo Jennifer chooses to rent, she will invest money that otherwise would have been spent on condo into stock market. Assume that stock market yields a 9 percent annual return. Compute the profit/loss of buying versus renting for different periods of time spent in the purchased condo until it is sold for two different scenarios of the condo's price appreciation: a) Worst case, when annual price increase is 2.5 percent; b) Best case, when annual price increase is 7.5 percent.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the profitloss of buying versus renting for different periods of time we need to compare the total costs and gains of each option Scenari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started