Question

(a) Stock Name Amount Invested Weight (by value) in Total Portfolio Stock Beta Stock 1 200000 (200000/500000) = 0.4 0.6 Stock 2 250000 (250000/500000) =

(a)

| Stock Name | Amount Invested | Weight (by value) in Total Portfolio | Stock Beta |

| Stock 1 | 200000 | (200000/500000) = 0.4 | 0.6 |

| Stock 2 | 250000 | (250000/500000) = 0.5 | 1.4 |

| Stock 3 | 50000 | (50000/500000) = 0.1 | 1.2 |

Total = $ 500000

Weighted Average Beta of the Portfolio = 0.4 x 0.6 + 0.5 x 1.4 + 0.1 x 1.2 = 1.06 = B(p)

Risk Free Rate = r(f) = 6%, Required Rate of Return = r(1) = 12%

Let Market Risk Premium r(m)

Assuming that CAPM holds

r(1) = r(f) + B(p) x r(m)

12 = 6 + 1.06 x r(m)

6 / 1.06 = r(m)

r(m) = 5.66%

This year the market risk premium has increase by 1 percentage point

This implies new market risk premium is r(m1) = r(m) +1 = 5.66 +1 =6.66%

Therefore, New (current) Required Rate of Return = r(f) + B(p) x r(m1) = 6 + 1.06 x 6.66 = 13.0596%

kindly answer b and e

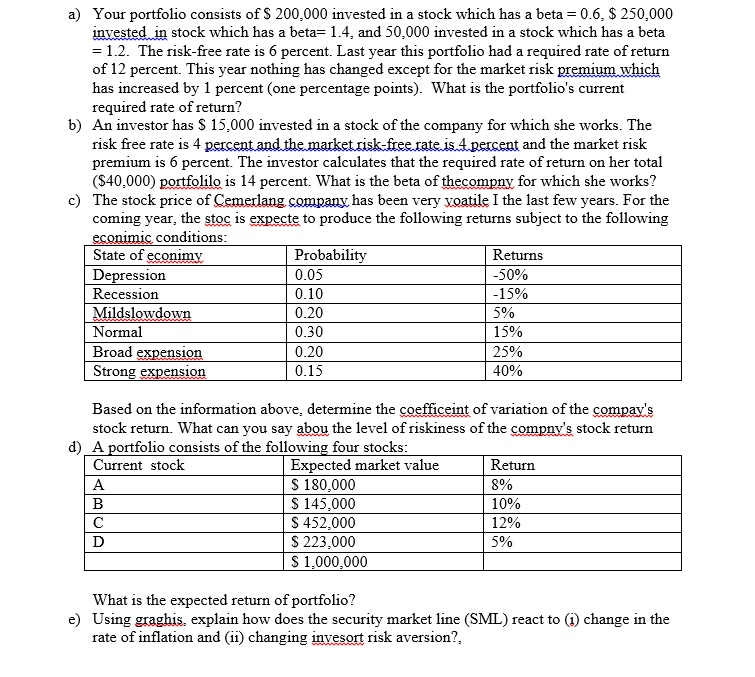

a) Your portfolio consists of $ 200,000 invested in a stock which has a beta = 0.6, $ 250,000 invested in stock which has a beta- 1.4, and 50,000 invested in a stock which has a beta = 1.2. The risk-free rate is 6 percent. Last year this portfolio had a required rate of return of 12 percent. This year nothing has changed except for the market risk premium which has increased by 1 percent (one percentage points). What is the portfolio's current required rate of return? b) An investor has S 15,000 invested in a stock of the company for which she works. The and the market risk risk free rate is 4 premium is 6 percent. The investor calculates that the required rate of return on her total (S40,000) portfolilo is 14 percent. What is the beta of thecompnv for which she works? The stock price of Cemerlang companx has been very voatile I the last few years. For the coming year, the stos is expecte to produce the following returns subject to the following c) conditions State of econimy Depression Recession Mildslowdown Normal Broad expension Strong expension Probability 0.05 0.10 0.20 0.30 0.20 0.15 Returns -50% -15% 590 15% 25% 40% Based on the information above, determine the coefficeint of variation of the compay's stock return. What can you say abou the level of riskiness of the compny's stock return d) A portfolio consists of the following four stocks Expected market value S 180,000 S 145,000 S 452,000 S 223,000 Current stock Return 10% 12% 5% 1,000,000 What is the expected return of portfolio? Using graghis, explain how does the security market line (SML) react to (i) change in the rate of inflation and (1) changing jnvesort risk aversion?, e)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started