Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A stock which is sold at its face value of $4,000 is expected to pay a dividend of $160 for the next three years. It

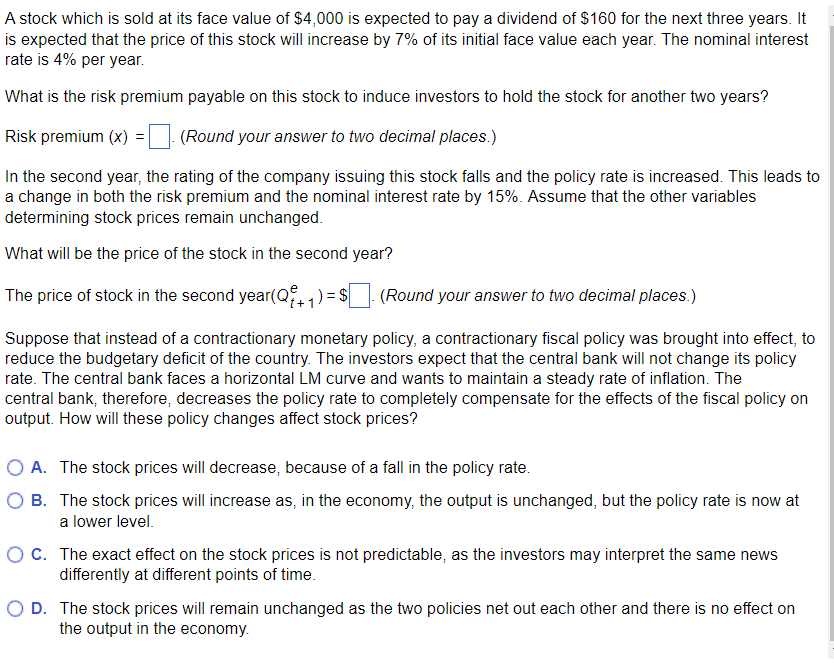

A stock which is sold at its face value of $4,000 is expected to pay a dividend of $160 for the next three years. It is expected that the price of this stock will increase by 7% of its initial face value each year. The nominal interest rate is 4% per year. What is the risk premium payable on this stock to induce investors to hold the stock for another two years? Risk premium (x)=. (Round your answer to two decimal places.) In the second year, the rating of the company issuing this stock falls and the policy rate is increased. This leads to a change in both the risk premium and the nominal interest rate by 15%. Assume that the other variables determining stock prices remain unchanged. What will be the price of the stock in the second year? The price of stock in the second year (Qt+1e)=$. (Round your answer to two decimal places.) Suppose that instead of a contractionary monetary policy, a contractionary fiscal policy was brought into effect, to reduce the budgetary deficit of the country. The investors expect that the central bank will not change its policy rate. The central bank faces a horizontal LM curve and wants to maintain a steady rate of inflation. The central bank, therefore, decreases the policy rate to completely compensate for the effects of the fiscal policy on output. How will these policy changes affect stock prices? A. The stock prices will decrease, because of a fall in the policy rate. B. The stock prices will increase as, in the economy, the output is unchanged, but the policy rate is now at a lower level. C. The exact effect on the stock prices is not predictable, as the investors may interpret the same news differently at different points of time. D. The stock prices will remain unchanged as the two policies net out each other and there is no effect on the output in the economy

A stock which is sold at its face value of $4,000 is expected to pay a dividend of $160 for the next three years. It is expected that the price of this stock will increase by 7% of its initial face value each year. The nominal interest rate is 4% per year. What is the risk premium payable on this stock to induce investors to hold the stock for another two years? Risk premium (x)=. (Round your answer to two decimal places.) In the second year, the rating of the company issuing this stock falls and the policy rate is increased. This leads to a change in both the risk premium and the nominal interest rate by 15%. Assume that the other variables determining stock prices remain unchanged. What will be the price of the stock in the second year? The price of stock in the second year (Qt+1e)=$. (Round your answer to two decimal places.) Suppose that instead of a contractionary monetary policy, a contractionary fiscal policy was brought into effect, to reduce the budgetary deficit of the country. The investors expect that the central bank will not change its policy rate. The central bank faces a horizontal LM curve and wants to maintain a steady rate of inflation. The central bank, therefore, decreases the policy rate to completely compensate for the effects of the fiscal policy on output. How will these policy changes affect stock prices? A. The stock prices will decrease, because of a fall in the policy rate. B. The stock prices will increase as, in the economy, the output is unchanged, but the policy rate is now at a lower level. C. The exact effect on the stock prices is not predictable, as the investors may interpret the same news differently at different points of time. D. The stock prices will remain unchanged as the two policies net out each other and there is no effect on the output in the economy Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started