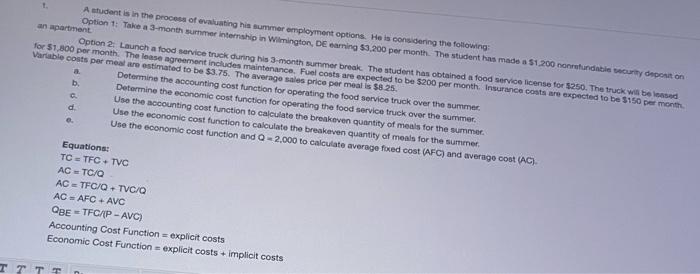

A student is in the process of evaluating his summer employment options. He is considering the following Option 1: Take a 3-month summer internship in Wilmington, DE caring $3,200 per month The student has made a $1200 nordable y ponton an apartment Option 2 Launch a food service truck during his 3-month summer break. The student has obtained a food service license for $250. The truck will be insed for $1.800 per month. The lease agreement includes maintenance Fuel costs are expected to be $200 per month Insurance costs are expected to be $150 per month Variable costs per meal are estimated to be $3.75. The average sales price per meal is $8.25 Determine the accounting cost function for operating the food service truck over the summer b Determine the economic cost function for operating the food service truck over the summer C Use the accounting cost function to calculate the breakeven quantity of meals for the summer. Use the economic cost function to calculate the breakeven quantity of meals for the summer. Use the economic cost function and Q -2,000 to calculate average foxed cost (AFC) and average cost (AC) d Equations: TC = TFC + TVC AC = TC/Q AC = TFC/Q + TVC/Q AC = AFC + AVC OBE-TFC/IP-AVC) Accounting Cost Function = explicit costs Economic Cost Function = explicit costs + Implicit costs T7 A student is in the process of evaluating his summer employment options. He is considering the following Option 1: Take a 3-month summer internship in Wilmington, DE caring $3,200 per month The student has made a $1200 nordable y ponton an apartment Option 2 Launch a food service truck during his 3-month summer break. The student has obtained a food service license for $250. The truck will be insed for $1.800 per month. The lease agreement includes maintenance Fuel costs are expected to be $200 per month Insurance costs are expected to be $150 per month Variable costs per meal are estimated to be $3.75. The average sales price per meal is $8.25 Determine the accounting cost function for operating the food service truck over the summer b Determine the economic cost function for operating the food service truck over the summer C Use the accounting cost function to calculate the breakeven quantity of meals for the summer. Use the economic cost function to calculate the breakeven quantity of meals for the summer. Use the economic cost function and Q -2,000 to calculate average foxed cost (AFC) and average cost (AC) d Equations: TC = TFC + TVC AC = TC/Q AC = TFC/Q + TVC/Q AC = AFC + AVC OBE-TFC/IP-AVC) Accounting Cost Function = explicit costs Economic Cost Function = explicit costs + Implicit costs T7