Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A student number is a 8 digit number that is used to identify each student at an educational institution Assume the student number is 14927641

A student number is a 8 digit number that is used to identify each student at an educational institution

Assume the student number is 14927641

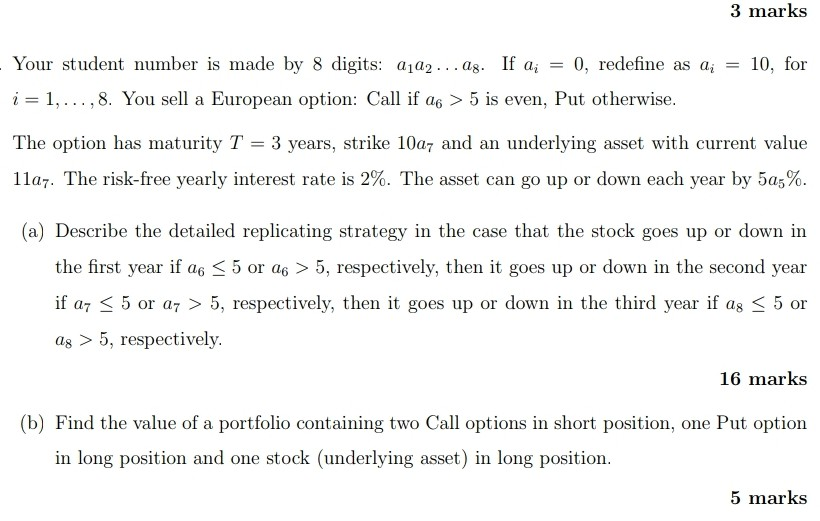

3 marks - Your student number is made by 8 digits: 2102 ... ag. If a; = 0, redefine as ai = 10, for i= 1,...,8. You sell a European option: Call if a6 > 5 is even, Put otherwise. The option has maturity T = 3 years, strike 10a7 and an underlying asset with current value 11a7. The risk-free yearly interest rate is 2%. The asset can go up or down each year by 5a5%. (a) Describe the detailed replicating strategy in the case that the stock goes up or down in the first year if an 5, respectively, then it goes up or down in the second year if ay 5, respectively, then it goes up or down in the third year if ag 5, respectively. 16 marks (b) Find the value of a portfolio containing two Call options in short position, one Put option in long position and one stock (underlying asset) in long position. 5 marks 3 marks - Your student number is made by 8 digits: 2102 ... ag. If a; = 0, redefine as ai = 10, for i= 1,...,8. You sell a European option: Call if a6 > 5 is even, Put otherwise. The option has maturity T = 3 years, strike 10a7 and an underlying asset with current value 11a7. The risk-free yearly interest rate is 2%. The asset can go up or down each year by 5a5%. (a) Describe the detailed replicating strategy in the case that the stock goes up or down in the first year if an 5, respectively, then it goes up or down in the second year if ay 5, respectively, then it goes up or down in the third year if ag 5, respectively. 16 marks (b) Find the value of a portfolio containing two Call options in short position, one Put option in long position and one stock (underlying asset) in long position. 5 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started