a swer the part 1 of the required section , hope the image is clear this time

a swer the part 1 of the required section , hope the image is clear this time

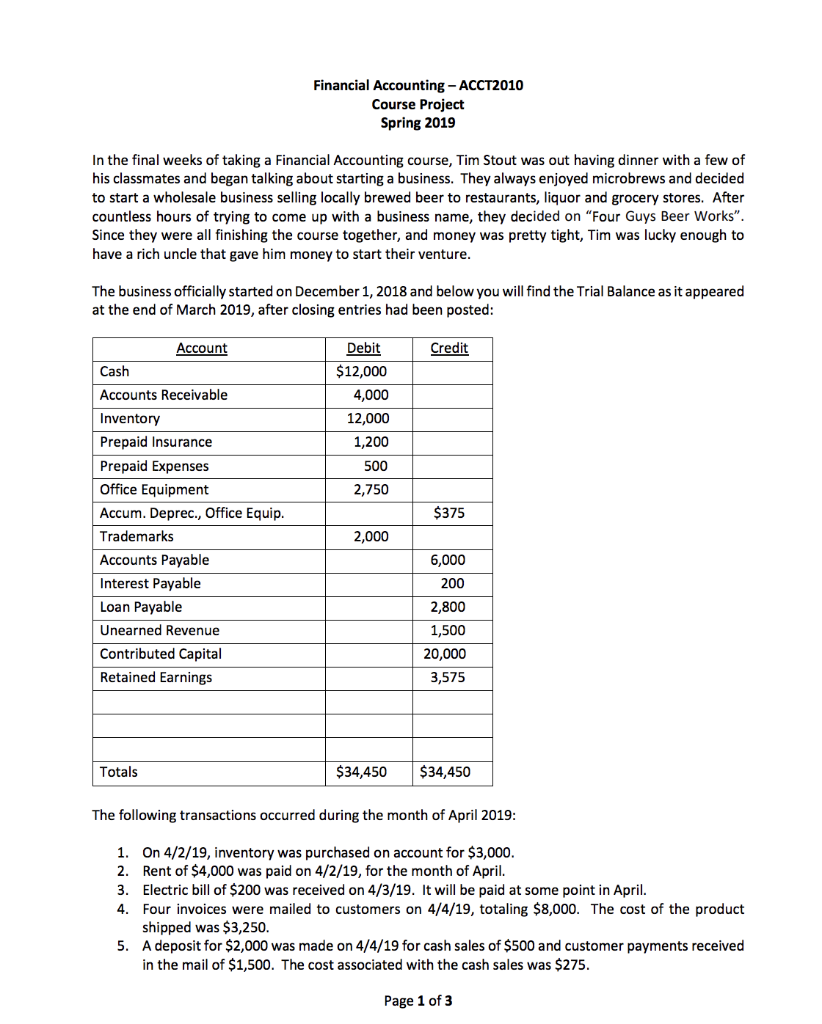

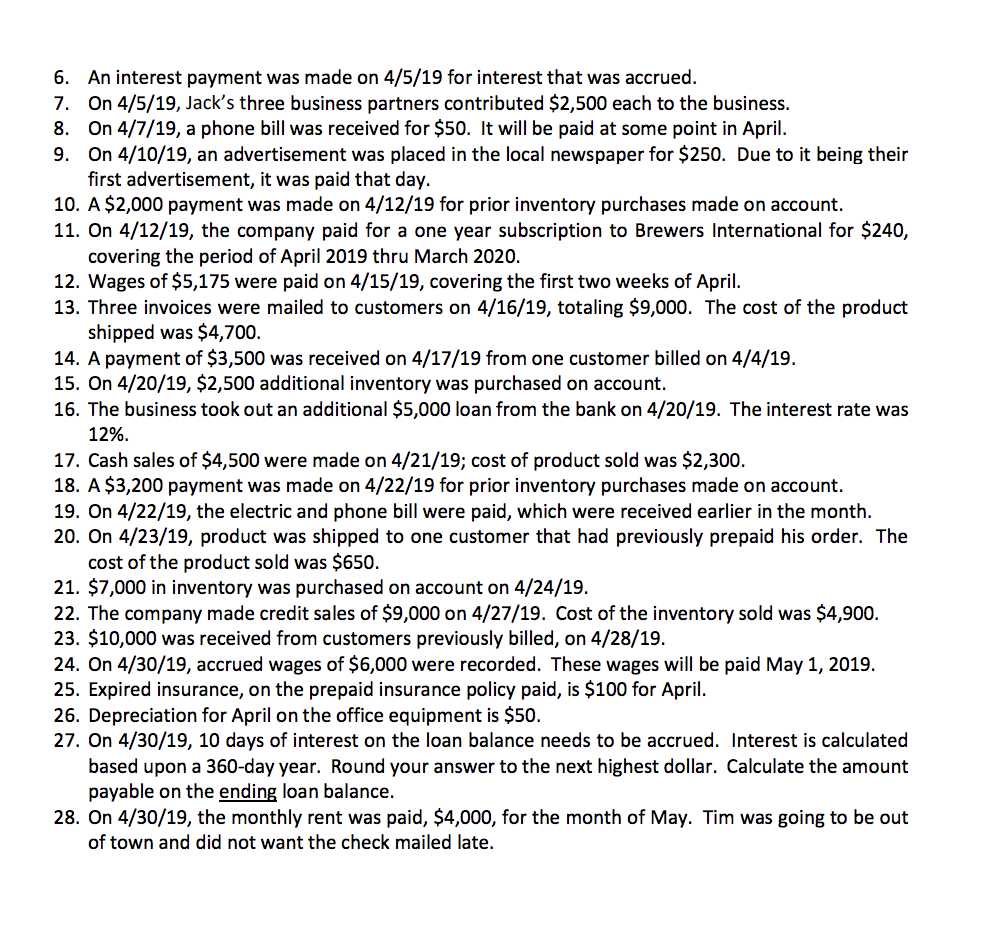

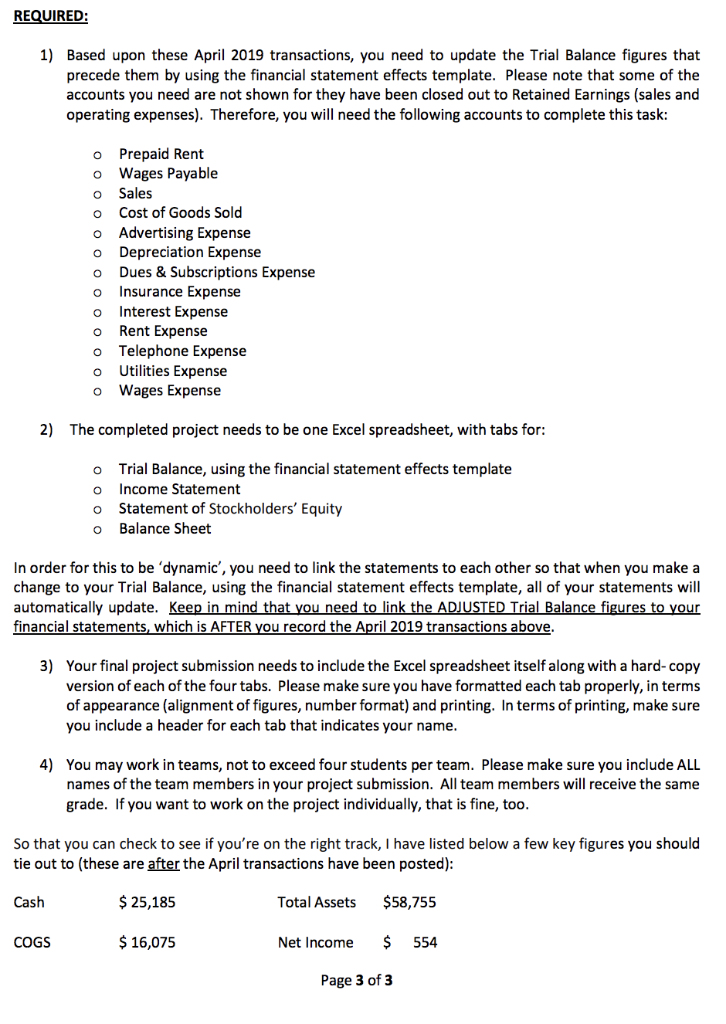

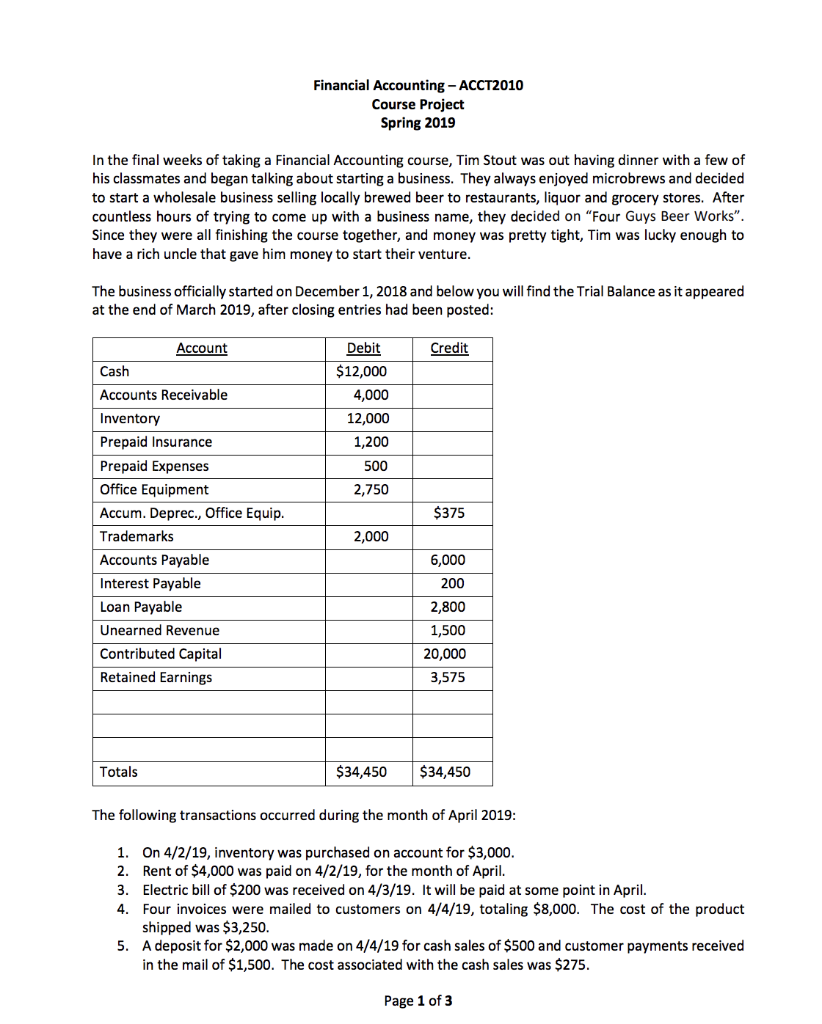

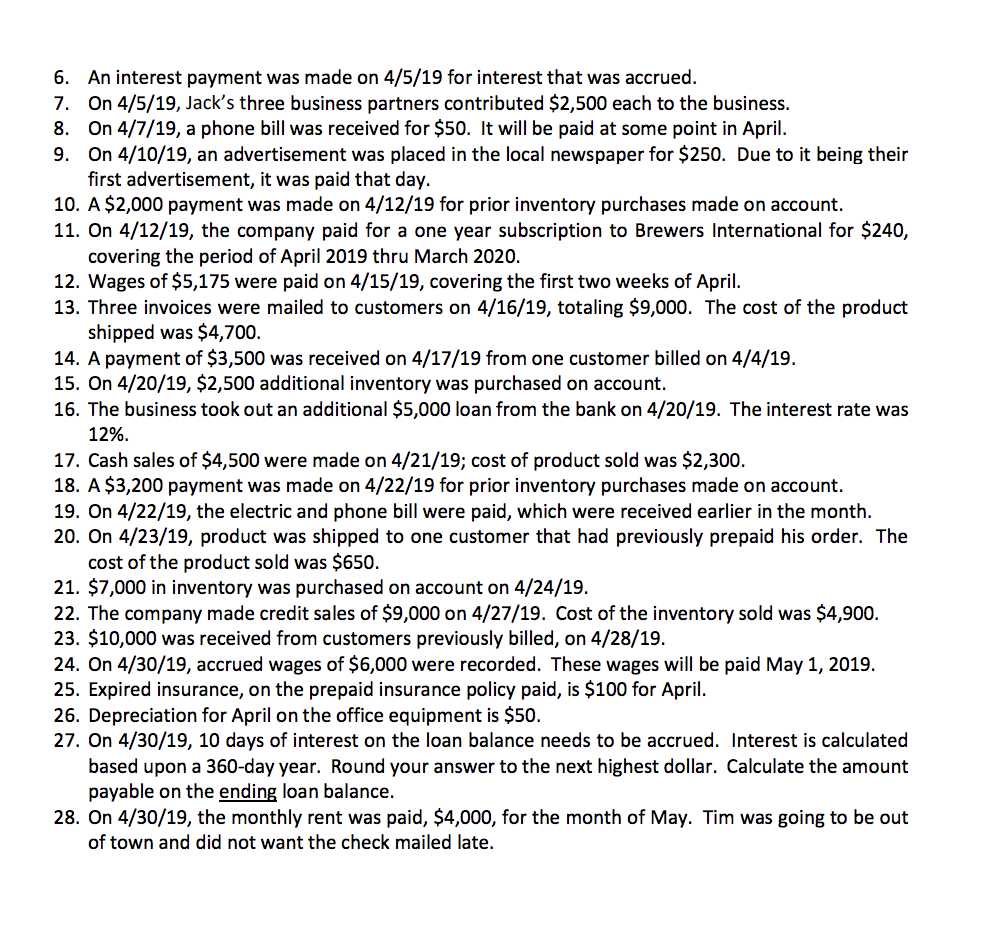

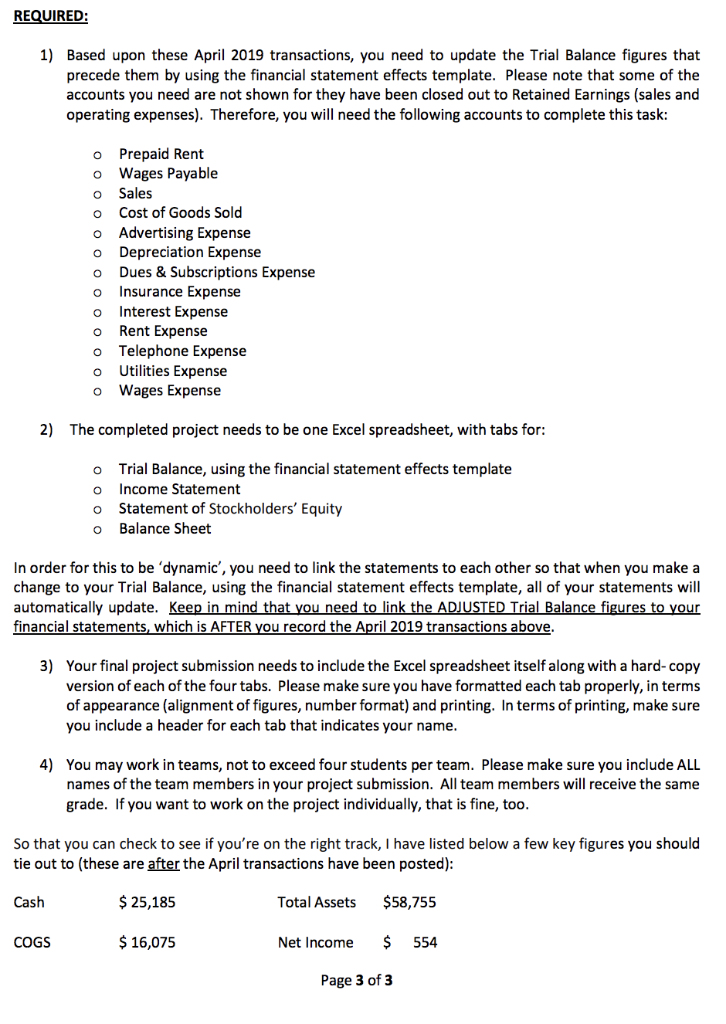

Financial Accounting- ACCT2010 Course Project Spring 201.9 In the final weeks of taking a Financial Accounting course, Tim Stout was out having dinner with a few of his classmates and began talking about starting a business. They always enjoyed microbrews and decided to start a wholesale business selling locally brewed beer to restaurants, liquor and grocery stores. After countless hours of trying to come up with a business name, they decided on "Four Guys Beer Works". Since they were all finishing the course together, and money was pretty tight, Tim was lucky enough to have a rich uncle that gave him money to start their venture The business officially started on December 1,2018 and below you will find the Trial Balance as it appeared at the end of March 2019, after closing entries had been posted: Debit $12,000 4,000 12,000 1,200 500 2,750 Credit Account Cash Accounts Receivable Inventory Prepaid Insurance Prepaid Expenses Office Equipment Accum. Deprec., Office Equip Trademarks Accounts Payable Interest Payable Loan Payable Unearned Revenue Contributed Capital Retained Earnings $375 2,000 6,000 200 2,800 1,500 20,000 3,575 $34,450 $34,450 Totals The following transactions occurred during the month of April 2019 On 4/2/19, inventory was purchased on account for $3,000 Rent of $4,000 was paid on 4/2/19, for the month of April. Electric bill of $200 was received on 4/3/19. It will be paid at some point in April. Four invoices were mailed to customers on 4/4/19, totaling $8,000. The cost of the product shipped was $3,250. A deposit for $2,000 was made on 4/4/19 for cash sales of $500 and customer payments received in the mail of $1,500. The cost associated with the cash sales was $275 1. 2. 3. 4. 5. Page 1 of 3 An interest payment was made on 4/5/19 for interest that was accrued. 6. On 4/5/19, Jack's three business partners contributed $2,500 each to the business. 8. 7. On 4/7/19, a phone bill was received for $50. It will be paid at some point in April. 9. On 4/10/19, an advertisement was placed in the local newspaper for $250. Due to it being their first advertisement, it was paid that day 10. A $2,000 payment was made on 4/12/19 for prior inventory purchases made on account. 11. On 4/12/19, the company paid for a one year subscription to Brewers International for $240, covering the period of April 2019 thru March 2020 12. Wages of $5,175 were paid on 4/15/19, covering the first two weeks of April. 13. Three invoices were mailed to customers on 4/16/19, totaling $9,000. The cost of the product shipped was $4,700. 14. A payment of $3,500 was received on 4/17/19 from one customer billed on 4/4/19. 15. On 4/20/19, $2,500 additional inventory was purchased on account. 16. The business took out an additional $5,000 loan from the bank on 4/20/19. The interest rate was 12%. 17. Cash sales of $4,500 were made on 4/21/19; cost of product sold was $2,300 18. A $3,200 payment was made on 4/22/19 for prior inventory purchases made on account. 19. On 4/22/19, the electric and phone bill were paid, which were received earlier in the month. 20. On 4/23/19, product was shipped to one customer that had previously prepaid his order. The cost of the product sold was $650 21. $7,000 in inventory was purchased on account on 4/24/19 22. The company made credit sales of $9,000 on 4/27/19. Cost of the inventory sold was $4,900 23. $10,000 was received from customers previously billed, on 4/28/19 24. On 4/30/19, accrued wages of $6,000 were recorded. These wages will be paid May 1, 2019 25. Expired insurance, on the prepaid insurance policy paid, is $100 for April 26. Depreciation for April on the office equipment is $50. 27. On 4/30/19, 10 days of interest on the loan balance needs to be accrued. Interest is calculated based upon a 360-day year. Round your answer to the next highest dollar. Calculate the amount payable on the ending loan balance 28. On 4/30/19, the monthly rent was paid, $4,000, for the month of May. Tim was going to be out of town and did not want the check mailed late. REQUIRED: 1) Based upon these April 2019 transactions, you need to update the Trial Balance figures that precede them by using the financial statement effects template. Please note that some of the accounts you need are not shown for they have been closed out to Retained Earnings (sales and operating expenses). Therefore, you will need the following accounts to complete this task: o Prepaid Rent o Wages Payable o Sales o Cost of Goods Sold o Advertising Expense o Depreciation Expense o Dues &Subscriptions Expense o Insurance Expense o Interest Expense o Rent Expense o Telephone Expense o Utilities Expense o Wages Expense 2) The completed project needs to be one Excel spreadsheet, with tabs for: o Trial Balance, using the financial statement effects template o Income Statement o Statement of Stockholders' Equity o Balance Sheet In order for this to be 'dynamic', you need to link the statements to each other so that when you make a change to your Trial Balance, using the financial statement effects template, all of your statements will automatically update financial statements, which is AFTER u record the April 2019 transactions above yo 3) Your final project submission needs to include the Excel spreadsheet itself along with a hard-copy version of each of the four tabs. Please make sure you have formatted each tab properly, in terms of appearance (alignment of figures, number format) and printing. In terms of printing, make sure you include a header for each tab that indicates your name 4) You may work in teams, not to exceed four students per team. Please make sure you include ALL names of the team members in your project submission. All team members will receive the same grade. If you want to work on the project individually, that is fine, too So that you can check to see if you're on the right track, I have listed below a few key figures you should tie out to (these are after the April transactions have been posted) Cash COGS $25,185 Total Assets $58,755 Net Income 554 Page 3 of3 $16,075 Financial Accounting- ACCT2010 Course Project Spring 201.9 In the final weeks of taking a Financial Accounting course, Tim Stout was out having dinner with a few of his classmates and began talking about starting a business. They always enjoyed microbrews and decided to start a wholesale business selling locally brewed beer to restaurants, liquor and grocery stores. After countless hours of trying to come up with a business name, they decided on "Four Guys Beer Works". Since they were all finishing the course together, and money was pretty tight, Tim was lucky enough to have a rich uncle that gave him money to start their venture The business officially started on December 1,2018 and below you will find the Trial Balance as it appeared at the end of March 2019, after closing entries had been posted: Debit $12,000 4,000 12,000 1,200 500 2,750 Credit Account Cash Accounts Receivable Inventory Prepaid Insurance Prepaid Expenses Office Equipment Accum. Deprec., Office Equip Trademarks Accounts Payable Interest Payable Loan Payable Unearned Revenue Contributed Capital Retained Earnings $375 2,000 6,000 200 2,800 1,500 20,000 3,575 $34,450 $34,450 Totals The following transactions occurred during the month of April 2019 On 4/2/19, inventory was purchased on account for $3,000 Rent of $4,000 was paid on 4/2/19, for the month of April. Electric bill of $200 was received on 4/3/19. It will be paid at some point in April. Four invoices were mailed to customers on 4/4/19, totaling $8,000. The cost of the product shipped was $3,250. A deposit for $2,000 was made on 4/4/19 for cash sales of $500 and customer payments received in the mail of $1,500. The cost associated with the cash sales was $275 1. 2. 3. 4. 5. Page 1 of 3 An interest payment was made on 4/5/19 for interest that was accrued. 6. On 4/5/19, Jack's three business partners contributed $2,500 each to the business. 8. 7. On 4/7/19, a phone bill was received for $50. It will be paid at some point in April. 9. On 4/10/19, an advertisement was placed in the local newspaper for $250. Due to it being their first advertisement, it was paid that day 10. A $2,000 payment was made on 4/12/19 for prior inventory purchases made on account. 11. On 4/12/19, the company paid for a one year subscription to Brewers International for $240, covering the period of April 2019 thru March 2020 12. Wages of $5,175 were paid on 4/15/19, covering the first two weeks of April. 13. Three invoices were mailed to customers on 4/16/19, totaling $9,000. The cost of the product shipped was $4,700. 14. A payment of $3,500 was received on 4/17/19 from one customer billed on 4/4/19. 15. On 4/20/19, $2,500 additional inventory was purchased on account. 16. The business took out an additional $5,000 loan from the bank on 4/20/19. The interest rate was 12%. 17. Cash sales of $4,500 were made on 4/21/19; cost of product sold was $2,300 18. A $3,200 payment was made on 4/22/19 for prior inventory purchases made on account. 19. On 4/22/19, the electric and phone bill were paid, which were received earlier in the month. 20. On 4/23/19, product was shipped to one customer that had previously prepaid his order. The cost of the product sold was $650 21. $7,000 in inventory was purchased on account on 4/24/19 22. The company made credit sales of $9,000 on 4/27/19. Cost of the inventory sold was $4,900 23. $10,000 was received from customers previously billed, on 4/28/19 24. On 4/30/19, accrued wages of $6,000 were recorded. These wages will be paid May 1, 2019 25. Expired insurance, on the prepaid insurance policy paid, is $100 for April 26. Depreciation for April on the office equipment is $50. 27. On 4/30/19, 10 days of interest on the loan balance needs to be accrued. Interest is calculated based upon a 360-day year. Round your answer to the next highest dollar. Calculate the amount payable on the ending loan balance 28. On 4/30/19, the monthly rent was paid, $4,000, for the month of May. Tim was going to be out of town and did not want the check mailed late. REQUIRED: 1) Based upon these April 2019 transactions, you need to update the Trial Balance figures that precede them by using the financial statement effects template. Please note that some of the accounts you need are not shown for they have been closed out to Retained Earnings (sales and operating expenses). Therefore, you will need the following accounts to complete this task: o Prepaid Rent o Wages Payable o Sales o Cost of Goods Sold o Advertising Expense o Depreciation Expense o Dues &Subscriptions Expense o Insurance Expense o Interest Expense o Rent Expense o Telephone Expense o Utilities Expense o Wages Expense 2) The completed project needs to be one Excel spreadsheet, with tabs for: o Trial Balance, using the financial statement effects template o Income Statement o Statement of Stockholders' Equity o Balance Sheet In order for this to be 'dynamic', you need to link the statements to each other so that when you make a change to your Trial Balance, using the financial statement effects template, all of your statements will automatically update financial statements, which is AFTER u record the April 2019 transactions above yo 3) Your final project submission needs to include the Excel spreadsheet itself along with a hard-copy version of each of the four tabs. Please make sure you have formatted each tab properly, in terms of appearance (alignment of figures, number format) and printing. In terms of printing, make sure you include a header for each tab that indicates your name 4) You may work in teams, not to exceed four students per team. Please make sure you include ALL names of the team members in your project submission. All team members will receive the same grade. If you want to work on the project individually, that is fine, too So that you can check to see if you're on the right track, I have listed below a few key figures you should tie out to (these are after the April transactions have been posted) Cash COGS $25,185 Total Assets $58,755 Net Income 554 Page 3 of3 $16,075

a swer the part 1 of the required section , hope the image is clear this time

a swer the part 1 of the required section , hope the image is clear this time