Answered step by step

Verified Expert Solution

Question

1 Approved Answer

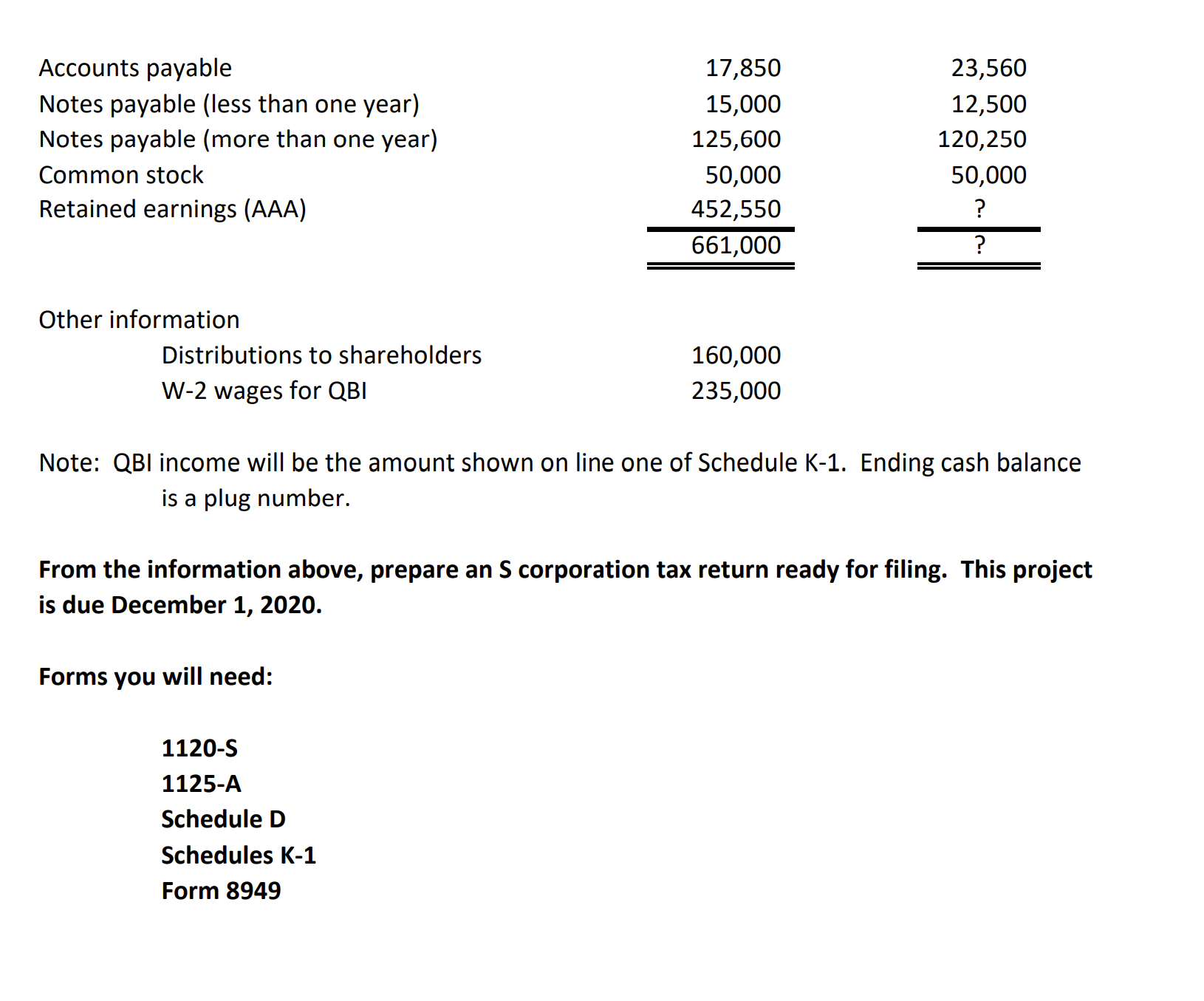

A tax return problem. Using the preceding information, complete 1120-S, 1125-A, Schedule D, Schedules K-1, and Form 8949 for Tin Cup, Inc. Project #2 (50

A tax return problem.

Using the preceding information, complete 1120-S, 1125-A, Schedule D, Schedules K-1, and Form 8949 for Tin Cup, Inc.

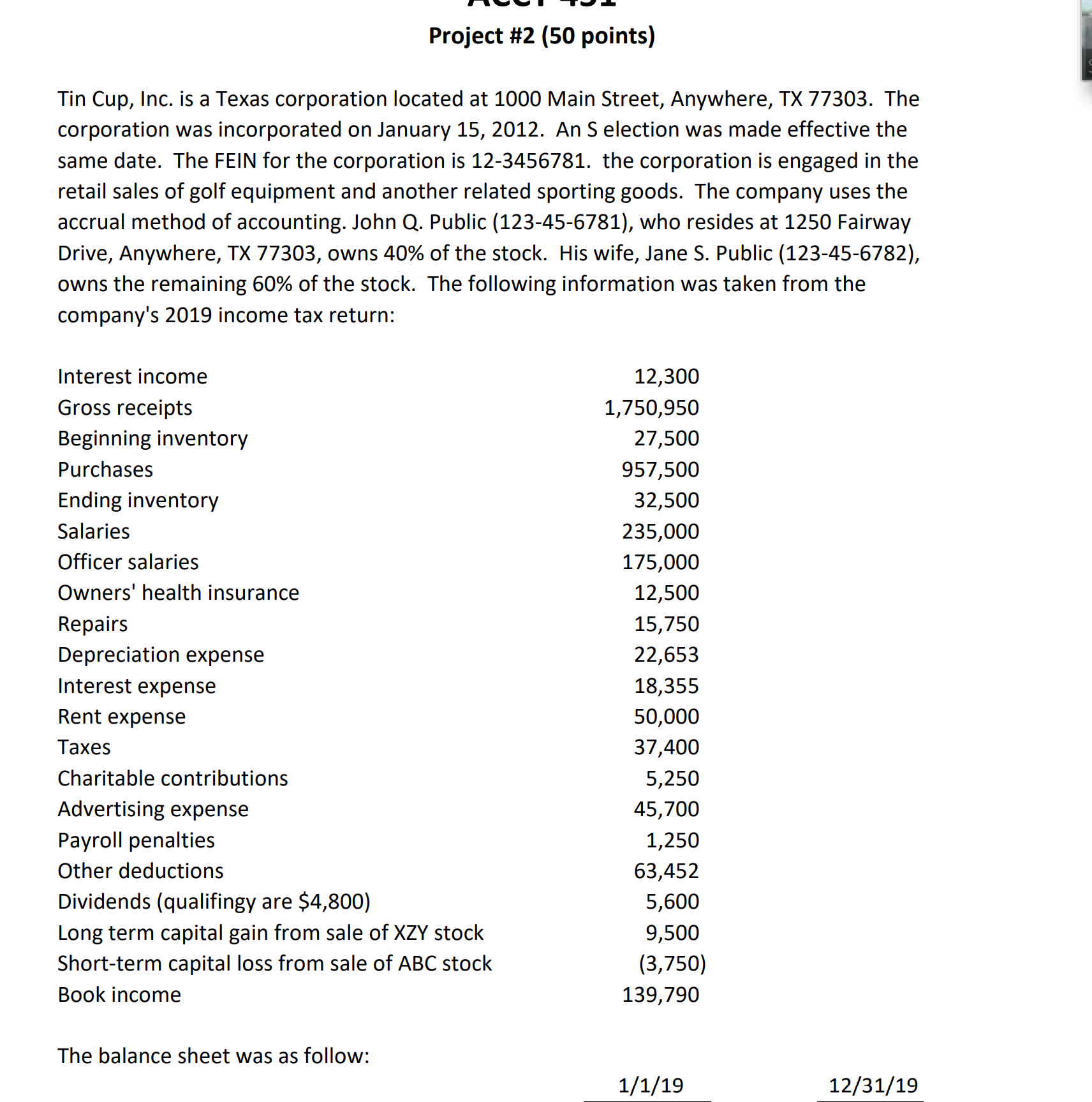

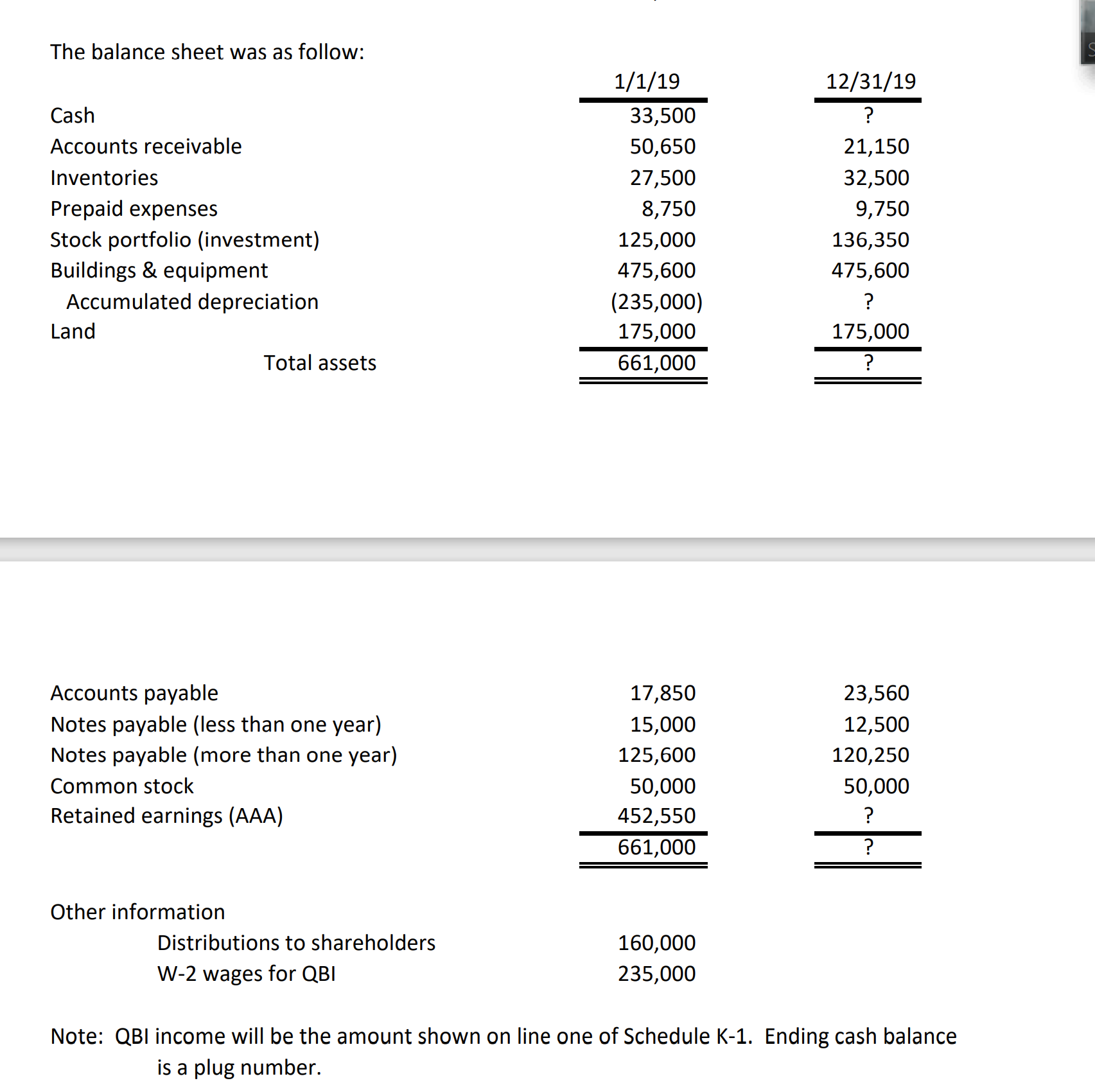

Project #2 (50 points) Tin Cup, Inc. is a Texas corporation located at 1000 Main Street, Anywhere, TX 77303. The corporation was incorporated on January 15, 2012. An S election was made effective the same date. The FEIN for the corporation is 12-3456781. the corporation is engaged in the retail sales of golf equipment and another related sporting goods. The company uses the accrual method of accounting. John Q. Public (123-45-6781), who resides at 1250 Fairway Drive, Anywhere, TX 77303, owns 40% of the stock. His wife, Jane S. Public (123-45-6782), owns the remaining 60% of the stock. The following information was taken from the company's 2019 income tax return: Interest income Gross receipts Beginning inventory Purchases Ending inventory Salaries Officer salaries Owners' health insurance Repairs Depreciation expense Interest expense Rent expense Taxes Charitable contributions Advertising expense Payroll penalties Other deductions Dividends (qualifingy are $4,800) Long term capital gain from sale of XZY stock Short-term capital loss from sale of ABC stock Book income The balance sheet was as follow: 12,300 1,750,950 27,500 957,500 32,500 235,000 175,000 12,500 15,750 22,653 18,355 50,000 37,400 5,250 45,700 1,250 63,452 5,600 9,500 (3,750) 139,790 1/1/19 12/31/19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started