Answered step by step

Verified Expert Solution

Question

1 Approved Answer

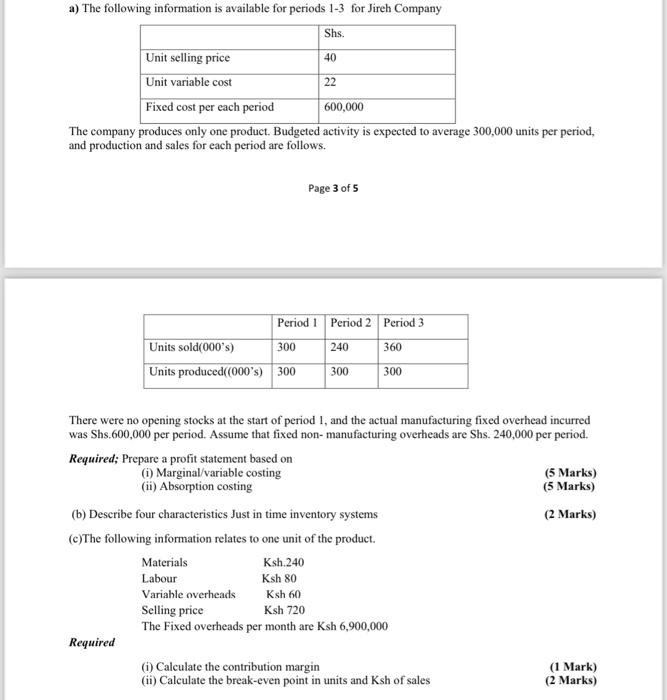

a) The following information is available for periods 1-3 for Jireh Company Shs. Unit selling price 40 Unit variable cost 22 Fixed cost per

a) The following information is available for periods 1-3 for Jireh Company Shs. Unit selling price 40 Unit variable cost 22 Fixed cost per each period 600,000 The company produces only one product. Budgeted activity is expected to average 300,000 units per period, and production and sales for each period are follows. Page 3 of 5 Period 1 Period 2 Period 3 Units sold(000's) 300 240 360 Units produced((000's) 300 300 300 There were no opening stocks at the start of period 1, and the actual manufacturing fixed overhead incurred was Shs.600,000 per period. Assume that fixed non-manufacturing overheads are Shs. 240,000 per period. Required; Prepare a profit statement based on (i) Marginal/variable costing (ii) Absorption costing (b) Describe four characteristics Just in time inventory systems (c)The following information relates to one unit of the product. (5 Marks) (5 Marks) (2 Marks) Required Materials Labour Ksh.240 Ksh 80 Variable overheads Ksh 60 Selling price Ksh 720 The Fixed overheads per month are Ksh 6,900,000 (i) Calculate the contribution margin (ii) Calculate the break-even point in units and Ksh of sales (1 Mark) (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Profit Statement 1 MarginalVariable Costing Period 1 Units Sold 300000 Unit Selling Price Shs 40 Unit Variable Cost Shs 22 Fixed Cost Not provided Total Sales Revenue 300000 units Shs 40 Shs 1200000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started