Answered step by step

Verified Expert Solution

Question

1 Approved Answer

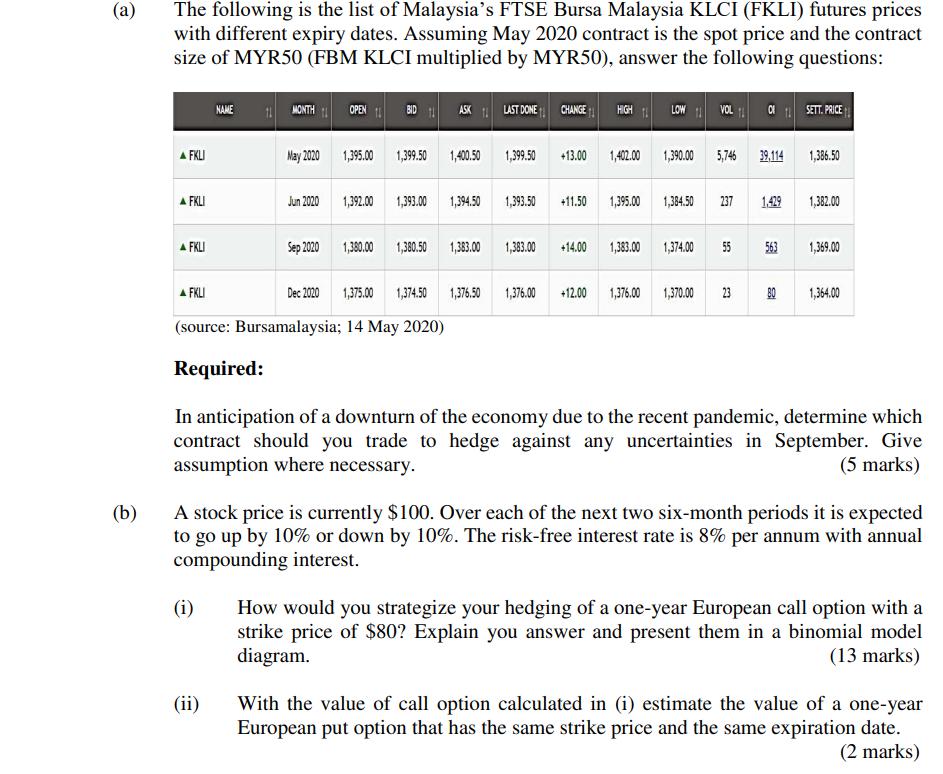

(a) The following is the list of Malaysia's FTSE Bursa Malaysia KLCI (FKLI) futures prices with different expiry dates. Assuming May 2020 contract is

(a) The following is the list of Malaysia's FTSE Bursa Malaysia KLCI (FKLI) futures prices with different expiry dates. Assuming May 2020 contract is the spot price and the contract size of MYR50 (FBM KLCI multiplied by MYR50), answer the following questions: NAME 11 MONTH OPEN 1 BID ASK LAST DONE CHANGE HIGH LOW VOLO SETT. PRICE AFKLI May 2020 1,395.00 1,399.50 1,400.50 1,399.50 +13.00 1,402.00 1,390.00 5,746 39,114 1,386.50 AFKLI Jun 2020 1,392.00 1,393.00 1,394.50 1,393.50 +11.50 1,395.00 1,384.50 237 1,429 1,382.00 AFKLI Sep 2020 1,380.00 1,380.50 1,383.00 1,383.00 +14.00 1,383.00 1,374.00 55 563 1,369.00 AFKLI Dec 2020 1,375.00 1,374.50 1,376.50 1,376.00 +12.00 1,376.00 1,370.00 23 225 80 1,364.00 (b) (source: Bursamalaysia; 14 May 2020) Required: In anticipation of a downturn of the economy due to the recent pandemic, determine which contract should you trade to hedge against any uncertainties in September. Give assumption where necessary. (5 marks) A stock price is currently $100. Over each of the next two six-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with annual compounding interest. (i) (ii) How would you strategize your hedging of a one-year European call option with a strike price of $80? Explain you answer and present them in a binomial model diagram. (13 marks) With the value of call option calculated in (i) estimate the value of a one-year European put option that has the same strike price and the same expiration date. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To hedge against uncertainties in September you should consider trading the FKLI futures contract with the expiration date in September This contract provides exposure to the FBM KLCI which is compris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started