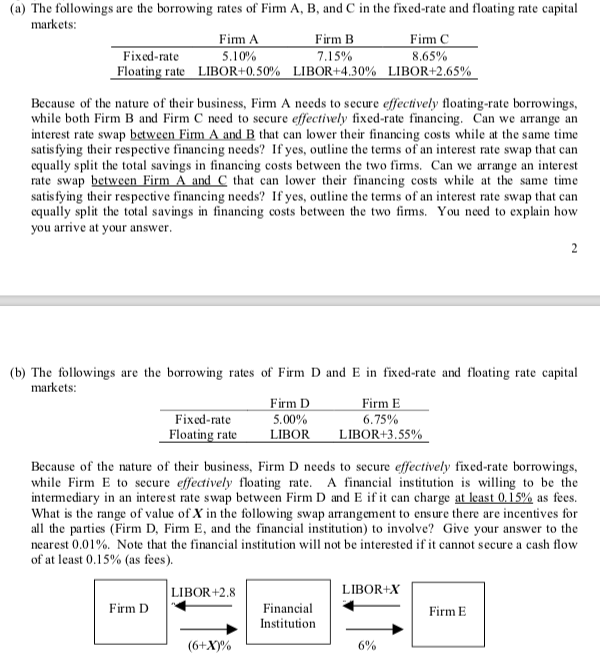

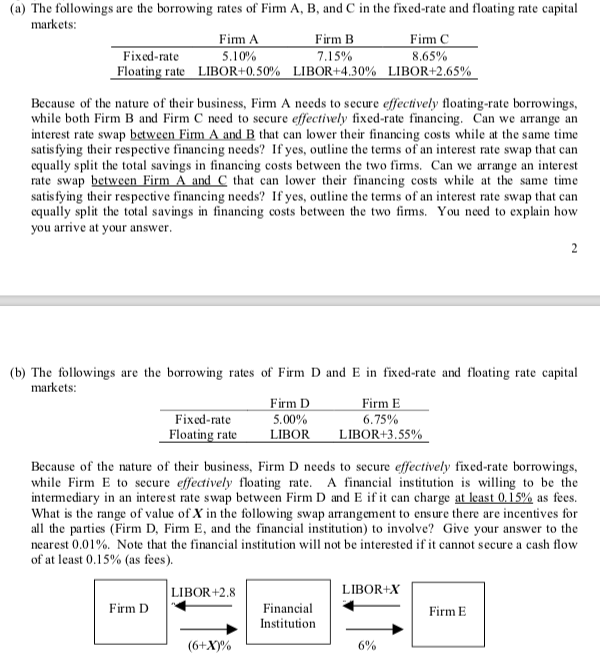

(a) The followings are the borrowing rates of Firm A, B, and C in the fixed-rate and floating rate capital markets: Firm A Firm B Firm C Fixed-rate 5.10% 7.15% 8.65% Floating rate LIBOR+0,50% LIBOR+4.30% LIBOR+2.65% Because of the nature of their business, Firm A needs to secure effectively floating-rate borrowings, while both Firm B and Firm C need to secure effectively fixed-rate financing. Can we arrange an interest rate swap between Firm A and B that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. Can we arrange an interest rate swap between Firm A and C that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. You need to explain how you arrive at your answer. 2 (b) The followings are the borrowing rates of Firm D and E in fixed-rate and floating rate capital markets: Firm D Firm E Fixed-rate 5.00% 6.75% Floating rate LIBOR LIBOR+3.55% Because of the nature of their business, Firm D needs to secure effectively fixed-rate borrowings, while Firm E to secure effectively floating rate. A financial institution is willing to be the intermediary in an interest rate swap between Firm D and E if it can charge at least 0.15% as fees. What is the range of value of X in the following swap arrangement to ensure there are incentives for all the parties (Firm D, Firm E, and the financial institution) to involve? Give your answer to the nearest 0.01%. Note that the financial institution will not be interested if it cannot secure a cash flow of at least 0.15% (as fees). LIBOR +2.8 LIBOR+x Firm D Financial Firm E Institution (6+X)% 6% (a) The followings are the borrowing rates of Firm A, B, and C in the fixed-rate and floating rate capital markets: Firm A Firm B Firm C Fixed-rate 5.10% 7.15% 8.65% Floating rate LIBOR+0,50% LIBOR+4.30% LIBOR+2.65% Because of the nature of their business, Firm A needs to secure effectively floating-rate borrowings, while both Firm B and Firm C need to secure effectively fixed-rate financing. Can we arrange an interest rate swap between Firm A and B that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. Can we arrange an interest rate swap between Firm A and C that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. You need to explain how you arrive at your answer. 2 (b) The followings are the borrowing rates of Firm D and E in fixed-rate and floating rate capital markets: Firm D Firm E Fixed-rate 5.00% 6.75% Floating rate LIBOR LIBOR+3.55% Because of the nature of their business, Firm D needs to secure effectively fixed-rate borrowings, while Firm E to secure effectively floating rate. A financial institution is willing to be the intermediary in an interest rate swap between Firm D and E if it can charge at least 0.15% as fees. What is the range of value of X in the following swap arrangement to ensure there are incentives for all the parties (Firm D, Firm E, and the financial institution) to involve? Give your answer to the nearest 0.01%. Note that the financial institution will not be interested if it cannot secure a cash flow of at least 0.15% (as fees). LIBOR +2.8 LIBOR+x Firm D Financial Firm E Institution (6+X)% 6%