Question

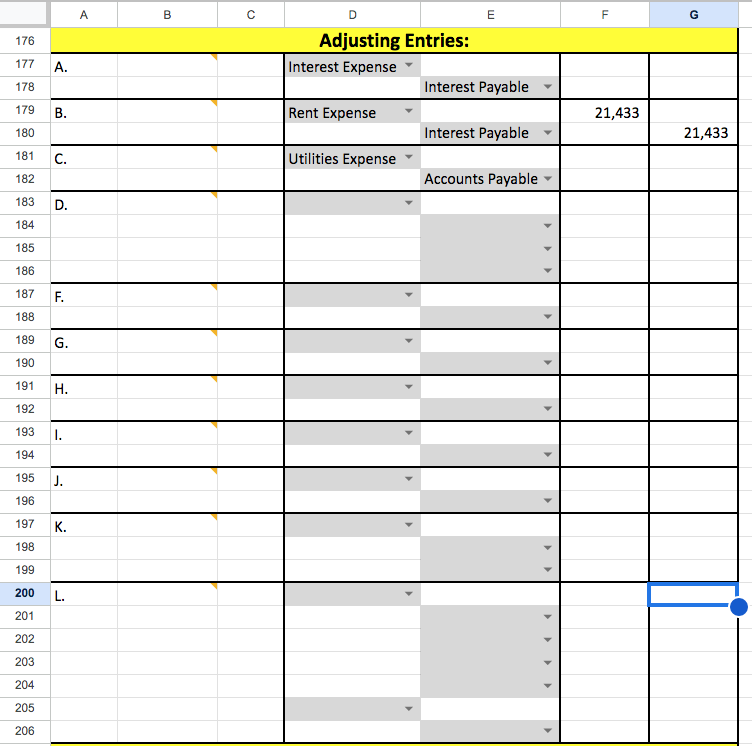

A. The interest accrued at 12/31 of this year on the note payable (current) of $65,000 at 11% needs to be accrued. You will need

A. The interest accrued at 12/31 of this year on the note payable (current) of $65,000 at 11% needs to be accrued. You will need to calculate only one month's interest (previous months' interest have already been recorded). Interest will be paid next year.

B. A warehouse lease payment of $32,150 was made on Oct. 1 of this year for rental through March 31th of next year. The amount was booked to prepaid rent on Oct. 1. Adjust for the used up portion of prepaid rent for Oct to Dec of this year. Round to the nearest $1.

C. $28,120 is owed for utilities used through the end of the year. The A/P balance goes to Naboo Utilities Co.

D. The office equipment has been depreciated up to the beginning of this year. You will need to calculate this year's depreciation. Note the beginning accum depr balance, as you will need it to calculate this year's double-declining balance depr.

E. The annual provision for bad debt is recorded as 6% of ending A/R. Use the allowance method (% of A/R method). Round to the nearest $1. Remember, the % of A/R method is a 2-step process.

F. The annual provision for bad debt is recorded as 6% of ending A/R. Use the allowance method (% of A/R method). Round to the nearest $1. Remember, the % of A/R method is a 2-step process.

G. The interest revenue accrued to Dec. 31 of this year on notes receivable is composed of the following:

Ben Kenobi, Inc. $3,250

Yoda, Inc. 92

R2D2 Computers 91

H. The insurance premium outstanding at the beginning of the year ($4,940) covers the period of Jan. 1 to August 31 of this year (therefore it is now expired). The insurance premium paid in August of this year (for $10,500) runs from September of this year to August of next year. Record the expired insurance (both the insurance coverage that ended in Aug. of this year and the one that started in Sept. of this year).

I. Interest has accrued at 8.5% on the long-term notes payable since July 1 of this year.

J. Office supplies on hand at the end of the year totaled $3,277.

K. The six month interest payment on the bonds payable is due Jan. 3 of next year for the six-month period ended on Dec. 31 of this year. The stated (coupon) rate of interest is 10% annually. The market (yield-to-maturity) rate of interest is 12% annually. There were 10 years to maturity at June 30th of this year (the last interest payment date). The bonds are semi-annual. Record interest expense and discount amortization at Dec. 31.

L. Payroll summary for wages earned from Dec. 24 to Dec. 31 is detailed below. These amounts will be paid next year.

Gross Wages $6,300

FICA Taxes Payable 482

Federal Withholding Taxes 1,246

State Withholding Taxes 389

Net Pay 4,183

Employer's share of FICA (use payroll tax exp) 482

(No FUTA or SUTA is due)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started