Question: A. This problem is a simplification of reality. It could be, and is, more complicated in actuality. You are asked to choose among or

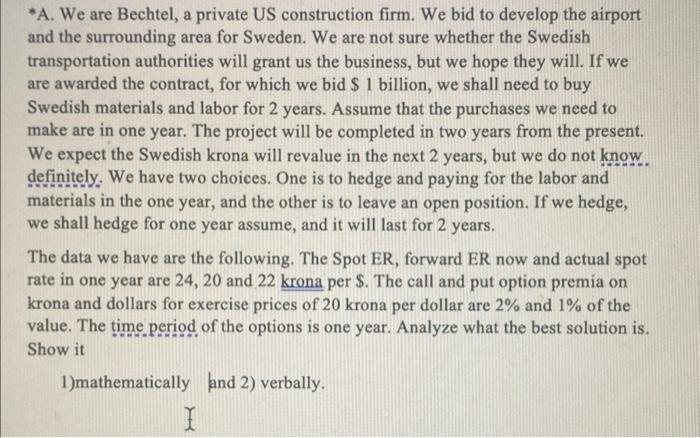

A. This problem is a simplification of reality. It could be, and is, more complicated in actuality. You are asked to choose among or use two different hedging techniques. You have to explain the hedging technique(s) you use. If you choose one, why is this better than the other one. "Better" can be defined in different ways. One of them is there is more (less) cash flow, as a revenue (expense), for the US firm. There may be others. Another issue may be that one has features, which the other one has not got. These attributes may make them better. *A. We are Bechtel, a private US construction firm. We bid to develop the airport and the surrounding area for Sweden. We are not sure whether the Swedish transportation authorities will grant us the business, but we hope they will. If we are awarded the contract, for which we bid $ 1 billion, we shall need to buy Swedish materials and labor for 2 years. Assume that the purchases we need to make are in one year. The project will be completed in two years from the present. We expect the Swedish krona will revalue in the next 2 years, but we do not know definitely. We have two choices. One is to hedge and paying for the labor and materials in the one year, and the other is to leave an open position. If we hedge, we shall hedge for one year assume, and it will last for 2 years. The data we have are the following. The Spot ER, forward ER now and actual spot rate in one year are 24, 20 and 22 krona per $. The call and put option premia on krona and dollars for exercise prices of 20 krona per dollar are 2% and 1% of the value. The time period of the options is one year. Analyze what the best solution is. Show it 1)mathematically and 2) verbally. I

Step by Step Solution

There are 3 Steps involved in it

The best solution is to hedge Hed ging would require us to purchase a call option on the Swedish k ron a with a strike price of 20 k ron a per USD This would allow us to purchase the materials and lab... View full answer

Get step-by-step solutions from verified subject matter experts