Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A travelling production of Rent performs 145 shows each year. The average sales for each show are 1,600 tickets at $85 a ticket. The show

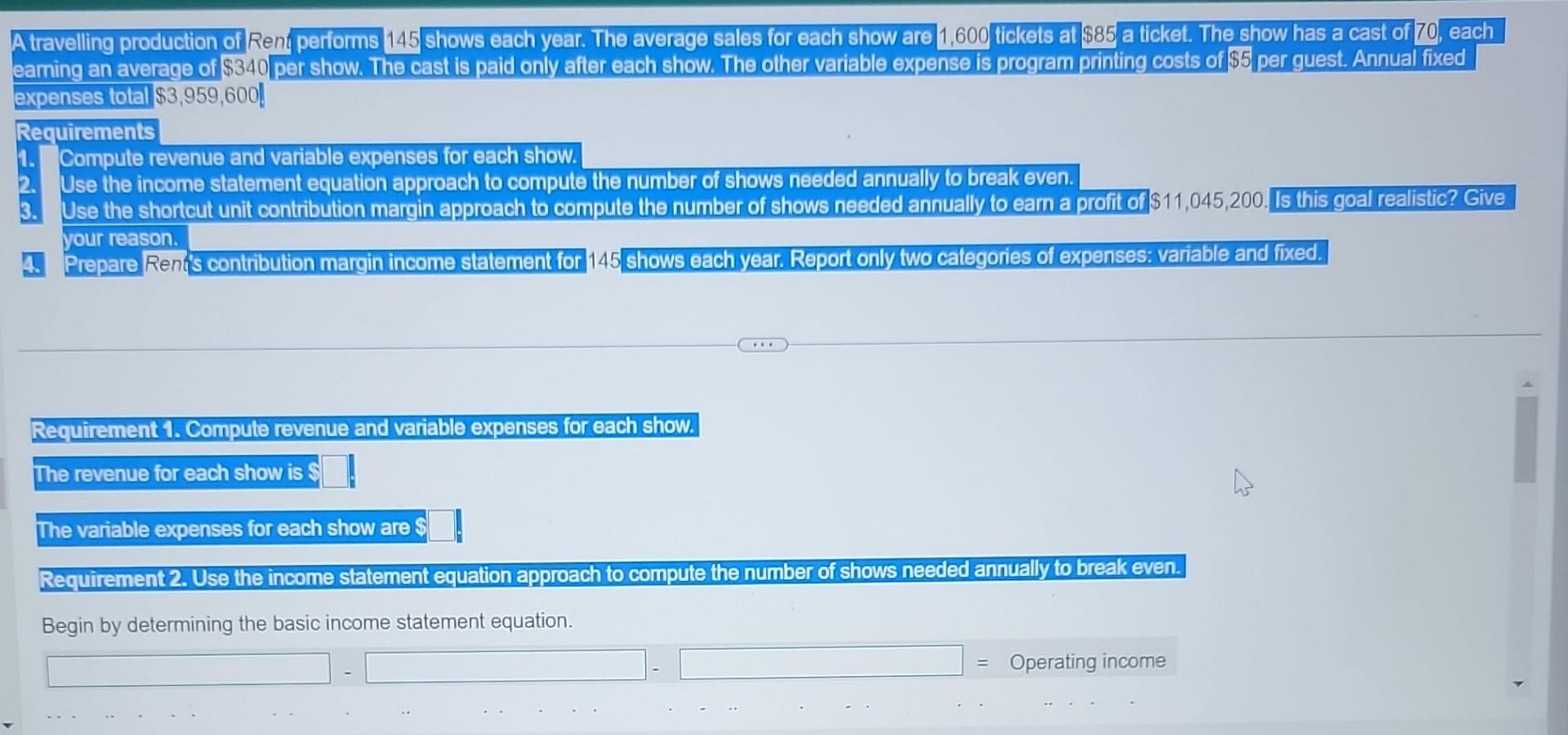

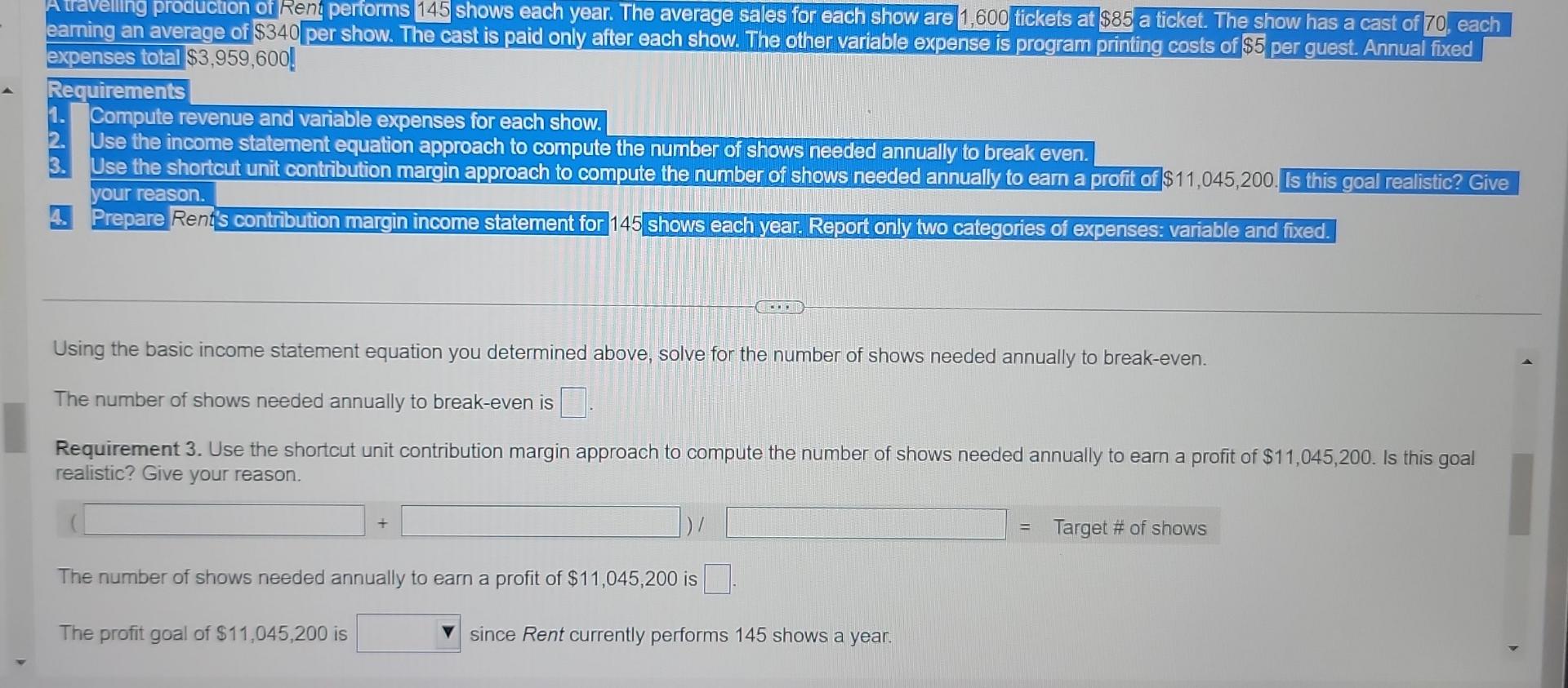

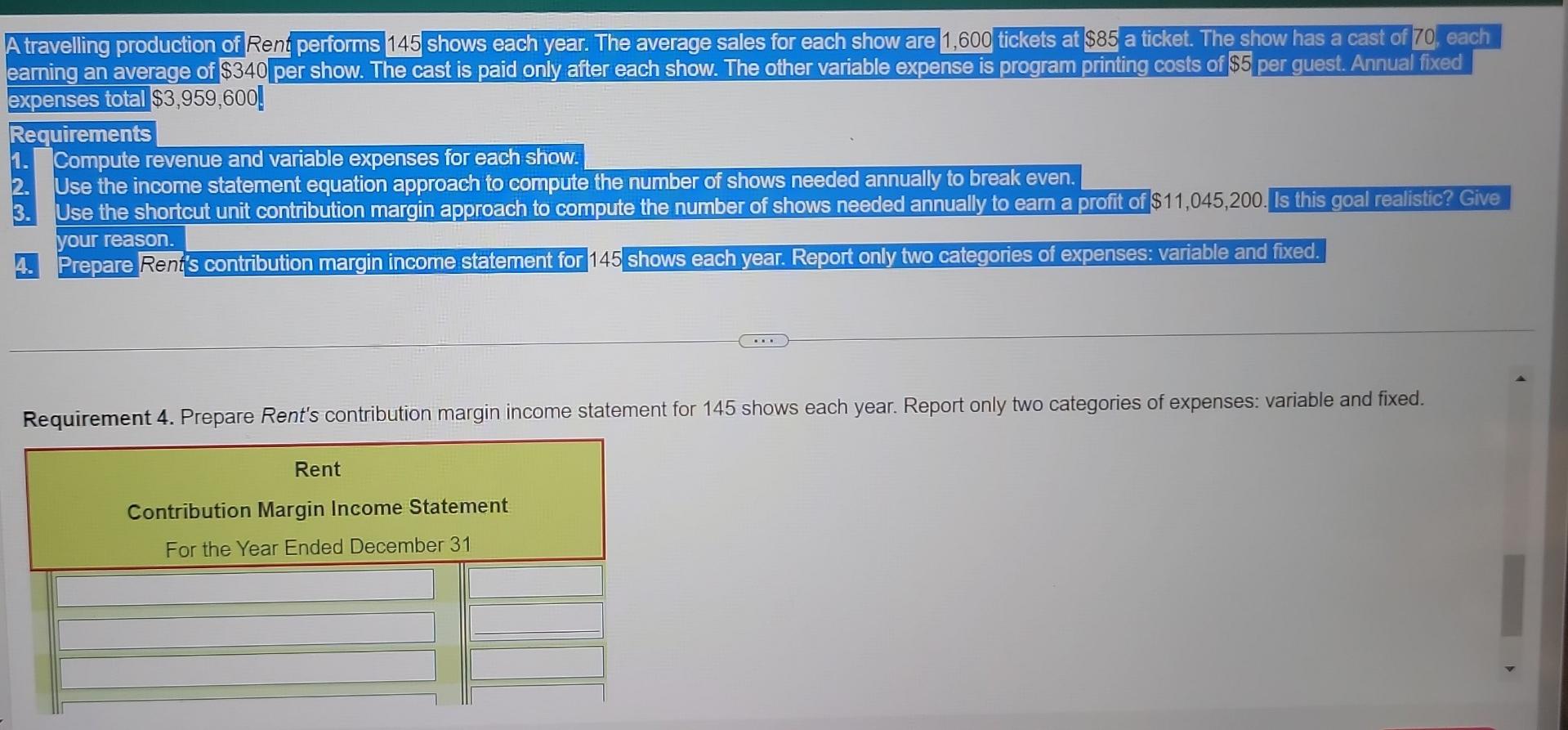

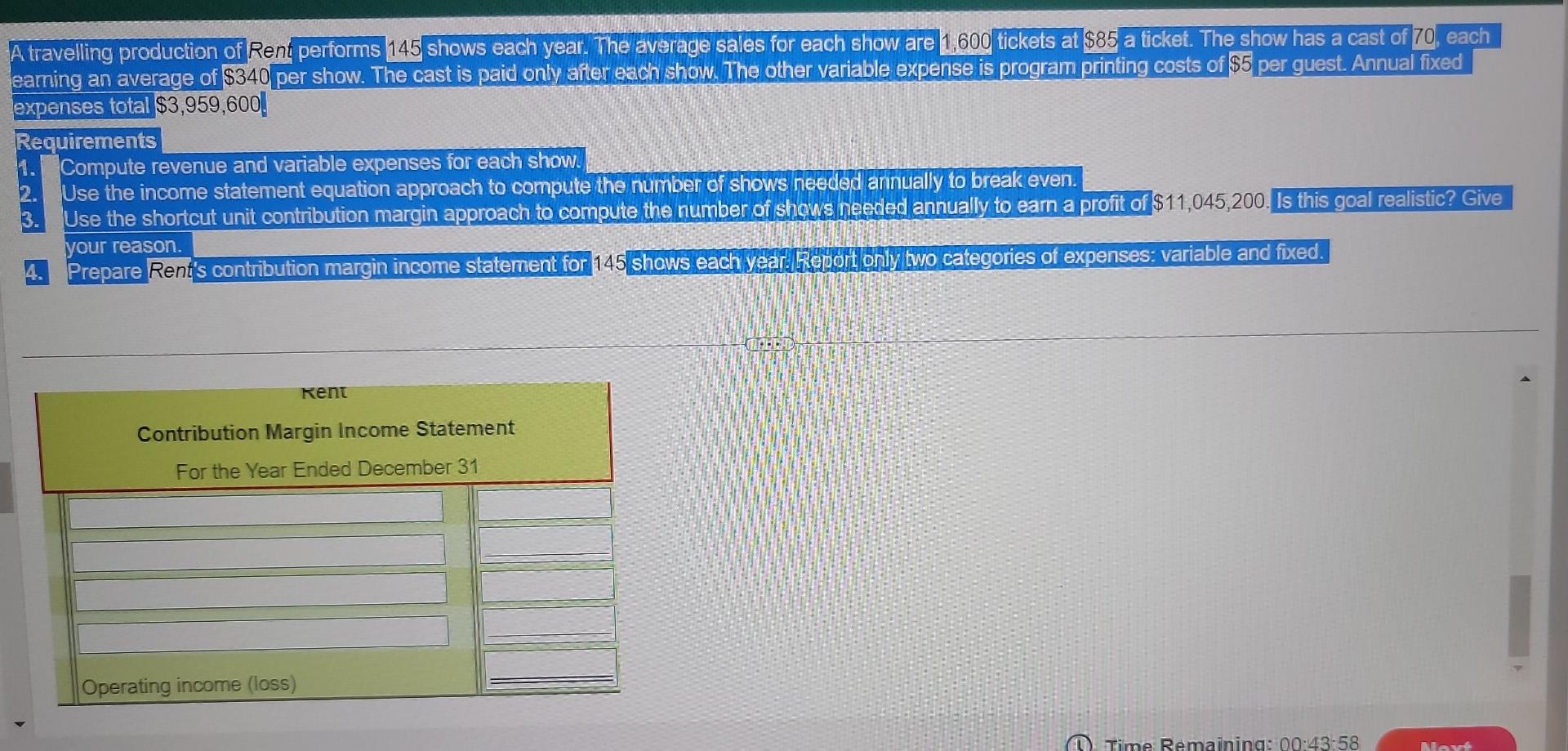

A travelling production of Rent performs 145 shows each year. The average sales for each show are 1,600 tickets at $85 a ticket. The show has a cast of 70 , each eaming an average of $340 per show. The cast is paid only after each show. The olher variable expense is program printing costs of $5 per guest. Annual fixed expenses total $3,959,600 ! Requirements 1. Compute revenue and variable expenses for each show. 2. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to eam a profit of $11,045,200. your reason. 4. Prepare Rent's contribution margin income statement for 145 shows each year. Report only two categories of expenses: variable and fixed. Atravelling production of Rent performs 145 shows each year. The average sales for each show are 1,600 tickets at $85 a ticket. The show has a cast of 70 , each earming an average of $340 Reouirements 1. Compute revenue and variable expenses for each show. 1. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to earn a profit of $11,045,200. your reason. 4. Prepare Rent's contribution margin income statement for 145 shows each year. Report only two categories of expenses: variable and fixed. Using the basic income statement equation you determined above, solve for the number of shows needed annually to break-even. The number of shows needed annually to break-even is Requirement 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to earn a profit of $11,045,200. Is this goal realistic? Give your reason. The number of shows needed annually to earn a profit of $11,045,200 is The profit goal of $11,045,200 is since Rent currently performs 145 shows a year. A travelling production of Rent performs 145 shows each year. The average sales for each show are 1,600 tickets at $85 a ticket. The show has a cast of 70 , each earning an average of $340 per show. The cast is paid only after each show. The other variable expense is program printing costs of $5 per guest. Annual fixed expenses total $3,959,600 ! Requirements 1. Compute revenue and variable expenses for each show. 2. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to earn a profit of $11,045,200.| your reason. Prepare Rent's contribution margin income statement for 145 s shows each year. Report only two categories of expenses: variable and fixed. A travelling production of Rent performs 145 shows each year. The average sales for each show are 1,600 tickets at $85 a ficket. The show has a cast of 70 , each eaming an average of $340 per show. The cast is paid only afier each show, The other variable expense is program printing costs of $5 per guest. Annual fixed expenses total $3,959,600. Requirements 1. Compute revenue and variable expenses for each show. 2. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows nossded annually to eam a profit of $11,045,200.| your reason. 4. Prepare Rent's contribution margin income statement for 145 shows each year . Repedit oflly lyo categories of expenses: variable and fixed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started