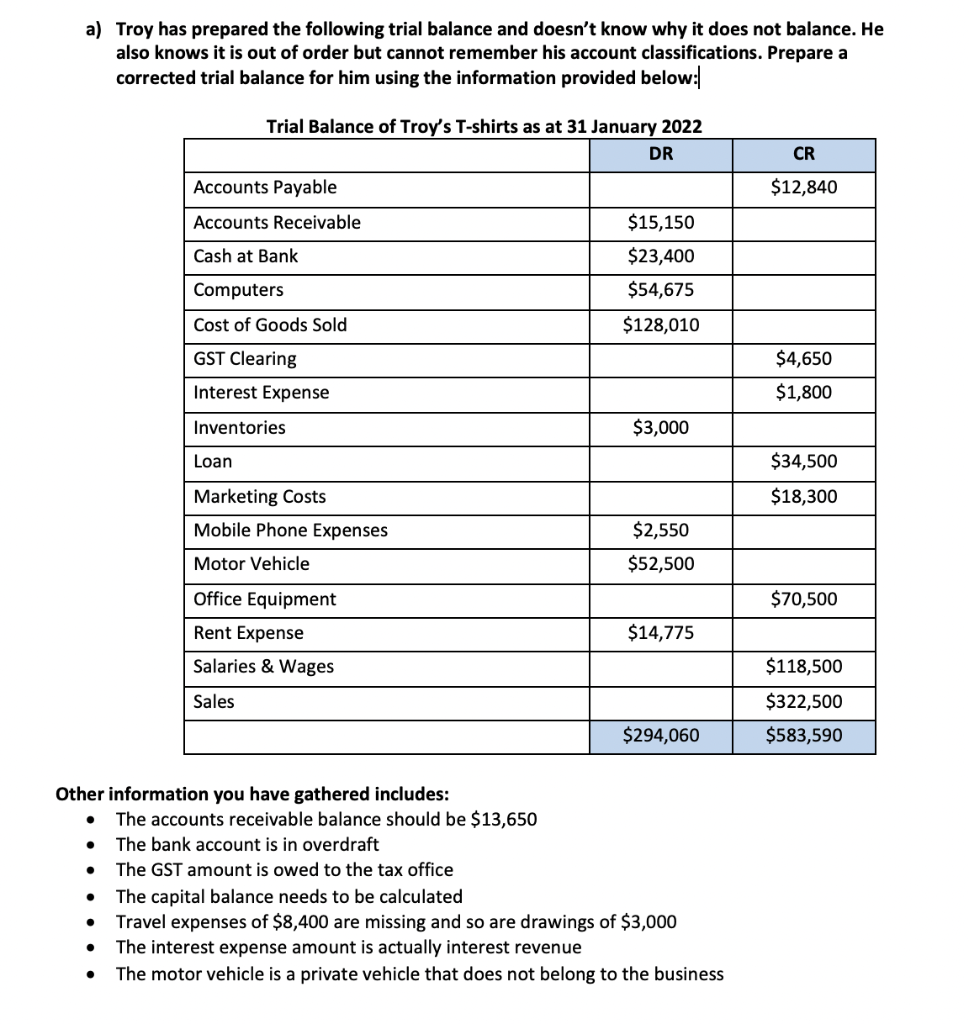

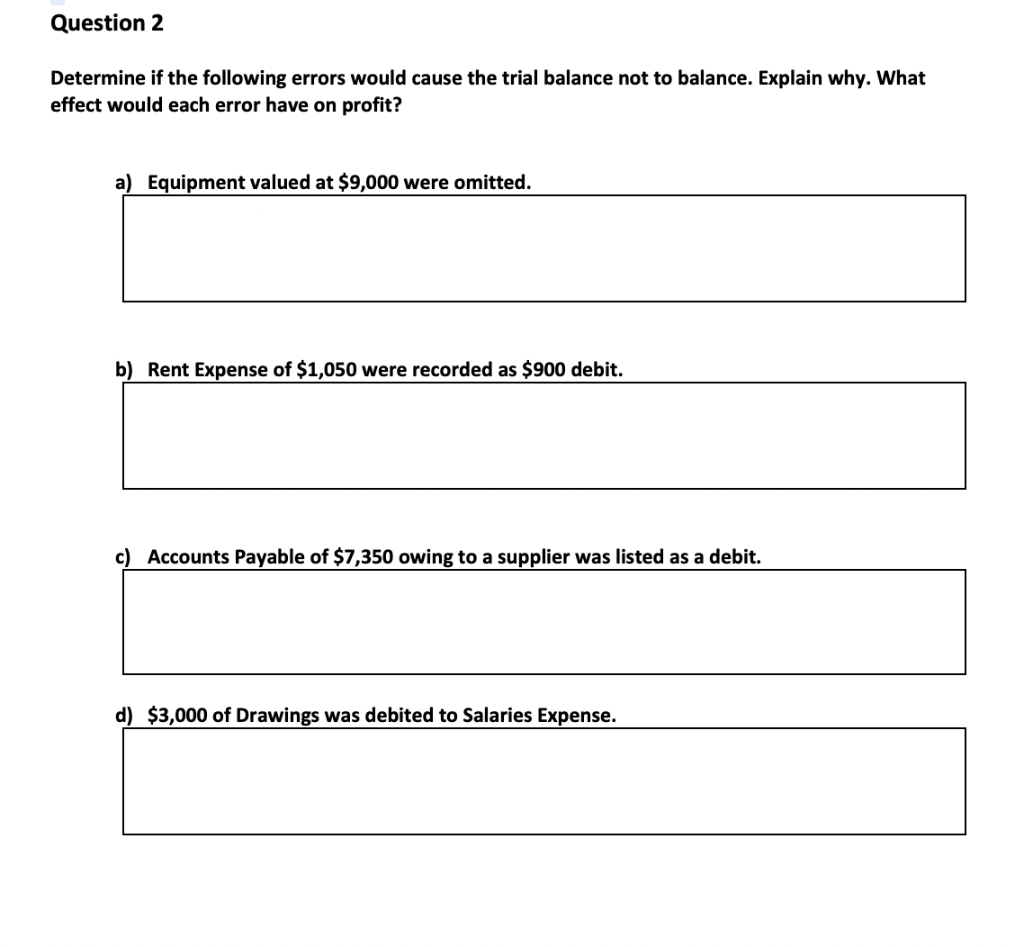

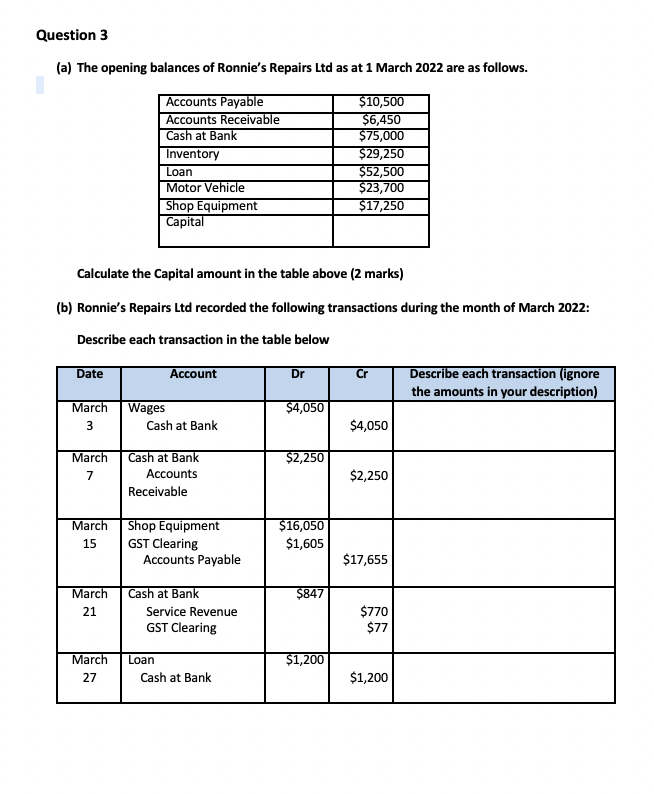

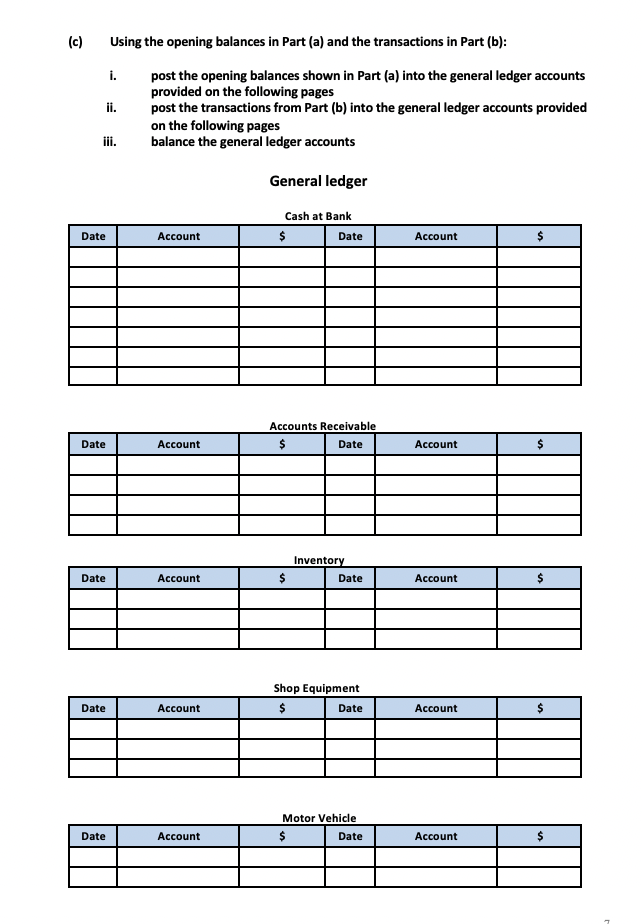

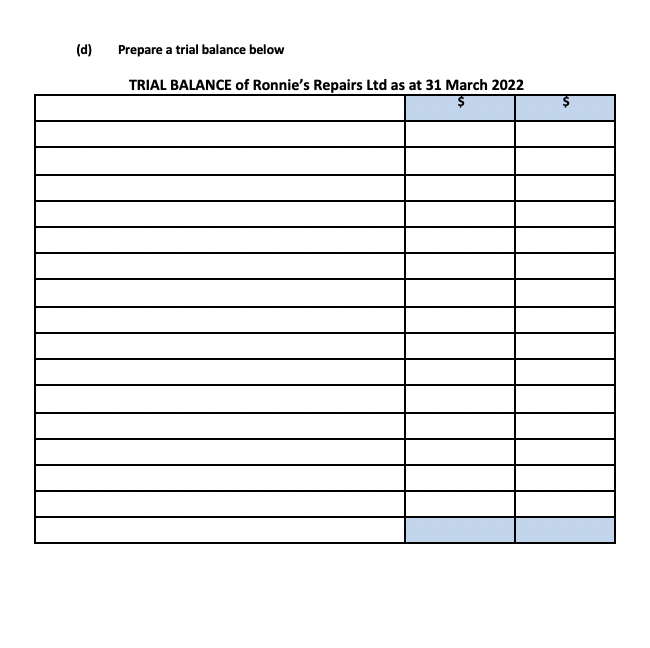

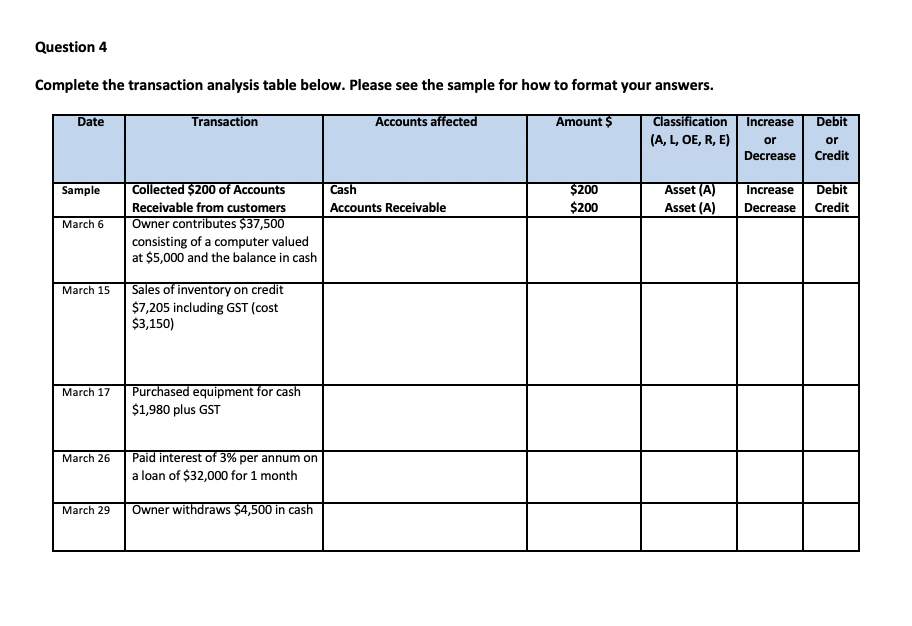

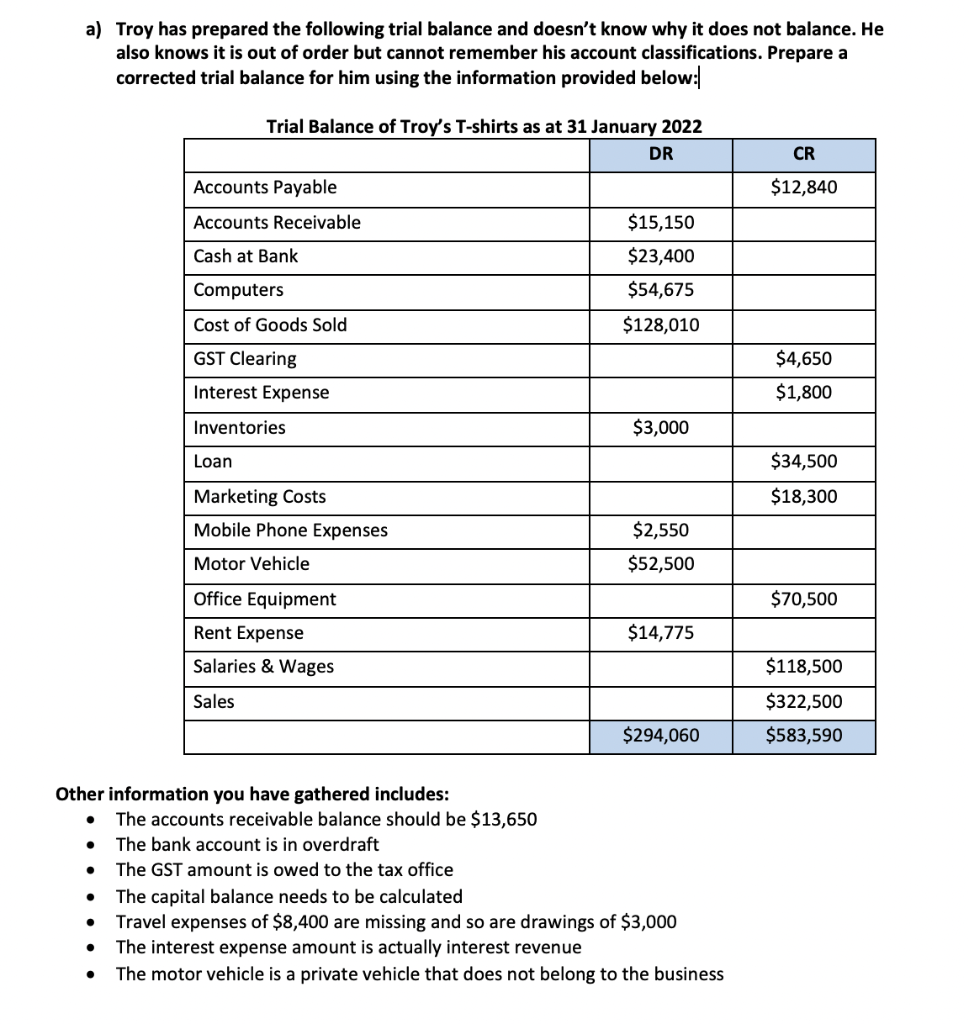

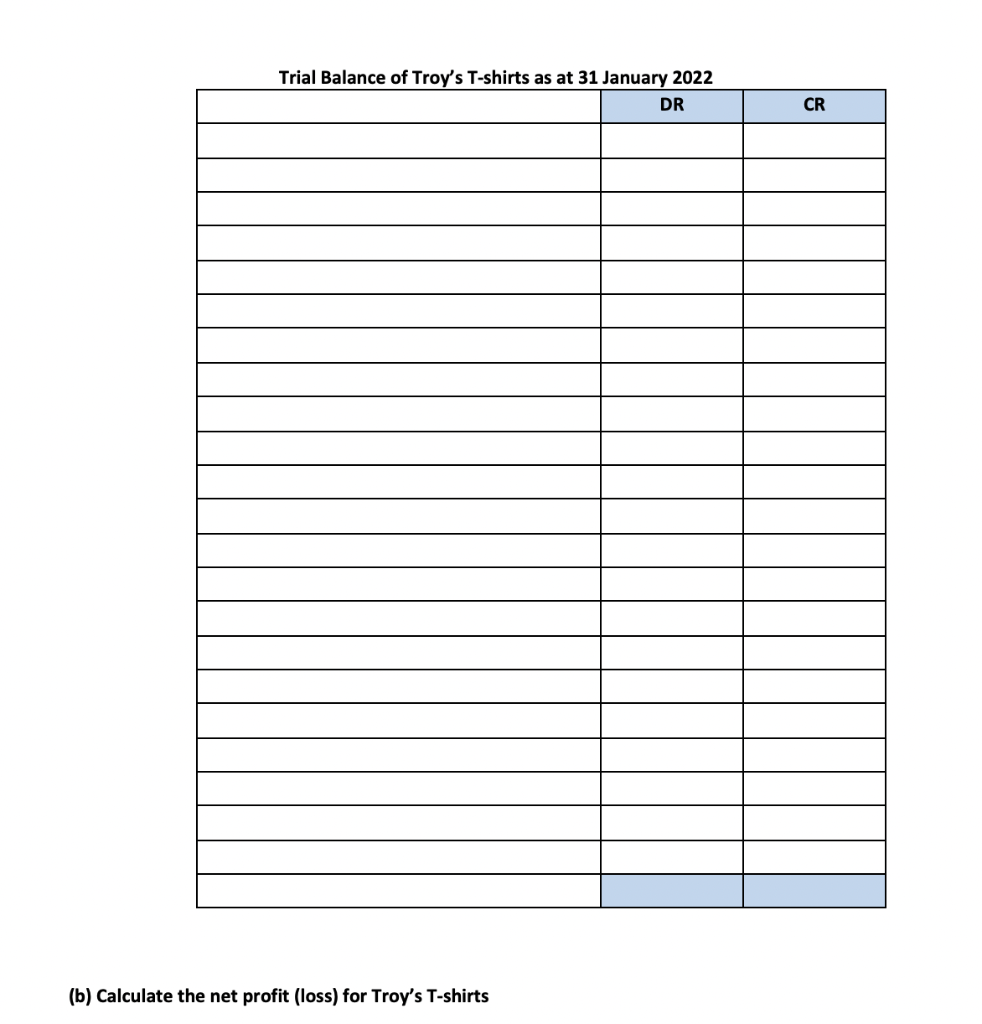

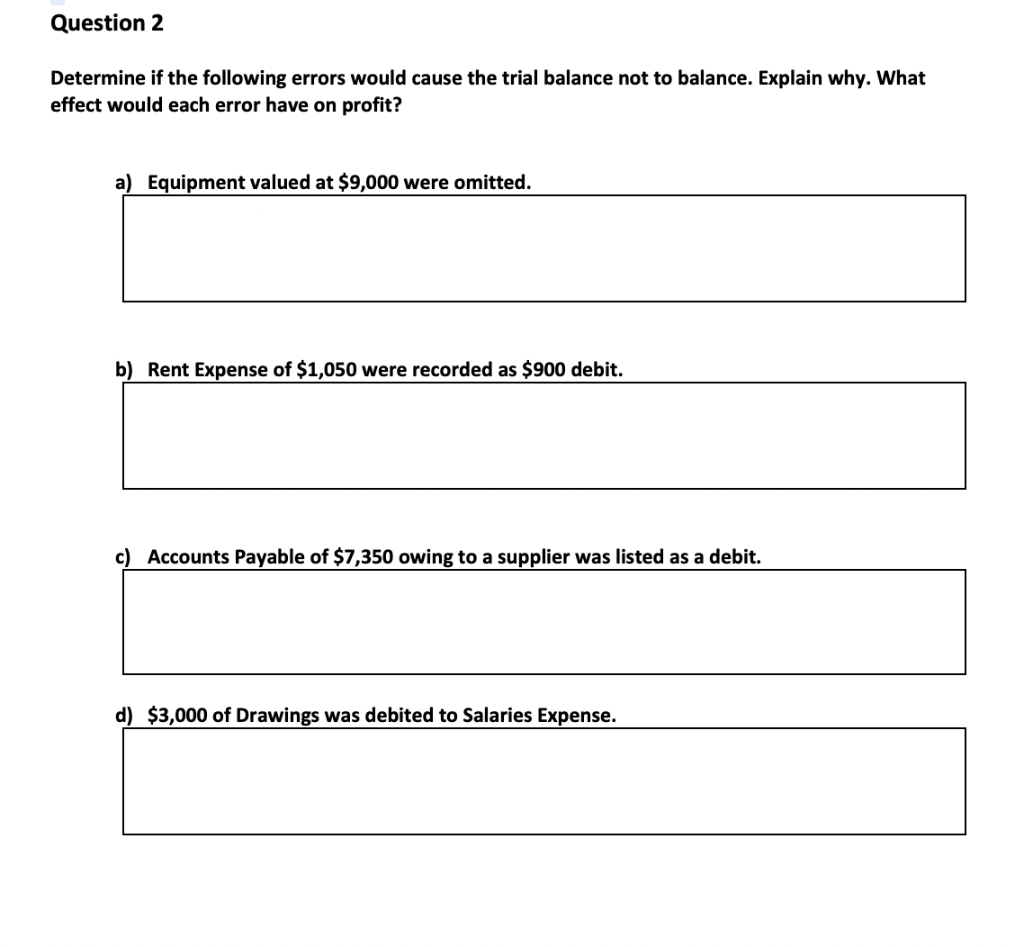

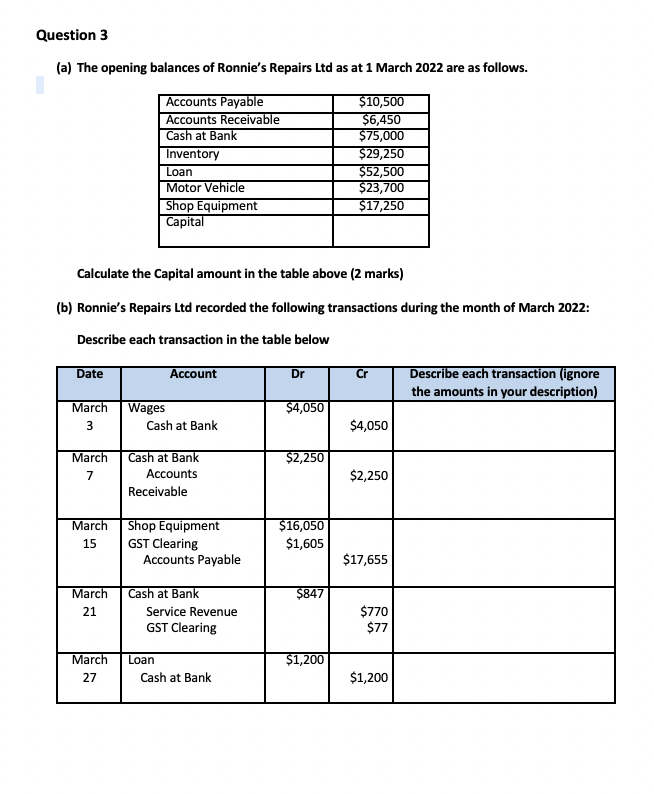

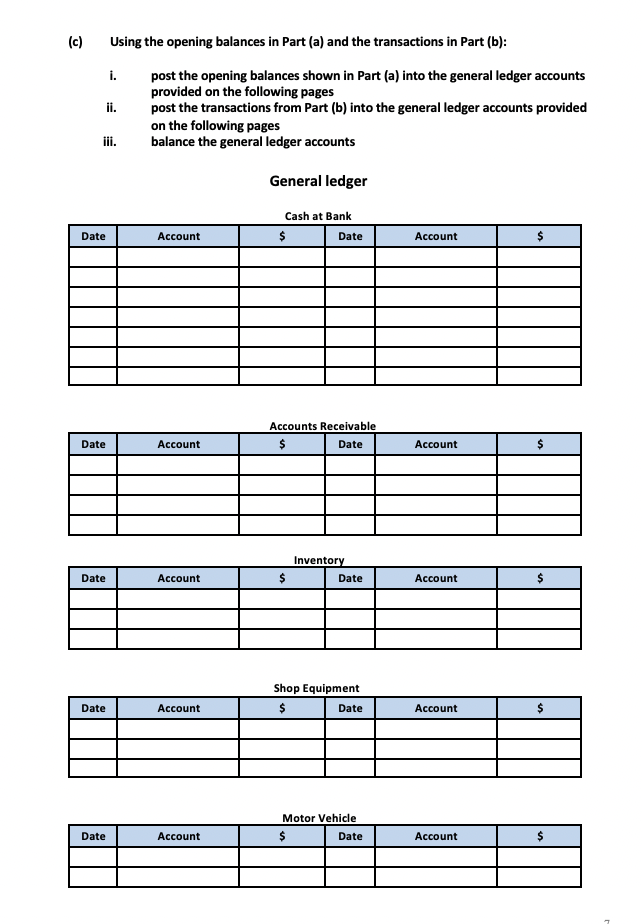

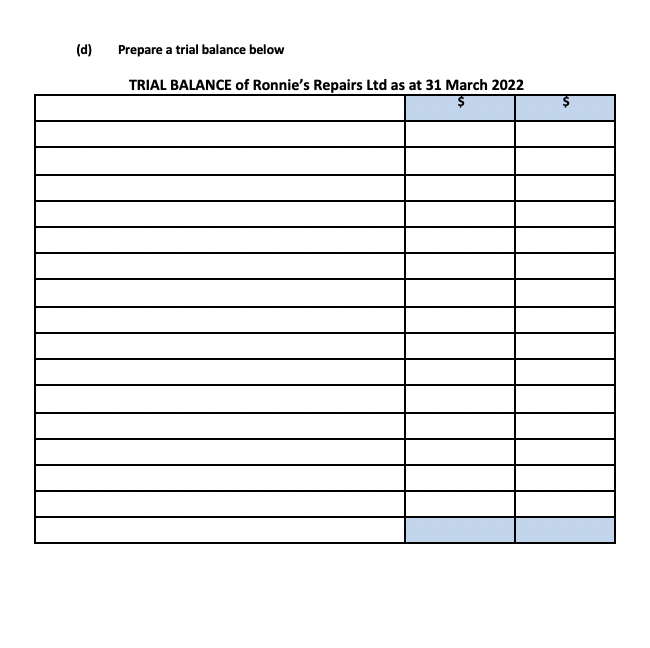

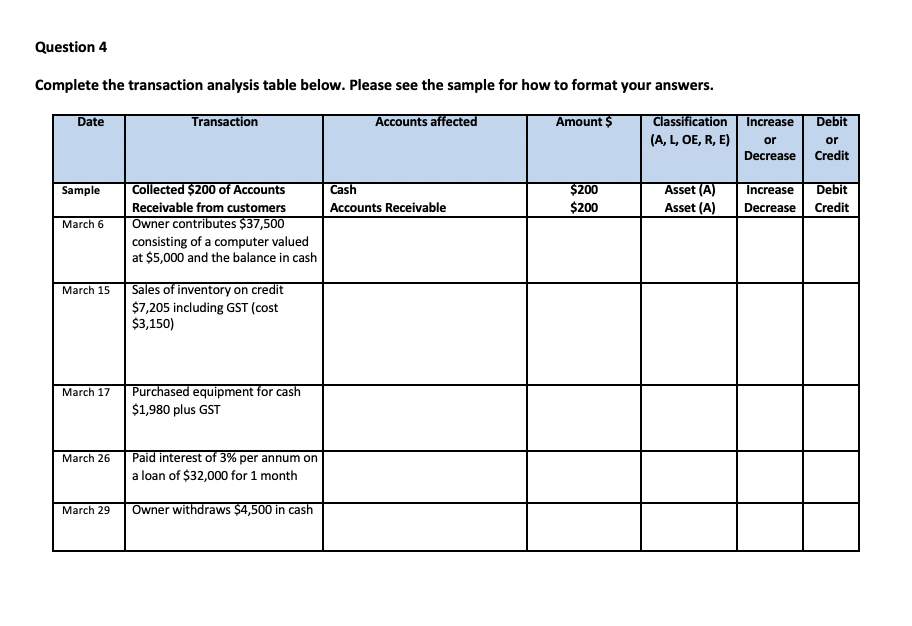

a) Troy has prepared the following trial balance and doesn't know why it does not balance. He also knows it is out of order but cannot remember his account classifications. Prepare a corrected trial balance for him using the information provided below: Trial Balance of Troy's T-shirts as at 31 January 2022 DR CR Accounts Payable $12,840 Accounts Receivable Cash at Bank $15,150 $23,400 $54,675 $128,010 Computers Cost of Goods Sold GST Clearing Interest Expense $4,650 $1,800 Inventories $3,000 Loan $34,5 $18,300 Marketing Costs Mobile Phone Expenses $2,550 $52,500 Motor Vehicle $70,500 Office Equipment Rent Expense Salaries & Wages $14,775 Sales $118,500 $322,500 $583,590 $294,060 . Other information you have gathered includes: The accounts receivable balance should be $13,650 The bank account is in overdraft The GST amount is owed to the tax office The capital balance needs to be calculated Travel expenses of $8,400 are missing and so are drawings of $3,000 The interest expense amount is actually interest revenue The motor vehicle is a private vehicle that does not belong to the business . . 0 . Trial Balance of Troy's T-shirts as at 31 January 2022 DR CR (b) Calculate the net profit (loss) for Troy's T-shirts Question 2 Determine if the following errors would cause the trial balance not to balance. Explain why. What effect would each error have on profit? a) Equipment valued at $9,000 were omitted. b) Rent Expense of $1,050 were recorded as $900 debit. c) Accounts Payable of $7,350 owing to a supplier was listed as a debit. d) $3,000 of Drawings was debited to Salaries Expense. Question 3 (a) The opening balances of Ronnie's Repairs Ltd as at 1 March 2022 are as follows. Accounts Payable Accounts Receivable Cash at Bank Inventory Loan Motor Vehicle Shop Equipment Capital $10,500 $6,450 $75,000 $29,250 $52,500 $23,700 $17,250 Calculate the Capital amount in the table above (2 marks) (b) Ronnie's Repairs Ltd recorded the following transactions during the month of March 2022: Describe each transaction in the table below Date Account Dr Cr Describe each transaction (ignore the amounts in your description) March 3 $4,050 Wages Cash at Bank $4,050 $2,250 March 7 Cash at Bank Accounts Receivable $2,250 March 15 Shop Equipment GST Clearing Accounts Payable $16,050 $1,605 $17,655 $847 March 21 Cash at Bank Service Revenue GST Clearing $770 $77 $1,200 March 27 Loan Cash at Bank $1,200 (c) Using the opening balances in Part (a) and the transactions in Part (b): i. ii. post the opening balances shown in Part (a) into the general ledger accounts provided on the following pages post the transactions from Part (b) into the general ledger accounts provided on the following pages balance the general ledger accounts iii. General ledger Cash at Bank $ Date Account Date Account Accounts Receivable Date Date Account Account Inventory $ Date Date Account Account Date Shop Equipment $ Date Account Account $ Motor Vehicle $ Date Date Account Account $ (d) Prepare a trial balance below TRIAL BALANCE of Ronnie's Repairs Ltd as at 31 March 2022 $ Question 4 Complete the transaction analysis table below. Please see the sample for how to format your answers. Date Transaction Accounts affected Amount $ Classification | Increase (A, L, OE, R, E) or Decrease Debit or Credit Sample Cash Accounts Receivable $200 $200 Asset (A) Asset (A) Increase Decrease Debit Credit March 6 Collected $200 of Accounts Receivable from customers Owner contributes $37,500 consisting of a computer valued at $5,000 and the balance in cash March 15 Sales of inventory on credit $7,205 including GST (cost $3,150) March 17 Purchased equipment for cash $1,980 plus GST March 26 Paid interest of 3% per annum on a loan of $32,000 for 1 month March 29 Owner withdraws $4,500 in cash