Answered step by step

Verified Expert Solution

Question

1 Approved Answer

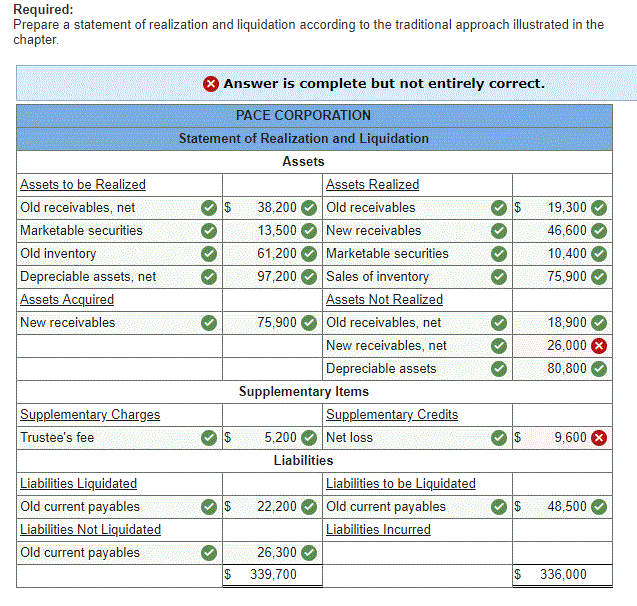

A trustee has been appointed for Pace Inc., which is being liquidated under Chapter 7 of the Bankruptcy Code. The following occurred after the assets

| A trustee has been appointed for Pace Inc., which is being liquidated under Chapter 7 of the Bankruptcy Code. The following occurred after the assets were transferred to the trustee: |

| 1. | Sales on account by the trustee were $75,900. Cost of goods sold were $61,200, consisting of all inventory transferred from Pace. |

| 2. | The trustee sold all $13,500 worth of marketable securities for $10,400. |

| 3. | Receivables collected by the trustee: |

| Old: | $ | 19,300 | of the $38,200 transferred | |

| New: | $ | 46,600 | ||

| 4. | Depreciation of $16,400 on the plant assets of $97,200 transferred from Pace recorded. |

| 5. | Disbursements by the trustee: |

| Old current payables: | $ | 22,200 | of the $48,500 transferred | |

| Trustees expenses: | $ | 5,200 | ||

| Required: |

| Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter. |

Please provide the formulas.

Required: Prepare a statement of realization and liquidation according to the traditional approach illustrated in the chapter X Answer is complete but not entirely correct. PACE CORPORATION Statement of Realization and Liquidation Assets Assets to be Realized Assets Realized Old receivables Old receivables, net 38,200 $ 19,300 Marketable securities New receivables 46,600 13,500 Old inventory 61,200 Marketable securities 10,400 Sales of inventory Assets Not Realized Old receivables, net Depreciable assets, net Assets Acquired 97,200 75,900 New receivables 75,900 18,900 New receivables, net 26,000 Depreciable assets 80,800 Supplementary Items Supplementary Credits |Supplementary Charges Trustee's fee 5,200 Net loss 9,600 Liabilities Liabilities Liquidated Old current payables Liabilities Not Liquidated Liabilities to be Liquidated Old current payables Liabilities Incurred 22,200 48,500 Old current payables 26,300 $ 339,700 336,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started