Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A U.S. company estimated that, in the first two months of 2026 , its export sales to a Swiss company would generate 396,000 francs. 0

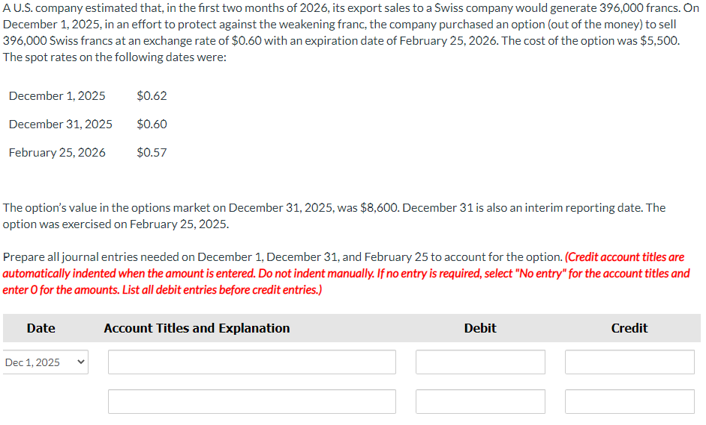

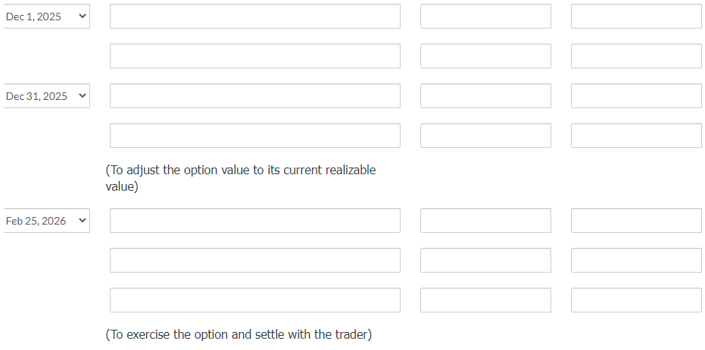

A U.S. company estimated that, in the first two months of 2026 , its export sales to a Swiss company would generate 396,000 francs. 0 December 1, 2025, in an effort to protect against the weakening franc, the company purchased an option (out of the money) to sell 396,000 Swiss francs at an exchange rate of $0.60 with an expiration date of February 25,2026 . The cost of the option was $5,500. The spot rates on the following dates were: The option's value in the options market on December 31,2025 , was $8,600. December 31 is also an interim reporting date. The option was exercised on February 25, 2025. Prepare all journal entries needed on December 1, December 31, and February 25 to account for the option. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Dec 1, 2025 Dec31,2025 (To adjust the option value to its current realizable value) Feb 25, 2026 (To exercise the option and settle with the trader)

A U.S. company estimated that, in the first two months of 2026 , its export sales to a Swiss company would generate 396,000 francs. 0 December 1, 2025, in an effort to protect against the weakening franc, the company purchased an option (out of the money) to sell 396,000 Swiss francs at an exchange rate of $0.60 with an expiration date of February 25,2026 . The cost of the option was $5,500. The spot rates on the following dates were: The option's value in the options market on December 31,2025 , was $8,600. December 31 is also an interim reporting date. The option was exercised on February 25, 2025. Prepare all journal entries needed on December 1, December 31, and February 25 to account for the option. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Dec 1, 2025 Dec31,2025 (To adjust the option value to its current realizable value) Feb 25, 2026 (To exercise the option and settle with the trader) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started