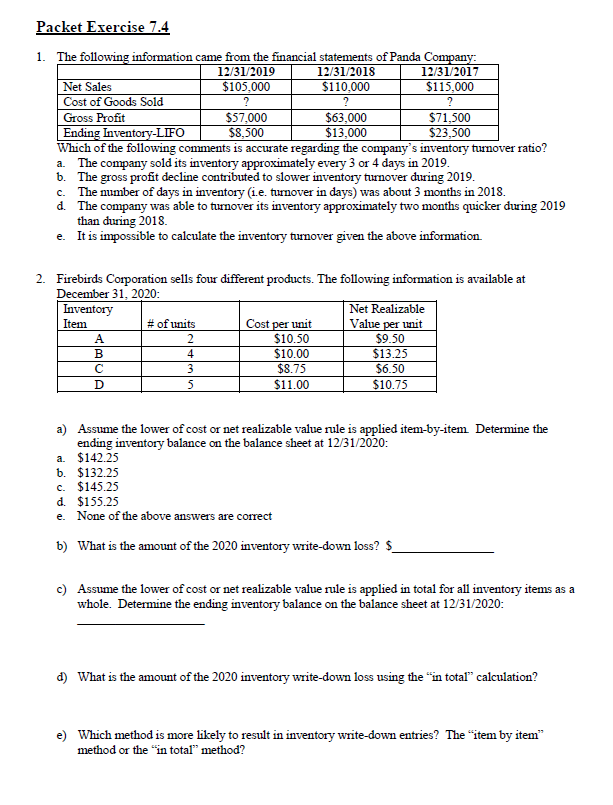

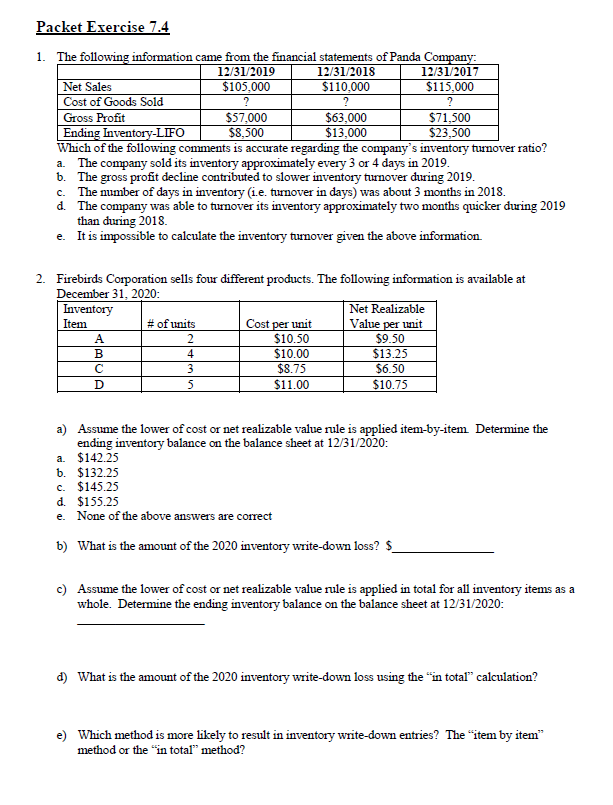

Packet Exercise 7.4 1. The following information came from the financial statements of Panda Company: 12/31/2019 12/31/2018 12/31/2017 Net Sales $105,000 $110,000 $115,000 Cost of Goods Sold Gross Profit $57,000 $63,000 $71,500 Ending Inventory-LIFO $8,500 $13,000 $23,500 Which of the following comments is accurate regarding the company's inventory turnover ratio? a. The company sold its inventory approximately every 3 or 4 days in 2019. b. The gross profit decline contributed to slower inventory turnover during 2019. c. The number of days in inventory (1.e. turnover in days) was about 3 months in 2018. d. The company was able to turnover its inventory approximately two months quicker during 2019 than during 2018 e. It is impossible to calculate the inventory turnover given the above information 2. Firebirds Corporation sells four different products. The following information is available at December 31, 2020: Inventory Net Realizable Item # of units Cost per unit Value per unit A 2 $10.50 $9.50 B 4 $10.00 $13.25 3 $8.75 $6.50 D 5 $11.00 $10.75 a) Assume the lower of cost or net realizable value rule is applied item-by-item Determine the ending inventory balance on the balance sheet at 12/31/2020: a. $142.25 b. $132.25 c. $145.25 d. $155.25 e. None of the above answers are correct b) What is the amount of the 2020 inventory write-down loss? $ c) Assume the lower of cost or net realizable value rule is applied in total for all inventory items as a whole. Determine the ending inventory balance on the balance sheet at 12/31/2020: d) What is the amount of the 2020 inventory write-down loss using the in total calculation? e) Which method is more likely to result in inventory write-down entries? The "item by item" method or the "in total" method? Packet Exercise 7.4 1. The following information came from the financial statements of Panda Company: 12/31/2019 12/31/2018 12/31/2017 Net Sales $105,000 $110,000 $115,000 Cost of Goods Sold Gross Profit $57,000 $63,000 $71,500 Ending Inventory-LIFO $8,500 $13,000 $23,500 Which of the following comments is accurate regarding the company's inventory turnover ratio? a. The company sold its inventory approximately every 3 or 4 days in 2019. b. The gross profit decline contributed to slower inventory turnover during 2019. c. The number of days in inventory (1.e. turnover in days) was about 3 months in 2018. d. The company was able to turnover its inventory approximately two months quicker during 2019 than during 2018 e. It is impossible to calculate the inventory turnover given the above information 2. Firebirds Corporation sells four different products. The following information is available at December 31, 2020: Inventory Net Realizable Item # of units Cost per unit Value per unit A 2 $10.50 $9.50 B 4 $10.00 $13.25 3 $8.75 $6.50 D 5 $11.00 $10.75 a) Assume the lower of cost or net realizable value rule is applied item-by-item Determine the ending inventory balance on the balance sheet at 12/31/2020: a. $142.25 b. $132.25 c. $145.25 d. $155.25 e. None of the above answers are correct b) What is the amount of the 2020 inventory write-down loss? $ c) Assume the lower of cost or net realizable value rule is applied in total for all inventory items as a whole. Determine the ending inventory balance on the balance sheet at 12/31/2020: d) What is the amount of the 2020 inventory write-down loss using the in total calculation? e) Which method is more likely to result in inventory write-down entries? The "item by item" method or the "in total" method