a) Using ten key ratios of your choice, analyse and discuss the financial performance of Mog Plc as an investment prospect during the two years of 20X3 and 20X4. (Ratios should be rounded to one decimal place). (Word count guidance: 500 - 600 words).

b) Identifytwopiecesofinformation,otherthantheinformationcontainedinthe financial statements of Mog Plc, which would enable you to prepare a more thorough analysis of the companys performance. For each additional piece of information, explain why it would be useful for your analysis. (Word count guidance: 200 250 words).

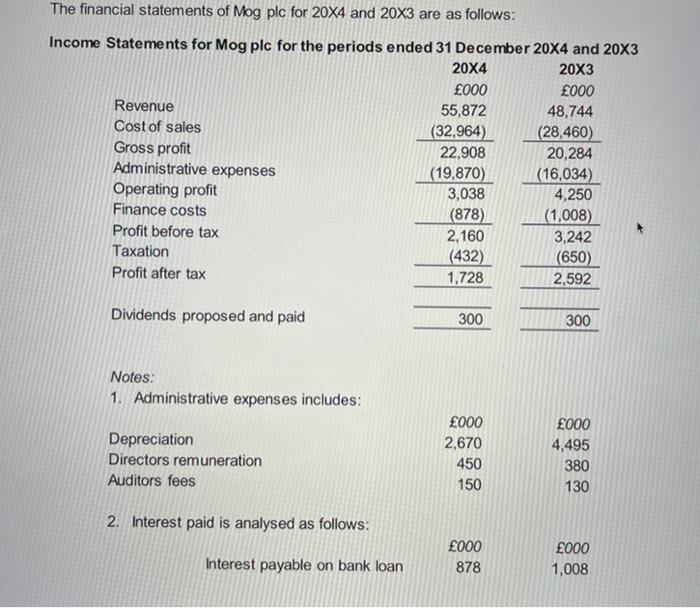

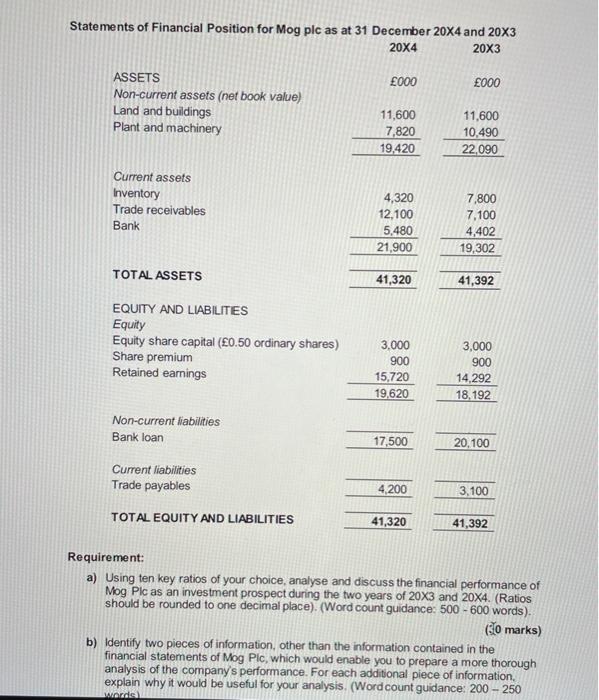

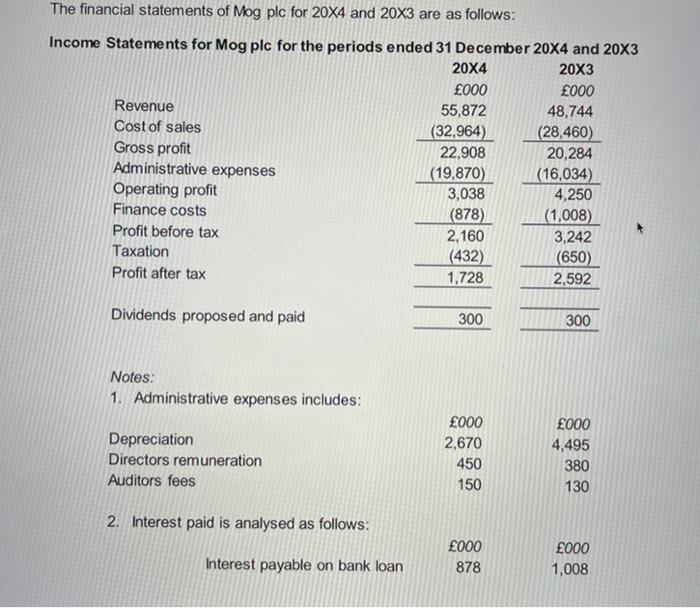

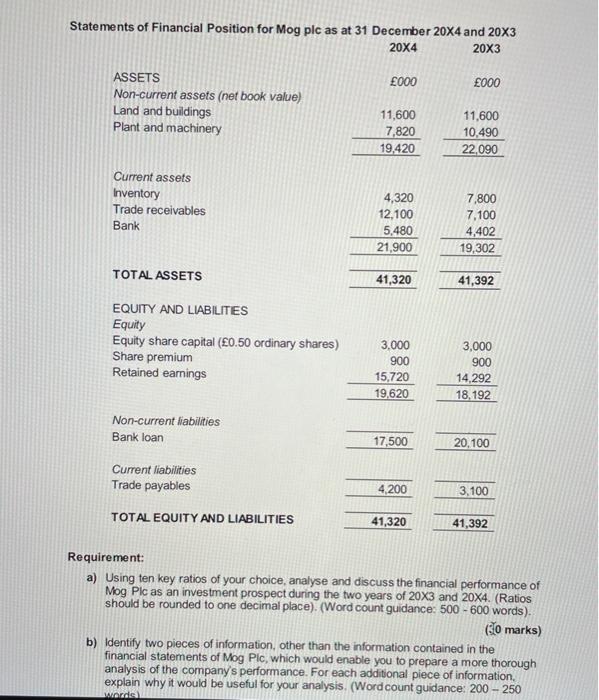

The financial statements of Mog plc for 20x4 and 20x3 are as follows: Income Statements for Mog plc for the periods ended 31 December 20X4 and 20X3 20X4 20X3 000 000 Revenue 55,872 48,744 Cost of sales (32,964) (28,460) Gross profit 22.908 20,284 Administrative expenses (19,870) (16,034) Operating profit 3,038 4,250 Finance costs (878) (1,008) Profit before tax 2,160 3.242 Taxation (432) (650) Profit after tax 1,728 2,592 Dividends proposed and paid 300 300 Notes: 1. Administrative expenses includes: Depreciation Directors remuneration Auditors fees 000 2,670 450 150 000 4,495 380 130 2. Interest paid is analysed as follows: Interest payable on bank loan 000 878 000 1,008 Statements of Financial Position for Mog plc as at 31 December 20x4 and 20X3 20X4 20X3 000 000 ASSETS Non-current assets (net book value) Land and buildings Plant and machinery 11,600 7,820 19.420 11,600 10,490 22.090 Current assets Inventory Trade receivables Bank 4,320 12,100 5,480 21,900 7,800 7,100 4,402 19,302 TOTAL ASSETS 41,320 41,392 EQUITY AND LIABILITES Equity Equity share capital (0.50 ordinary shares) Share premium Retained earnings 3.000 900 15,720 19.620 3,000 900 14,292 18,192 Non-current liabilities Bank loan 17,500 20,100 Current liabilities Trade payables 4,200 3.100 TOTAL EQUITY AND LIABILITIES 41,320 41,392 Requirement: a) Using ten key ratios of your choice, analyse and discuss the financial performance of Mog Plc as an investment prospect during the two years of 20x3 and 20X4. (Ratios should be rounded to one decimal place). (Word count guidance: 500 - 600 words). (o marks) b) Identify two pieces of information, other than the information contained in the financial statements of Mog Plc, which would enable you to prepare a more thorough analysis of the company's performance. For each additional piece of information, explain why it would be useful for your analysis. (Wordcount guidance: 200 - 250 Wande The financial statements of Mog plc for 20x4 and 20x3 are as follows: Income Statements for Mog plc for the periods ended 31 December 20X4 and 20X3 20X4 20X3 000 000 Revenue 55,872 48,744 Cost of sales (32,964) (28,460) Gross profit 22.908 20,284 Administrative expenses (19,870) (16,034) Operating profit 3,038 4,250 Finance costs (878) (1,008) Profit before tax 2,160 3.242 Taxation (432) (650) Profit after tax 1,728 2,592 Dividends proposed and paid 300 300 Notes: 1. Administrative expenses includes: Depreciation Directors remuneration Auditors fees 000 2,670 450 150 000 4,495 380 130 2. Interest paid is analysed as follows: Interest payable on bank loan 000 878 000 1,008 Statements of Financial Position for Mog plc as at 31 December 20x4 and 20X3 20X4 20X3 000 000 ASSETS Non-current assets (net book value) Land and buildings Plant and machinery 11,600 7,820 19.420 11,600 10,490 22.090 Current assets Inventory Trade receivables Bank 4,320 12,100 5,480 21,900 7,800 7,100 4,402 19,302 TOTAL ASSETS 41,320 41,392 EQUITY AND LIABILITES Equity Equity share capital (0.50 ordinary shares) Share premium Retained earnings 3.000 900 15,720 19.620 3,000 900 14,292 18,192 Non-current liabilities Bank loan 17,500 20,100 Current liabilities Trade payables 4,200 3.100 TOTAL EQUITY AND LIABILITIES 41,320 41,392 Requirement: a) Using ten key ratios of your choice, analyse and discuss the financial performance of Mog Plc as an investment prospect during the two years of 20x3 and 20X4. (Ratios should be rounded to one decimal place). (Word count guidance: 500 - 600 words). (o marks) b) Identify two pieces of information, other than the information contained in the financial statements of Mog Plc, which would enable you to prepare a more thorough analysis of the company's performance. For each additional piece of information, explain why it would be useful for your analysis. (Wordcount guidance: 200 - 250 Wande