Question

a. Using the data from problem 2, calculate the forward rate of the following Forward Rate for the 1-year annual rate next year = ?

a. Using the data from problem 2, calculate the forward rate of the following

Forward Rate for the 1-year annual rate next year = ?

Forward Rate for the 2-year annual rate next year = ?

b. Based on your analysis of future inflation and its effect on future interest rates, you predict that short-term interest rates will rise over the next year. In particular, you think that the 1-year and the 2-year rates will be higher than they are currently (based on data from Problem 2). More specifically, you think that the 1-year rate next year will be 3%( per annum) and the two-year rate will be 3.5% (per annum). You want to exploit your analysis to generate a return over 1 year. Based on your beliefs, you want to analyze the returns from two investment strategies: (1) Investing in 2-year zeros and selling them early (in exactly one year), or (2) investing in 3-year zeros and selling them early(in exactly one year.)

Given your expectations about the 1-year and 2-year zero rates next year(in exactly one year), what are the returns you expect for each strategy? Return from investing in the 2-year zeros and selling them next year = ?

Return from investing in the 3-year zeros and selling them next year = ?

c. How do the returns from the two strategies calculated in part b compare to just investing directly for one year by investing in the current 1-year zero?

Explain why these returns are different and ranked the way they are. Hint: How do your expectations compare to those implied by the current yield curve?

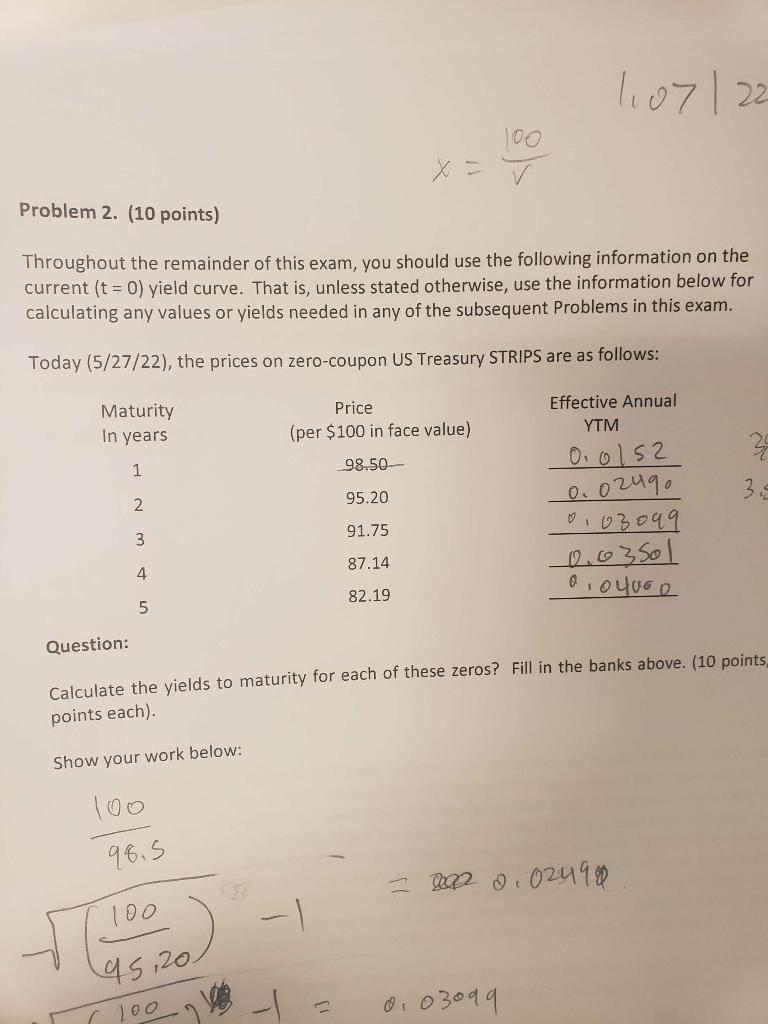

Problem 2. (10 points) Throughout the remainder of this exam, you should use the following information on the current (t=0) yield curve. That is, unless stated otherwise, use the information below for calculating any values or yields needed in any of the subsequent Problems in this exam. Today (5/27/22), the prices on zero-coupon US Treasury STRIPS are as follows: Question: Calculate the yields to maturity for each of these zeros? Fill in the banks above. (10 points points each). Show your work below: 98.510045,20100)=1=0.024 Problem 2. (10 points) Throughout the remainder of this exam, you should use the following information on the current (t=0) yield curve. That is, unless stated otherwise, use the information below for calculating any values or yields needed in any of the subsequent Problems in this exam. Today (5/27/22), the prices on zero-coupon US Treasury STRIPS are as follows: Question: Calculate the yields to maturity for each of these zeros? Fill in the banks above. (10 points points each). Show your work below: 98.510045,20100)=1=0.024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started