Answered step by step

Verified Expert Solution

Question

1 Approved Answer

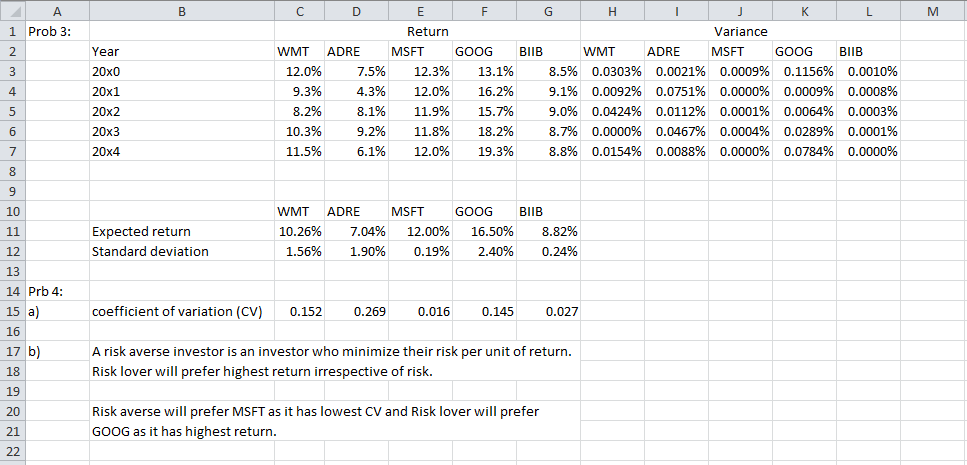

a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you

a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG. b. How would the portfolio be affected if you distributed your investment in the following way: 30% in ADRE; 25% on MSFT and 45% on GOOG? c. Which of the two portfolios would a risk seeking investor prefer and why?

B M 1 Prob 3: 2 Year BIIB 3 D E F Return WMT ADRE MSFT GOOG 12.0% 7.5% 12.3% 13.1% 9.3% 4.3% 12.0% 16.2% 8.2% 8.1% 11.9% 15.7% 10.3% 9.2% 11.8% 18.2% 11.5% 6.1% 12.0% 19.3% H K L Variance WMT ADRE MSFT GOOG BIIB 8.5% 0.0303% 0.0021% 0.0009% 0.1156% 0.0010% 9.1% 0.0092% 0.0751% 0.0000% 0.0009% 0.0008% 9.0% 0.0424% 0.0112% 0.0001% 0.0064% 0.0003% 8.7% 0.0000% 0.0467% 0.0004% 0.0289% 0.0001% 8.8% 0.0154% 0.0088% 0.0000% 0.0784% 0.0000% 20x0 20x1 20x2 20x3 20x4 4 5 6 7 8 9 9 10 11 Expected return Standard deviation WMT ADRE MSFT GOOG 10.26% 7.04% 12.00% 16.50% 1.56% 1.90% 0.19% 2.40% BIIB 8.82% 0.24% 12 13 coefficient of variation (CV) 0.152 0.269 0.016 0.145 0.027 14 Prb 4: 15 a) 16 17 b) 18 A risk averse investor is an investor who minimize their risk per unit of return. Risk lover will prefer highest return irrespective of risk. 19 20 Risk averse will prefer MSFT as it has lowest CV and Risk lover will prefer GOOG as it has highest return. 21 22 B M 1 Prob 3: 2 Year BIIB 3 D E F Return WMT ADRE MSFT GOOG 12.0% 7.5% 12.3% 13.1% 9.3% 4.3% 12.0% 16.2% 8.2% 8.1% 11.9% 15.7% 10.3% 9.2% 11.8% 18.2% 11.5% 6.1% 12.0% 19.3% H K L Variance WMT ADRE MSFT GOOG BIIB 8.5% 0.0303% 0.0021% 0.0009% 0.1156% 0.0010% 9.1% 0.0092% 0.0751% 0.0000% 0.0009% 0.0008% 9.0% 0.0424% 0.0112% 0.0001% 0.0064% 0.0003% 8.7% 0.0000% 0.0467% 0.0004% 0.0289% 0.0001% 8.8% 0.0154% 0.0088% 0.0000% 0.0784% 0.0000% 20x0 20x1 20x2 20x3 20x4 4 5 6 7 8 9 9 10 11 Expected return Standard deviation WMT ADRE MSFT GOOG 10.26% 7.04% 12.00% 16.50% 1.56% 1.90% 0.19% 2.40% BIIB 8.82% 0.24% 12 13 coefficient of variation (CV) 0.152 0.269 0.016 0.145 0.027 14 Prb 4: 15 a) 16 17 b) 18 A risk averse investor is an investor who minimize their risk per unit of return. Risk lover will prefer highest return irrespective of risk. 19 20 Risk averse will prefer MSFT as it has lowest CV and Risk lover will prefer GOOG as it has highest return. 21 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started