Question

Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge. Q1: Using basic terminology, explain

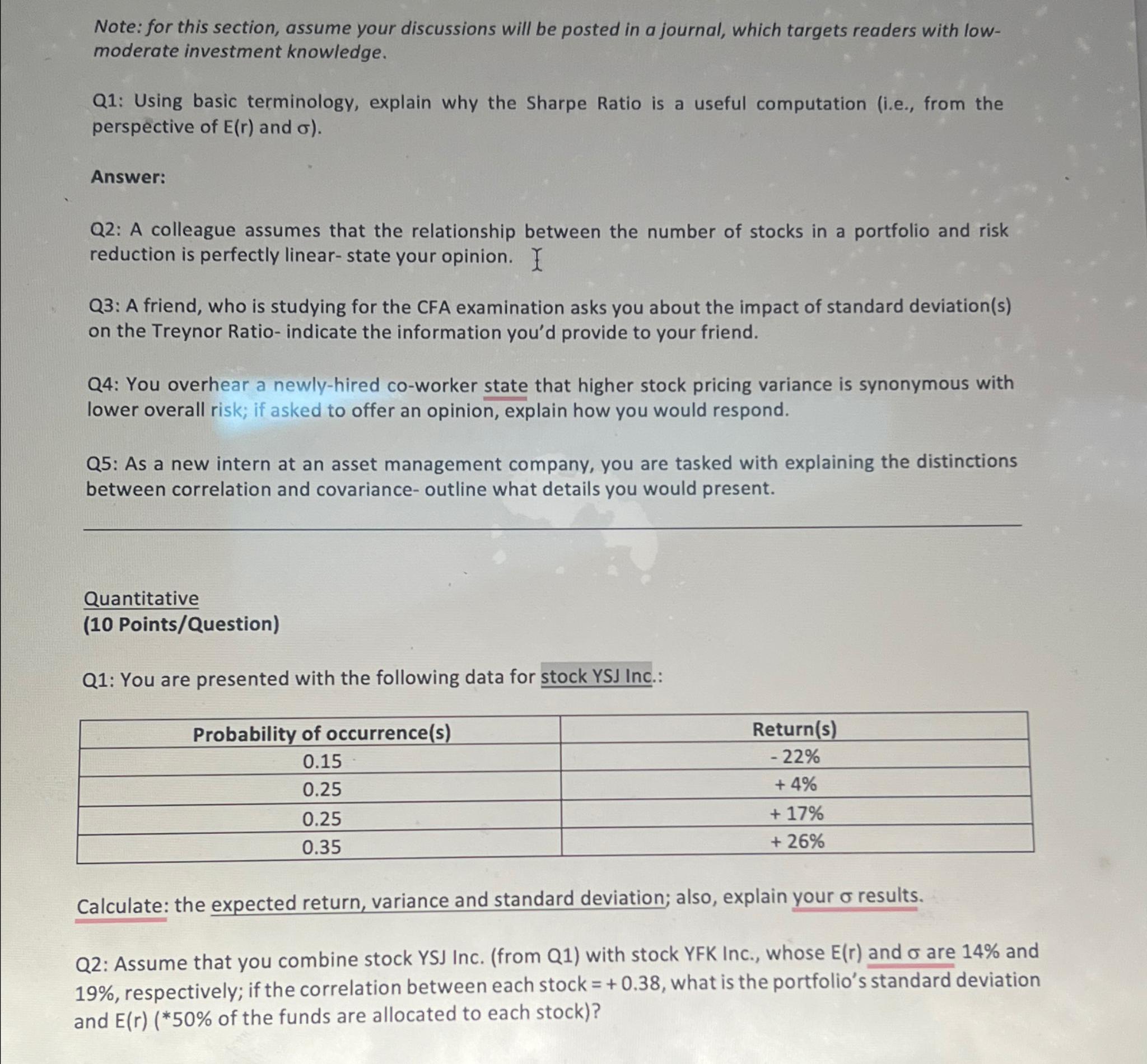

Note: for this section, assume your discussions will be posted in a journal, which targets readers with lowmoderate investment knowledge.\ Q1: Using basic terminology, explain why the Sharpe Ratio is a useful computation (i.e., from the perspective of

E(r)and

\\\\sigma ).\ Answer:\ Q2: A colleague assumes that the relationship between the number of stocks in a portfolio and risk reduction is perfectly linear-state your opinion.\ Q3: A friend, who is studying for the CFA examination asks you about the impact of standard deviation(s) on the Treynor Ratio- indicate the information you'd provide to your friend.\ Q4: You overhear a newly-hired co-worker state that higher stock pricing variance is synonymous with lower overall risk; if asked to offer an opinion, explain how you would respond.\ Q5: As a new intern at an asset management company, you are tasked with explaining the distinctions between correlation and covariance- outline what details you would present.\ Quantitative\ (10 Points/Question)\ Q1: You are presented with the following data for stock YSJ Inc.:\ \\\\table[[Probability of occurrence(s),Return(s)],[0.15,

-22%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started