Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A vendor sells hotdogs at $17.00 /piece. For every hot dog he spends $11.19 in the raw material. Additionally he spends $0.95 for packing each

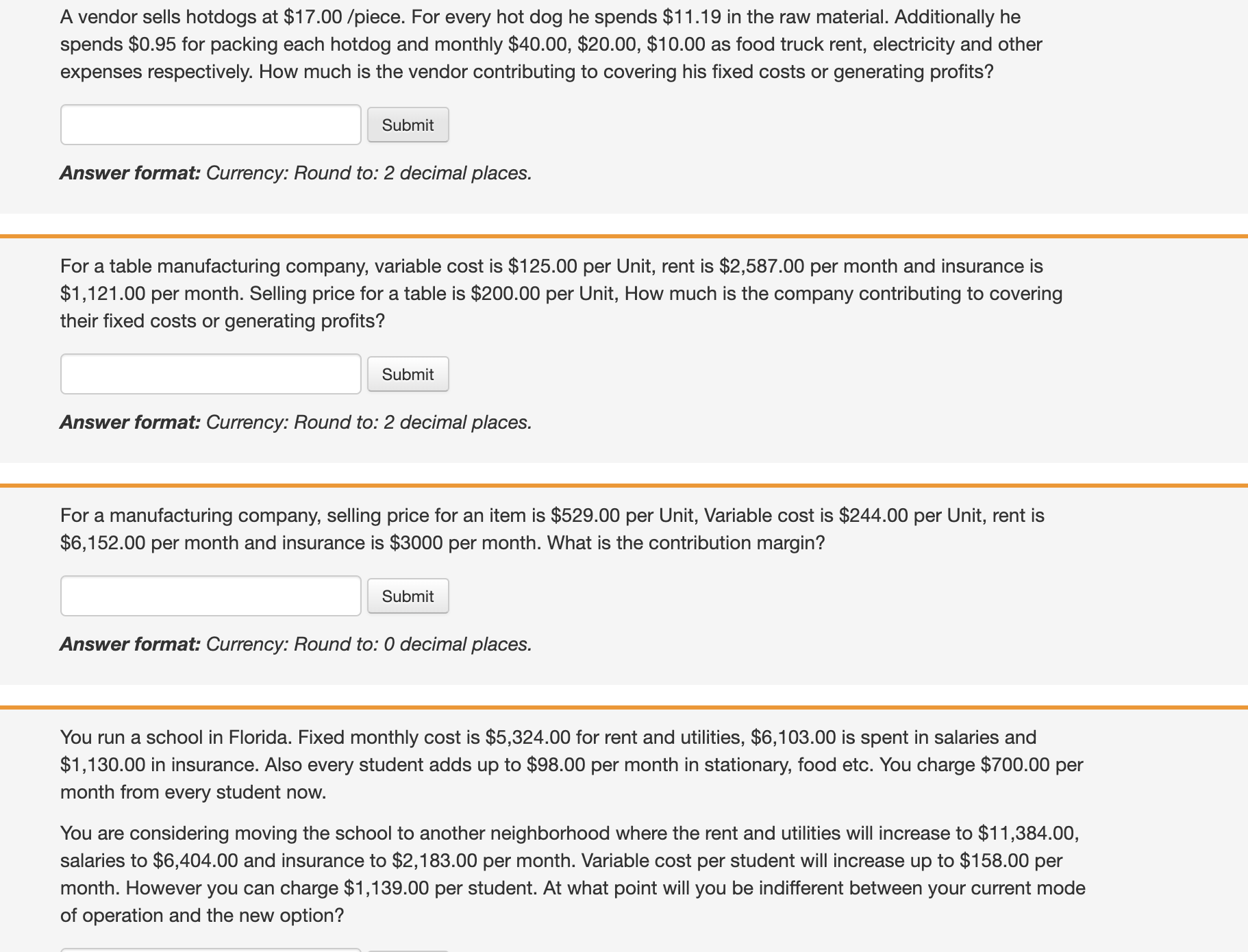

A vendor sells hotdogs at $17.00 /piece. For every hot dog he spends $11.19 in the raw material. Additionally he spends $0.95 for packing each hotdog and monthly $40.00,$20.00,$10.00 as food truck rent, electricity and other expenses respectively. How much is the vendor contributing to covering his fixed costs or generating profits? Answer format: Currency: Round to: 2 decimal places. For a table manufacturing company, variable cost is $125.00 per Unit, rent is $2,587.00 per month and insurance is $1,121.00 per month. Selling price for a table is $200.00 per Unit, How much is the company contributing to covering their fixed costs or generating profits? Answer format: Currency: Round to: 2 decimal places. For a manufacturing company, selling price for an item is $529.00 per Unit, Variable cost is $244.00 per Unit, rent is $6,152.00 per month and insurance is $3000 per month. What is the contribution margin? Answer format: Currency: Round to: 0 decimal places. You run a school in Florida. Fixed monthly cost is $5,324.00 for rent and utilities, $6,103.00 is spent in salaries and $1,130.00 in insurance. Also every student adds up to $98.00 per month in stationary, food etc. You charge $700.00 per month from every student now. You are considering moving the school to another neighborhood where the rent and utilities will increase to $11,384.00, salaries to $6,404.00 and insurance to $2,183.00 per month. Variable cost per student will increase up to $158.00 per month. However you can charge $1,139.00 per student. At what point will you be indifferent between your current mode of operation and the new option

A vendor sells hotdogs at $17.00 /piece. For every hot dog he spends $11.19 in the raw material. Additionally he spends $0.95 for packing each hotdog and monthly $40.00,$20.00,$10.00 as food truck rent, electricity and other expenses respectively. How much is the vendor contributing to covering his fixed costs or generating profits? Answer format: Currency: Round to: 2 decimal places. For a table manufacturing company, variable cost is $125.00 per Unit, rent is $2,587.00 per month and insurance is $1,121.00 per month. Selling price for a table is $200.00 per Unit, How much is the company contributing to covering their fixed costs or generating profits? Answer format: Currency: Round to: 2 decimal places. For a manufacturing company, selling price for an item is $529.00 per Unit, Variable cost is $244.00 per Unit, rent is $6,152.00 per month and insurance is $3000 per month. What is the contribution margin? Answer format: Currency: Round to: 0 decimal places. You run a school in Florida. Fixed monthly cost is $5,324.00 for rent and utilities, $6,103.00 is spent in salaries and $1,130.00 in insurance. Also every student adds up to $98.00 per month in stationary, food etc. You charge $700.00 per month from every student now. You are considering moving the school to another neighborhood where the rent and utilities will increase to $11,384.00, salaries to $6,404.00 and insurance to $2,183.00 per month. Variable cost per student will increase up to $158.00 per month. However you can charge $1,139.00 per student. At what point will you be indifferent between your current mode of operation and the new option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started