Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A venture capital fund is considering investing in a startup that is seeking to raise $1,500,000 in equity capital. The venture had previously raised

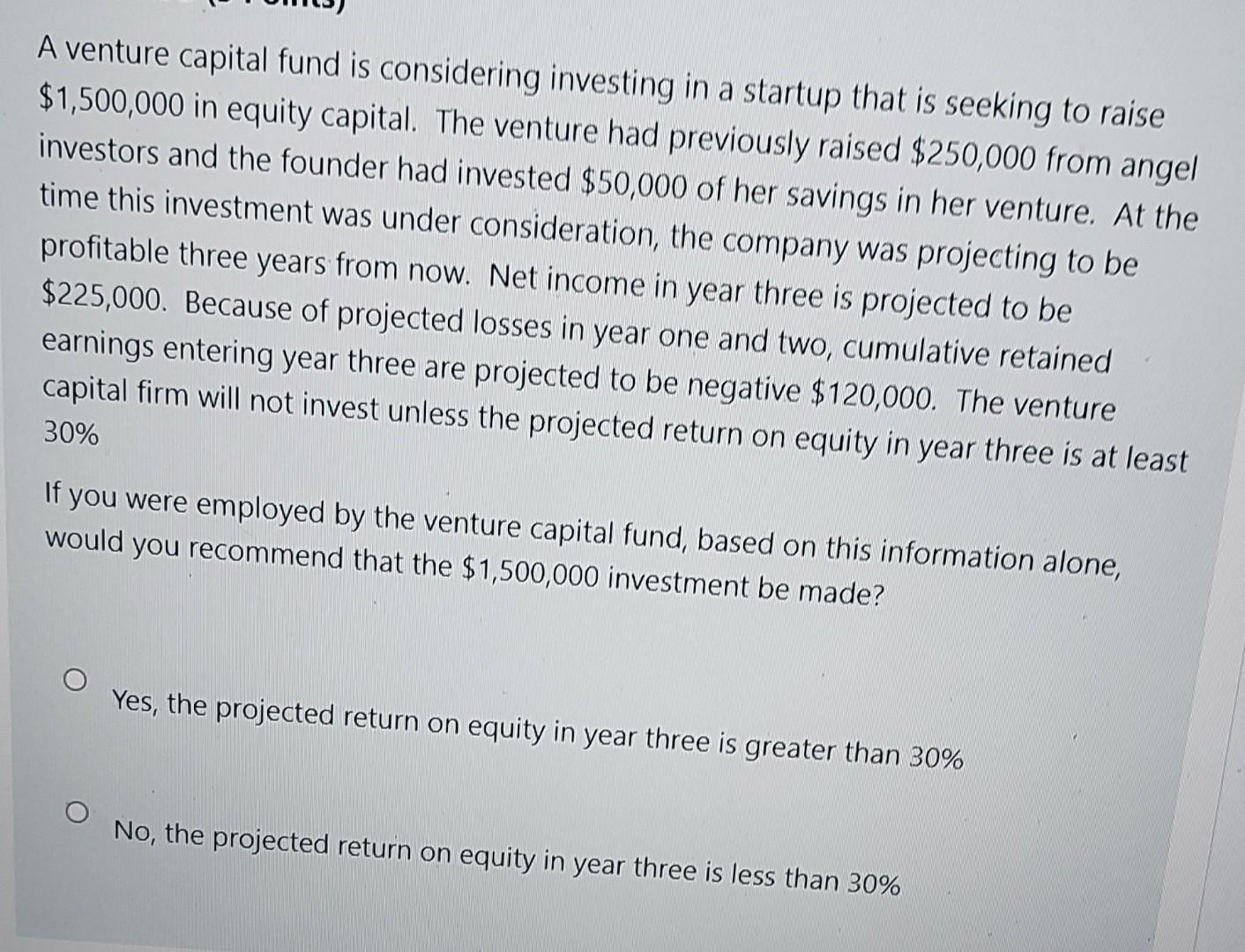

A venture capital fund is considering investing in a startup that is seeking to raise $1,500,000 in equity capital. The venture had previously raised $250,000 from angel investors and the founder had invested $50,000 of her savings in her venture. At the time this investment was under consideration, the company was projecting to be profitable three years from now. Net income in year three is projected to be $225,000. Because of projected losses in year one and two, cumulative retained earnings entering year three are projected to be negative $120,000. The venture capital firm will not invest unless the projected return on equity in year three is at least 30% If you were employed by the venture capital fund, based on this information alone, would you recommend that the $1,500,000 investment be made? Yes, the projected return on equity in year three is greater than 30% No, the projected return on equity in year three is less than 30%

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Option b No the projected return on equity in year three ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started