Question

A waterside worker is commencing his last decade prior to retirement. His disposable income during this decade will be 1000 (thousands of dollars). He expects

A waterside worker is commencing his last decade prior to retirement. His disposable income during this decade will be 1000 (thousands of dollars). He expects to live one further decade beyond retirement but to have no disposable income in that period. The bond market offers a nominal interest rate of i = 0.7 (70%) per decade and no inflation is expected between the two decades, implying the price level P=1 in both decades. His discount rate is ?=0.5 (50% per decade) and the elasticity of his decade utility to his decade consumption is 0.6, implying that period utility depends on period consumption as Ut = ACt 0.6, where A is a constant for which calibration is not needed.

a) Formulate the worker's inter-temporal budget constraint and illustrate it in a diagram.

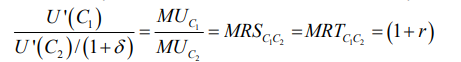

b) Use the Euler equation for optimal inter-temporal choice (below) to calculate how much the worker consumes and saves. From these derive his saving rate out of his disposable income. We can write the Euler equation as:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started